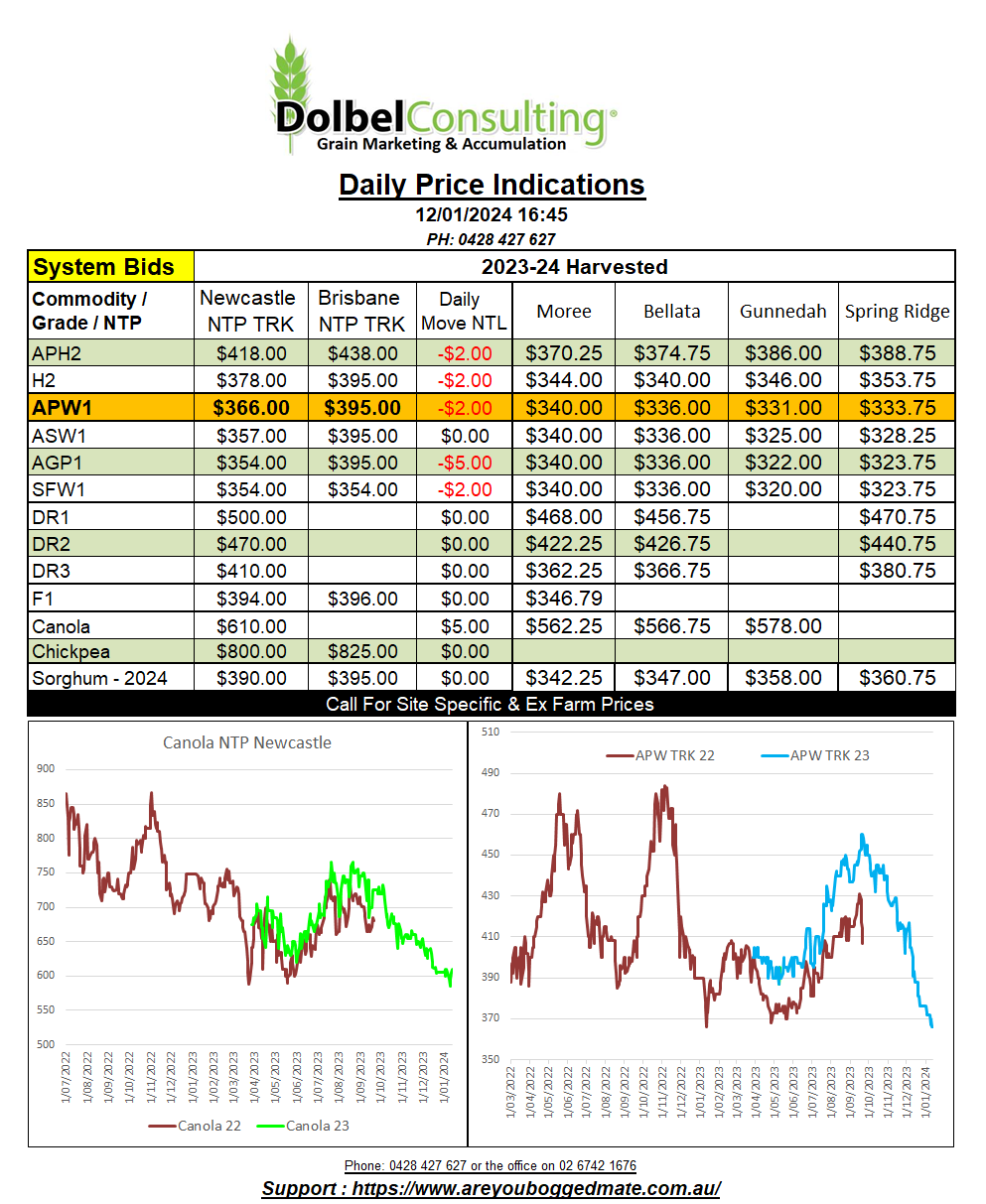

12/1/24 Prices

Another poor session for US wheat futures. Corn was pressured by lower wheat and a better outlook from the S.American corn crop. Chicago soybeans closed flat to a smidge firmer. The fact the soybean market didn’t fall further was all the Paris rapeseed and Winnipeg canola market needed to see some profit taking push the market higher by the close. Taking moves in both Paris and Winnipeg into account and fluctuations in both those exchange rates against the AUD the moves indicate between AUD$2.00 and $4.00 upside here today, so hopefully enough to drive local canola higher.

With a World Ag Supply & Demand Estimates report due out from the USDA tonight, it’s going to be hard to get much of a pulse from the local market today. Some analyst expect to see an increase in world wheat production. This may weigh further on international values but since the last WASDE Chicago soft red winter wheat futures have shed 45.75c/bu. Using spot AUD for those dates, which has also gained 144pts, we see this equates to a move lower of AUD$32.92/tonne, a 7% fall. Some assume this is enough to counter any potential adjustment to USDA world wheat estimates. If this is so, we may see a little sell the rumour / buy the fact trade creep into this. A good time for a fund reversal maybe ?

Maybe I’m just being the eternal optimist too, the wheat market is dead, as is often the case in Jan / Feb, and as I said early, it needs some big demand news to give it a pulse.

US sorghum values out of the Gulf were valued at US$258.30 FOB Texas port. That’s back less than a dollar day to day. One would expect that Argentina is having good sorghum season this year. Argie sorghum is valued at US$295.90 FOB river. Costs to execute Argie and US sorghum to China have increased. US sorghum is close to current Aussie values CiF China. Weekly US sales to China were 133kt Dec 29 – Jan 4th, exports 241.6kt to China.