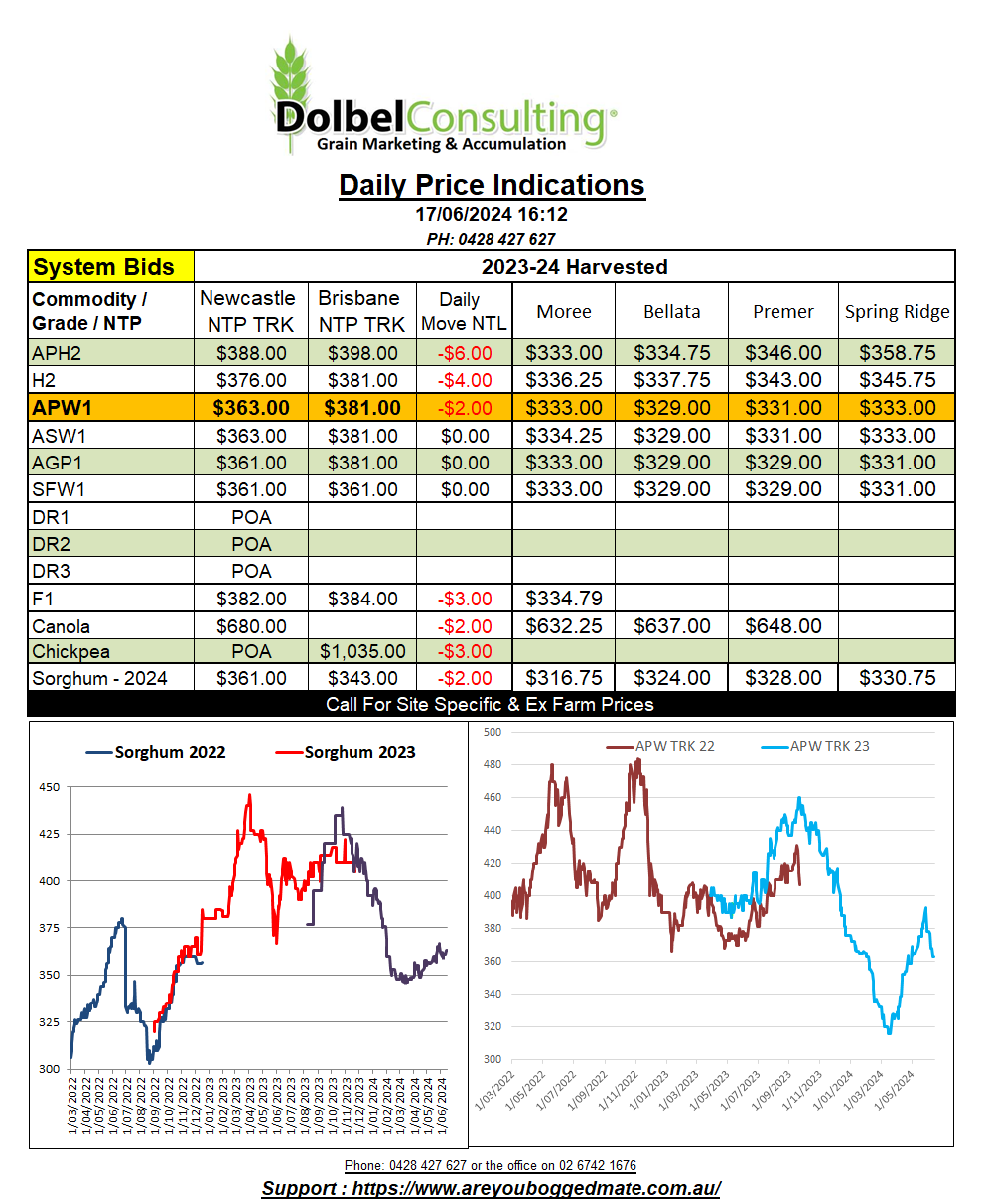

17/6/24 Prices

US wheat, corn and soybean futures all pushed lower in overnight trade. The weaker soybean market spilling over into the ICE canola contract at Winnipeg, values there closing the session sharply lower. In AUD terms nearby canola futures were back AUD$20.99 / tonne. Moves in the Jan25 contract were not as dramatic as nearby but C$14.70, roughly AUD$16.20, was lost. Paris rapeseed futures were not as pressured. Conditions in the EU not as beneficial to crop production as the unfolding season in Canada. The nearby slot at Paris saw rapeseed futures shed just E0.50c/t, taking the lower AUD into account, a decline of just 26c/t here. Outer months were pressed a little harder, the Feb25 slot back E1.50 by the close.

European futures for wheat, corn, feed wheat and rapeseed were all lower. Paris milling wheat shedding E1.25 in the Dec24 slot.

The US Wheat Associates weekly harvest update shows the headers are now active across a good slice of Kansas. The short term forecast of hot, dry weather will come to an abrupt end around the middle of next week when rain is expected to return to much of the corn belt and the eastern spring wheat regions of the USA. In the meantime producers will forge on with hard red winter wheat harvest in Kansas which is now just over 5% complete. White wheat quality and yields in Kansas are also better then expected. Around half the HRWW crop is in the bin across Texas and Oklahoma after some rain delays.

In the Pacific Northwest, where the bulk of the white wheat is grown, the crop there is now coming into head. The USDA expect to see around 5.7mt of white wheat out of the US this season, a slight reduction on the May forecast. White wheat values FOB PNW were off a little overnight, US$249 FOB. Using Japan as a consumer the US price works back to an equivalent XF LPP price of something close to AUD$310 – US$330. Tending to confirm current new crop contract bids here are in the ball park.

A US$5.07/t increase in the cost of passage through the Bosphorus and Dardanelles from July 1st will impact new season Black Sea wheat values.