1/9/23 Prices

Tunisia picked up 100kt of durum overnight at US$426.49 to US$428.89, let’s call it an average price of US$427.68 per tonne CFR. With Italian merchant / miller Casillo picking up the lions share of the sale it makes one wonder if it’s not Turkish durum being traded. The price is a little lower than expected by some but does work in well with the grade specifications outlined on the tender.

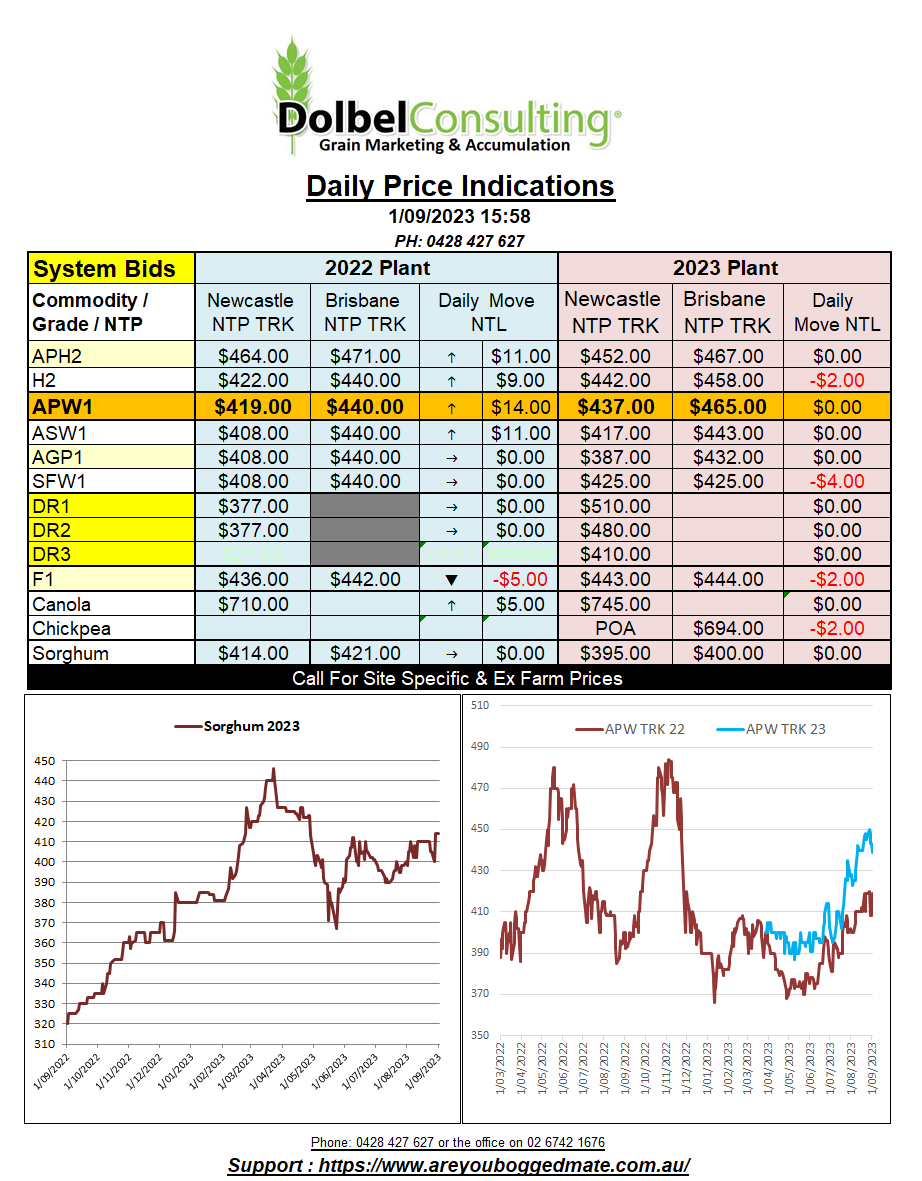

On the back of an envelope this would compare to durum ex farm LPP being priced somewhere close to AUD$480 – AUD$500. Current new crop bids for DR2 are close to that on a delivered port or NTL NTP number, but not ex farm.

Algeria was also in for some durum, unlike Tunisia the results are private, so there are only trade rumours at present. The first “rumour” I’ve seen this morning indicates that the sale price is closer to US$475 per tonne CiF but that is likely to change throughout the day. A US$475 number would convert back to an XF LPP number somewhere around AUD$560 – AUD$580.

The interesting point to take out of these two tenders is probably the grade spread. Either way we did see a little pressure on Canadian cash durum bids overnight. PDQ determined the average contract price XF SE Saskatchewan was down C$6.93 for a Dec23 lift, to C$507.56 per tonne. This still leaves prompt durum bid a fraction higher than the outer month, indicating that nearby demand is still not met. Saskatchewan durum harvest is estimated to be about 50% complete now. Conditions across the Prairies have been mostly dry in the south, the durum belt, showers more active further north where canola acres are more prolific. The week ahead is expected to see good progress made across the Canadian Prairies.

Low water levels in the Panama canal continue to stall transit there, not unlike a Mitch McConnell speech. There is talk of Panama authorities, auctioning off slots for those happy to pay for quicker transit, one such sale going for US$2.4m (US$400k normally), all this hurts US > Asian sales.