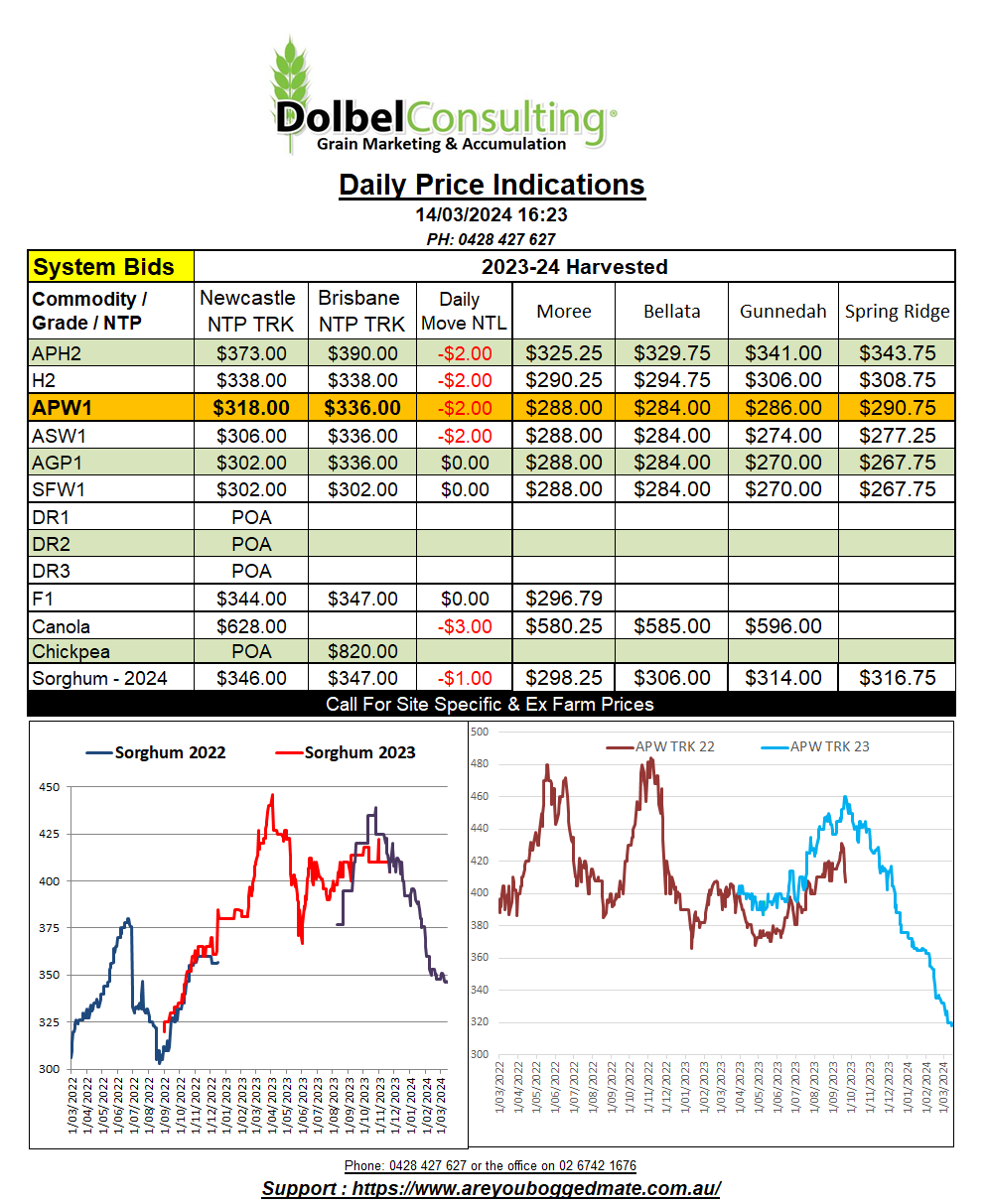

14/3/24 Prices

There’s an increasing amount of speculation that the bottom for wheat might be in, for futures at least. The funds appear to be covering their short position at both Chicago and Paris. To date this has been done in a relatively orderly fashion, although the volatility in HRWW futures remains interesting to watch.

Soft red winter wheat at Chicago has moved higher by 15.75c/bu (AUD$8.73) since the 7th of March in the now nearby contract of May. Mind you this is after shedding 52.75c/bu (AUD$29.26) since this time last month.

HRWW is back just 4.75c/bu (AUD$2.63) since this time last month and showing a rally of 31.25c/bu (AUD$17.33) since the 6th of March.

During the days since Feb 6th our local H2 price on the track has fallen AUD$34.00. H2 delivered port is back roughly AUD$13.00.

The trend of short covering has also occurred in the Paris milling wheat contract. Wet weather in France is seeing crop ratings slip away a little. Russian wheat values have also moved higher in the last week or so, potentially signalling that burr is now out from under the saddle.

Thailand picked up 120kt of feed wheat overnight. Two 60kt parcels were thought to have been booked at US$244.80 CiF and US$242.80 CiF for delivery in June / July. On the back of an envelope these values convert back to an XF LPP rough price of AUD$280 +/-. Obviously this wouldn’t work out of the Newcastle zone as stocks are already very low and moving towards bringing wheat in at port numbers closer to what is being mentioned below.

International sorghum values were mixed but generally trended flat to lower. Some US sorghum offers were $1.00 to $2.00 lower while the Chinese Index was roughly AUD$1.26/t lower. There is continued speculation around the size of the coming US corn crop, some say 93mac will be sown, others say less. One would think that conditions would need to improve across Iowa and Nebraska significantly to see an area larger.