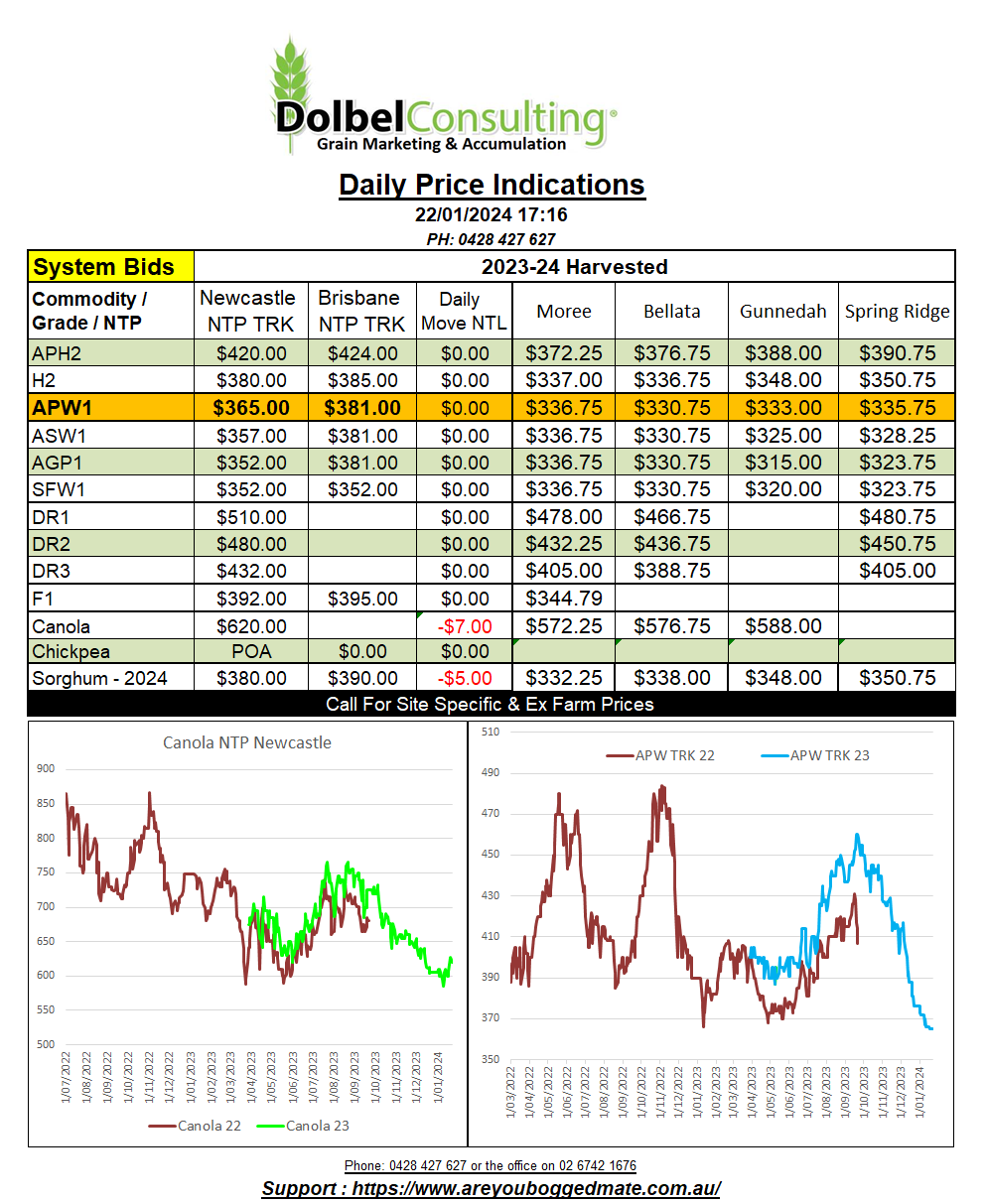

22/1/24 Prices

USA weekly net sales for the week January 5th to 11th for sorghum were 201,800 tonnes for the 2023-24 marketing period, up 52% from the previous week. China picked up 199,200 tonnes of that. Weekly export volume for US sorghum set a marketing year high of 354,100 tonnes, China again taking the lions share at 321,500 tonnes. So the Chinese demand is there.

Sorghum values FOB Texas were a little higher at US$254.50 for a Feb slot, roughly US$12.00 lower than a January offer. Using a standard ocean rate, a rate not reflecting the higher cost of execution through the Panama Canal, the FOB Texas value, using China as a destination, tends to indicate local prices here for new crop sorghum remain competitive with US sorghum.

The current season across much of the Australian sorghum belt should also result in a very good quality for Aussie sorghum this year, with a very good good test weight, if we see a good finish.

The better than expected volume of US corn sales should also help keep corn values in check. Better corn values tend to help sorghum. US weekly corn sales were reported at 1.251mt, up 61% on the 4 week average. Mexico picked up 637kt.

Weekly US sales of wheat were also good at 707.6kt, with Asian markets taking the lions share. The good weekly US sales pace helped the futures market in the states, especially those products that leave through the Pacific Northwest.

US weekly soybean sales were also good at 781.3kt. The better than expected volume likely saved Chicago beans from a sharply lower finish. The nearby contract closing just 0.025c lower, the outer months also basically unchanged. One would hope to see a better, or flat, bean number correlate to a better close for rapeseed and canola but this was not the case. Both Paris and Winnipeg were lower by roughly AUD$4.00 to AUD$5.00.