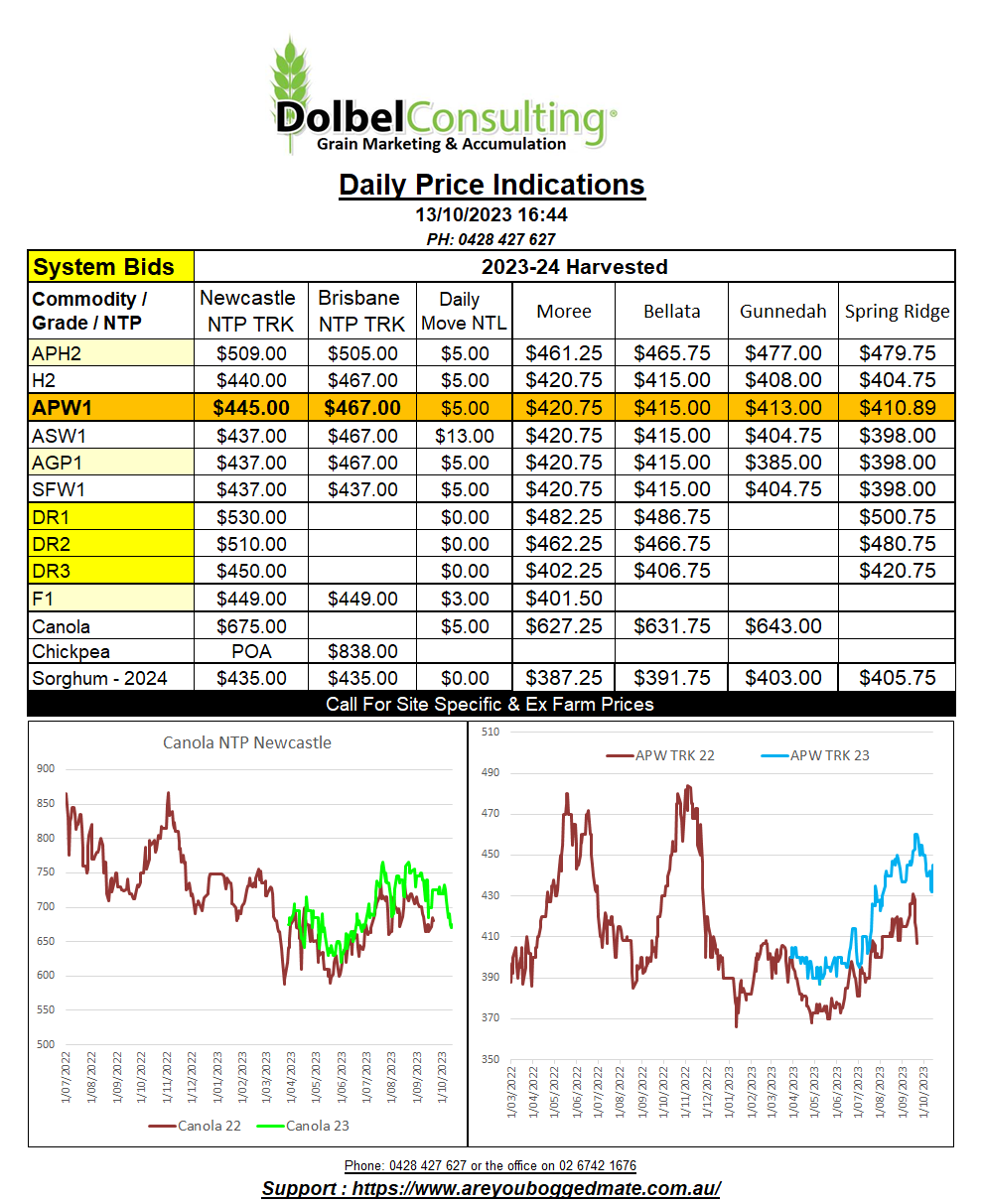

13/10/23 Prices

Chickpea values at Delhi continue to push higher on the back of lower production estimates for most summer pulse crops there. Mung bean area is expected to be back as much as 60% compared to last year. This is putting upward pressure on Indian chickpea values right at sowing time. This week chickpea values are up 150Rs/Q. When taking the AUD slippage into account the move is roughly equivalent to just under AUD$42.00 per tonne week on week. Local prices into the NNSW and SQLD packer remain relatively flat.

Private production estimates for Argentine wheat continue to slip. Yesterday the Buenos Aires Grain Exchange produced an estimate of 16.2mt, 300kt less than their previous estimate but still significantly higher than the Rosario Exchange estimate of 14.3mt earlier this week.

The USDA World Ag Supply and Demand Estimate report for October was out last night. Their number for Argentina was left unchanged at 16.5mt.

Looking through the WASDE shows world wheat production back 3.91mt on last month’s estimate, now pegged at 783.43mt. I slight increase in carry in and adjustments lower for consumption rolled through to a 480kt lower estimate month on month for ending stocks. So there’s plenty of scope for future adjustments there. Year on year ending stocks are expected to decline 9.42mt, but at 258.13mt globally it’s not small and represents a stocks to use ratio still in excess of 32%. Anything over 30% is too high.

Adjustments in wheat included and increase of 2.11mt to US production. A 1.5mt reduction in production for Australia, down to 24.5mt, still too high. Brazil production was reduced 500kt to 9.8mt, still a big crop by Brazilian standards. Russian production was left at 85mt but exports were increased to 50mt. Russian exports now making up 33% of all global wheat exports. Kazak production was reduced 2mt to 13mt, their ending stocks back 1.1mt.