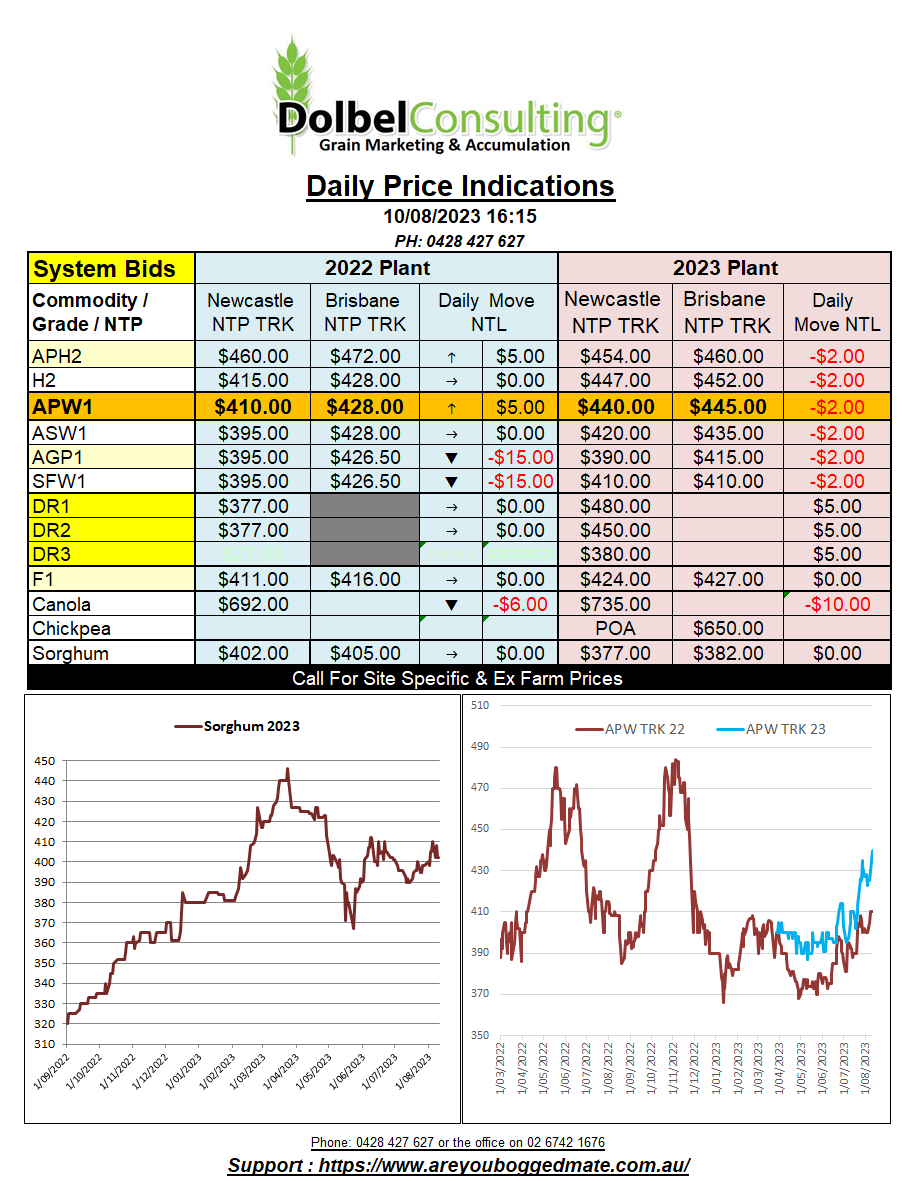

10/8/23 Prices

The international market continues to paint a moderately bullish picture for milling wheat. If we overlook the technical slip in US wheat futures values overnight, as that is probably more a function of positioning prior to the WASDE report out at the end of the week than anything fundamental. Than we continue to see clear cash price indicators that talk values higher.

There are rumors that Russia is introducing a new “unofficial” floor price for milling wheat at US$260 for cash business and US$270 FOB Black Sea for tenders, that’s not bearish. There is talk that India will begin to purchase milling wheat to help deflate local food inflation. Higher rice prices could potentially increase demand for wheat to some markets. What if the USDA start to get serious about adjusting Australian and Canadian wheat production estimates on Friday night. Parts of Argentina remain dry, the main wheat regions of Cordoba and Santa Fe do appear to be having an average year though. Spring wheat regions in Kazakhstan and Russia have had a mixed season, not unlike the spring wheat season in the USA. Their spring wheat now seeing more rain than it has all season now that the headers are getting greased. Poor quality in German milling wheat. What have I missed.

This all remains speculation until the vast majority of analyst see it on a USDA letter head though.

In the mean time we just need to enjoy the weaker AUD. Or as one headline puts it this morning, “Australian dollar drowns in Chinese depression economics”….. just fills one with optimism doesn’t it. Chinese export growth continues to be negative, all major facets of their market now suffering. The AUD is a commodities based currency, if our major commodity consumer is doing it tough, we are doing it tough, weaker Yuan = weaker AUD. That’s how most currency punters are calling it today. Financial markets are fickle though and I’m a grains analyst.