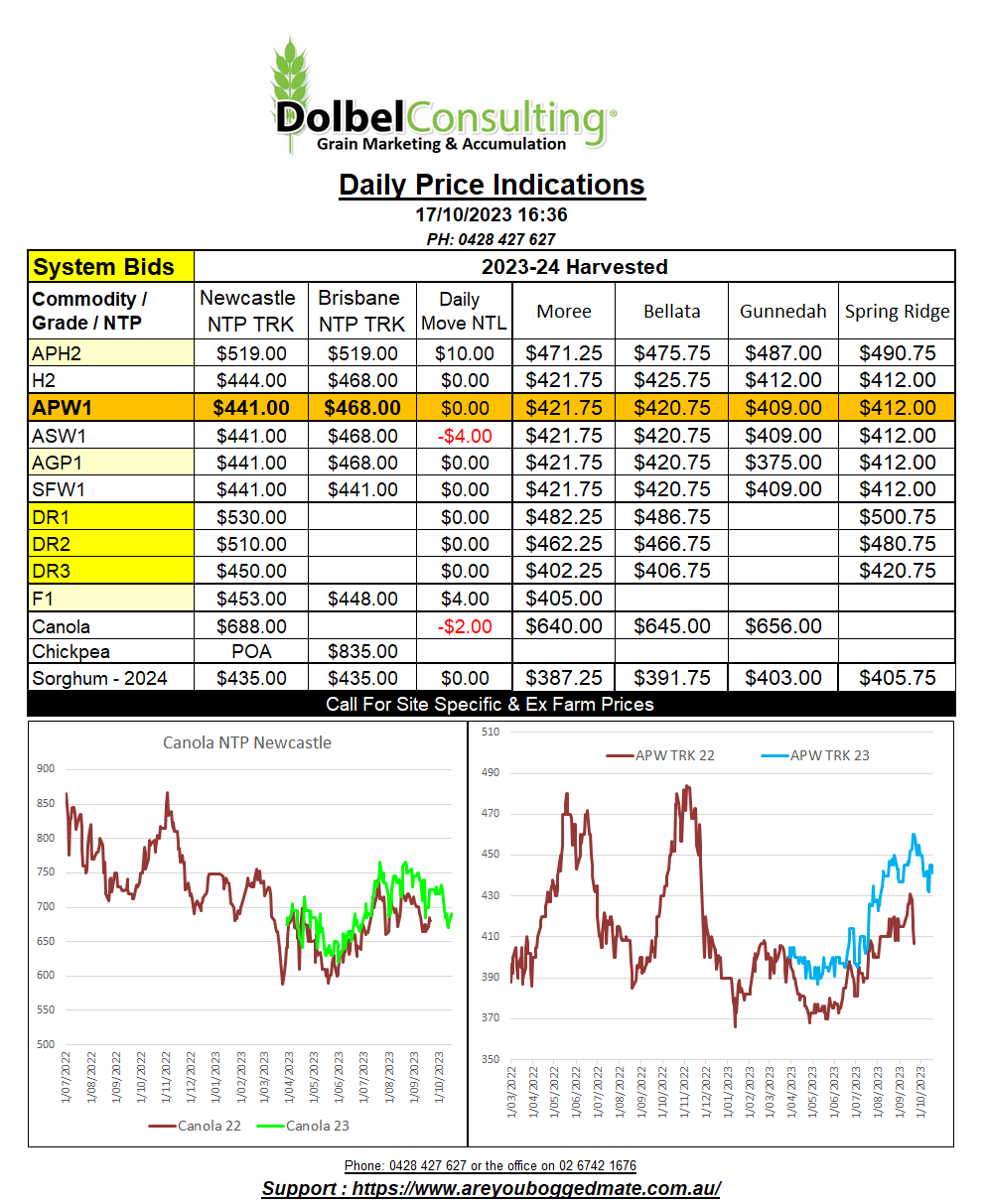

17/10/23 Prices

Cash prices for most grains around the world were lower last night. There were a few exceptions, that being good quality, high protein spring wheat out of the US Pacific Northwest. Both US and Canadian values for spring wheat 13.5%+ crept a few dollars higher.

Durum wheat didn’t enjoy any spill over leverage from the spring wheat, instead Canadian port and farm durum values slipped lower. Harvest pressure and slower exports into the EU market continue to weigh on Canadian values in the short to mid term. The spread between 1CWRS13.5 spring wheat and 1CWAD13 durum across SE Saskatchewan remain high though. Durum there seeing a premium of C$154.53 for a December lift.

Locally we see DR1 paying a $21 premium to APH2.

The oilseed market was mixed, Chicago soybean futures were a little higher, the move was reflected in Winnipeg canola futures which rallied C$2.10 in the Jan24 slot. Paris rapeseed futures were slightly lower though, the Feb24 slot back E1.00. The move in Paris futures, combined with a slightly stronger AUD converts to change of AUD$3.64 lower today.

World cash barley prices were generally flat to lower. French values seemed to be pushing lower the fastest but do have a ways to go to compete with Australian and Russian barley. Into the S.Arabian market Russian barley is by far the cheapest CiF. In order to compete French barley may need to fall another US$30. Australian barley into S.Arabia is midway between the two but is now more focused on the Chinese market. On the face of it Australian, Argentine and Ukraine barley are all closely priced CiF China. The price roughly converts to a delivered Aussie port number close to AUD$370 +/-. Yesterday BAR1 into Geelong was bid closer to AUD$352. Once you take trade margin into account this is probably pretty close to where the Chinese market is indicating it needs to be. Continuing to see Chinese demand for LPP barley and sorghum but struggling to compete with local feed markets.