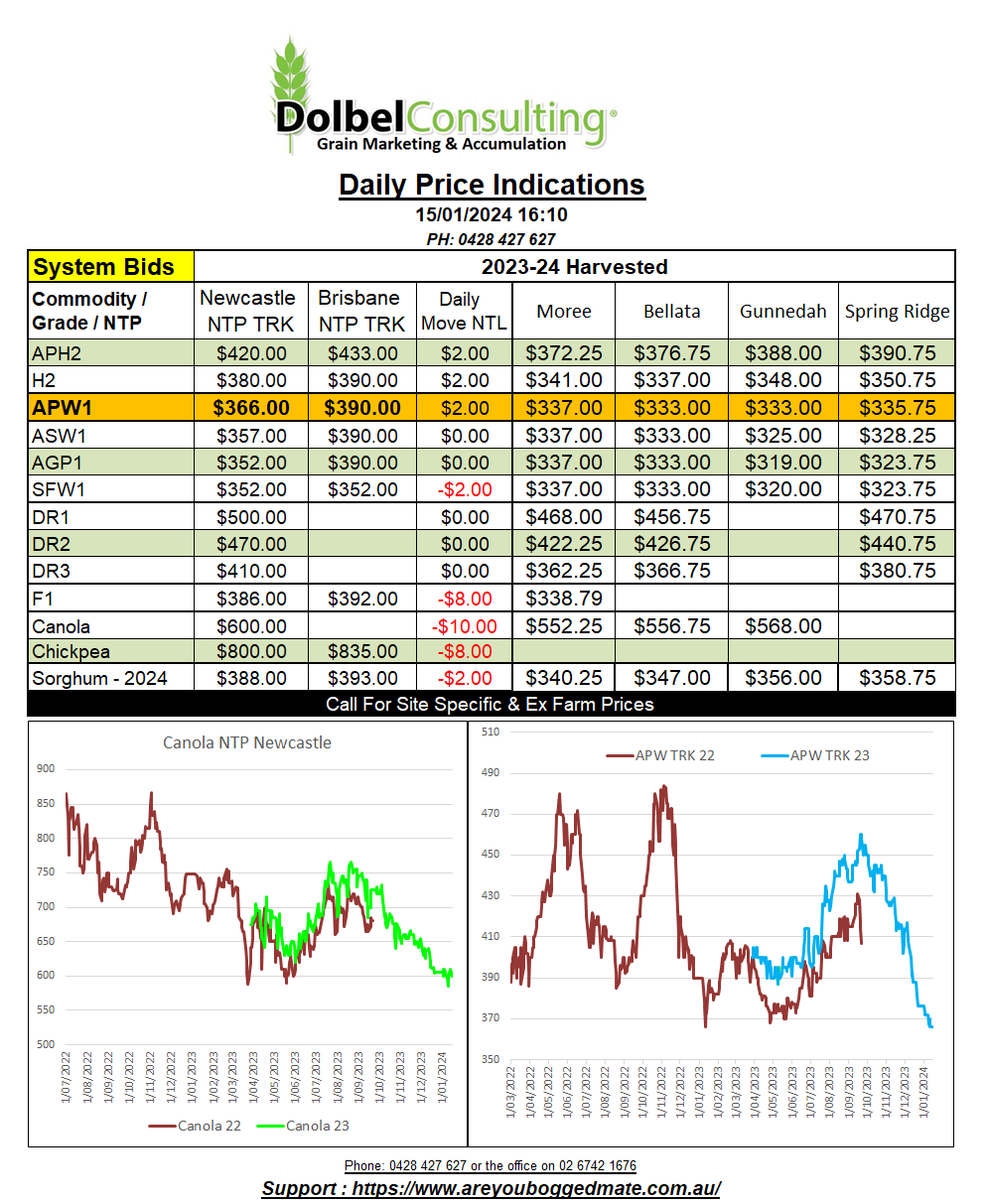

15/1/24 Prices

The WASDE was out last night and as expected the biggest losers were corn and soybeans.

World ending stocks for corn, wheat and soybeans were all higher than trade estimates prior to the release of the WASDE. Corn was by far the biggest surprise. The avg trade estimate for corn ending stocks was 313.03mt, the USDA came out at 325.22mt. Soybeans came in a little higher than the Dec estimate at 114.6mt ending stocks, and world wheat ending stocks were estimated by the USDA at 260.03mt, vs 258.2mt in December and 258.09mt was the average trade guess prior to the release.

A closer look into the wheat table to see where the 1.83mt increase in world ending stocks is. First thing we see is an increase of 1.71mt in opening stocks, a little surprising given it’s January 2024. Production was also increased 1.9mt to 784.91mt. Higher imports helped, as did higher domestic demand, but both were not enough to counter the increase in supply.

Higher production was recorded for some of the major exporters, Russia up 1mt to 91mt, Ukraine up 900kt to 23.4mt, the EU, Australian, Argentine and Canadian production were all left unchanged. Canadian exports were increased 500kt, that came straight off their ending stock, now just 3.5mt. Aussie exports were also increased 500kt, again coming straight off ending stocks, now just 3.57mt. Domestic use in Argentina was increased, that too coming straight off their ending stocks, now just 2.37mt. Ukraine was a bit of problem, beginning stocks increased 2.2mt, from 1.3mt to 3.3mt, production up 1mt, domestic consumption reduced 400kt and exports increased to 1.5mt to 14mt, but still a net increase in ending stocks of 1.8mt. So Black Sea wheat is destined to continue to be a problem going forward. Indian consumption was increases 1.25mt, their net ending stocks falling 1mt to 10mt.

Sorghum FOB Texas was actually a little higher at US$259.50. US sorghum stocks are up 18% from a year ago at 4.77mt, 3.9mt of that is off farm.