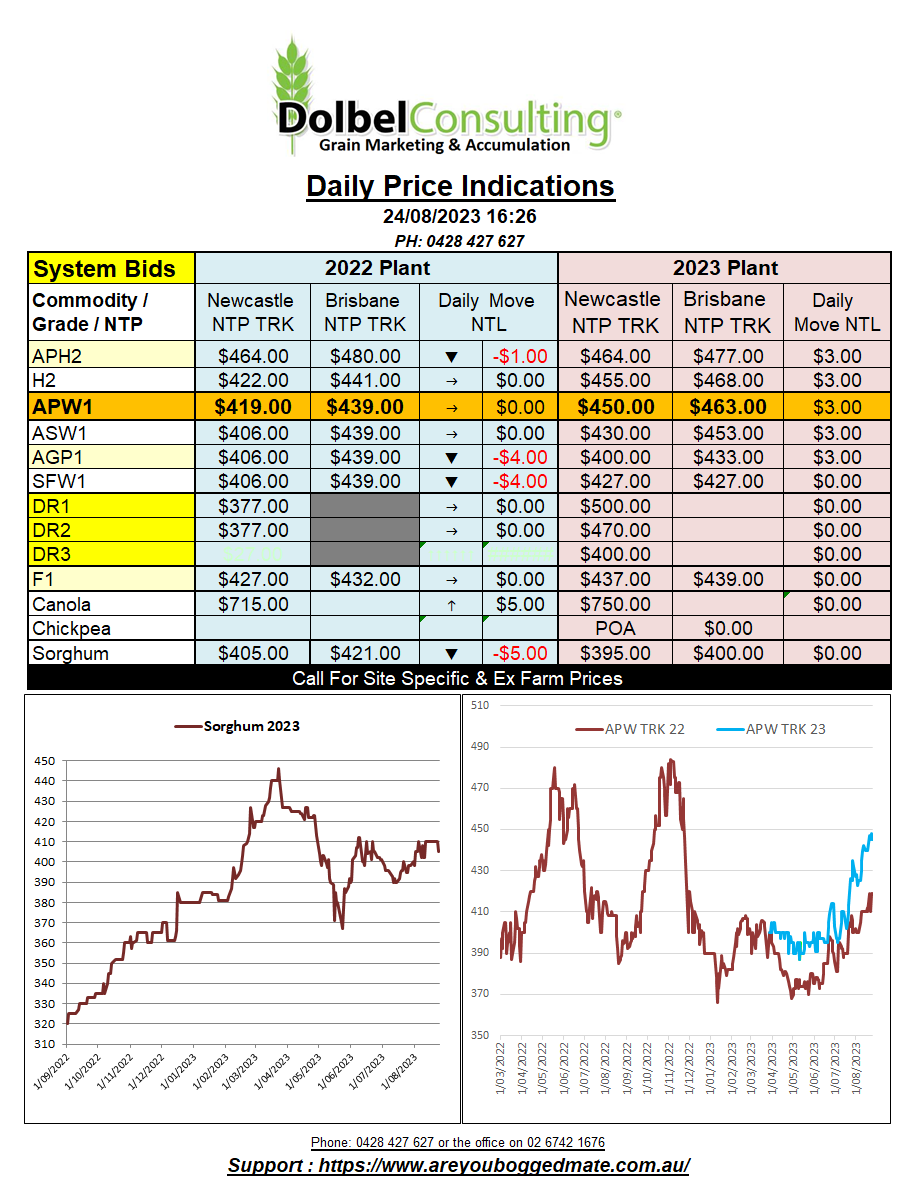

24/8/23 Prices

Egypt picked up 60kt of Romanian wheat as opposed to Russian wheat on Tuesday. This was interesting as the price for the Romanian product, US$256 FOB, was about US$4.00 under the “unofficial” floor price for offers of Russian wheat.

With India in talks to acquire between 3 to 4 million tonnes of Russian wheat (some say as much as 9mt), is this indicating that Russia will become a less aggressive seller in the mid to later part of the marketing year or are Russian export projections potentially very understated now.

In the last USDA WASDE report Indian imports were estimated at just 100kt, their ending stocks were pegged at 14mt. So even 3mt of the possible 9mt of imports was not accounted for. As for Russia, their exports were estimated at 47.5mt, again not including any Indian business. Russian ending stocks were 11.44mt. I don’t think it will be this simple, but say Russia sell an additional 4mt of wheat to export without reducing sales elsewhere and domestic consumption, this could leave Russia with just 7.44mt of ending stocks. Even in 2012/13 Russian wheat stocks were estimated at 8.47mt, this time of year, (but were later reduced to just 4.95mt).

The take home point appears to be that if Russia does sell the volume of wheat towards the higher end of the trade guess than the Russian S&D chart will start to look very tight. Combine this tightness due to smaller Canadian, Argentine and Australian crops, all major exporters, to the supply side for wheat, especially good quality milling wheat, and it starts to look very tight from a global perspective. This also throws doubt on the USDA Indian production estimate at 113.5mt, some private estimates are now closer to 105 to 110mt.

The next step is to take additional exports, smaller production estimates and higher imports and adjust the world S&D table for wheat. You start to realise some potential issues with current USDA estimates, and start to understand why world wheat values are historically high. Tables / charts Attached.