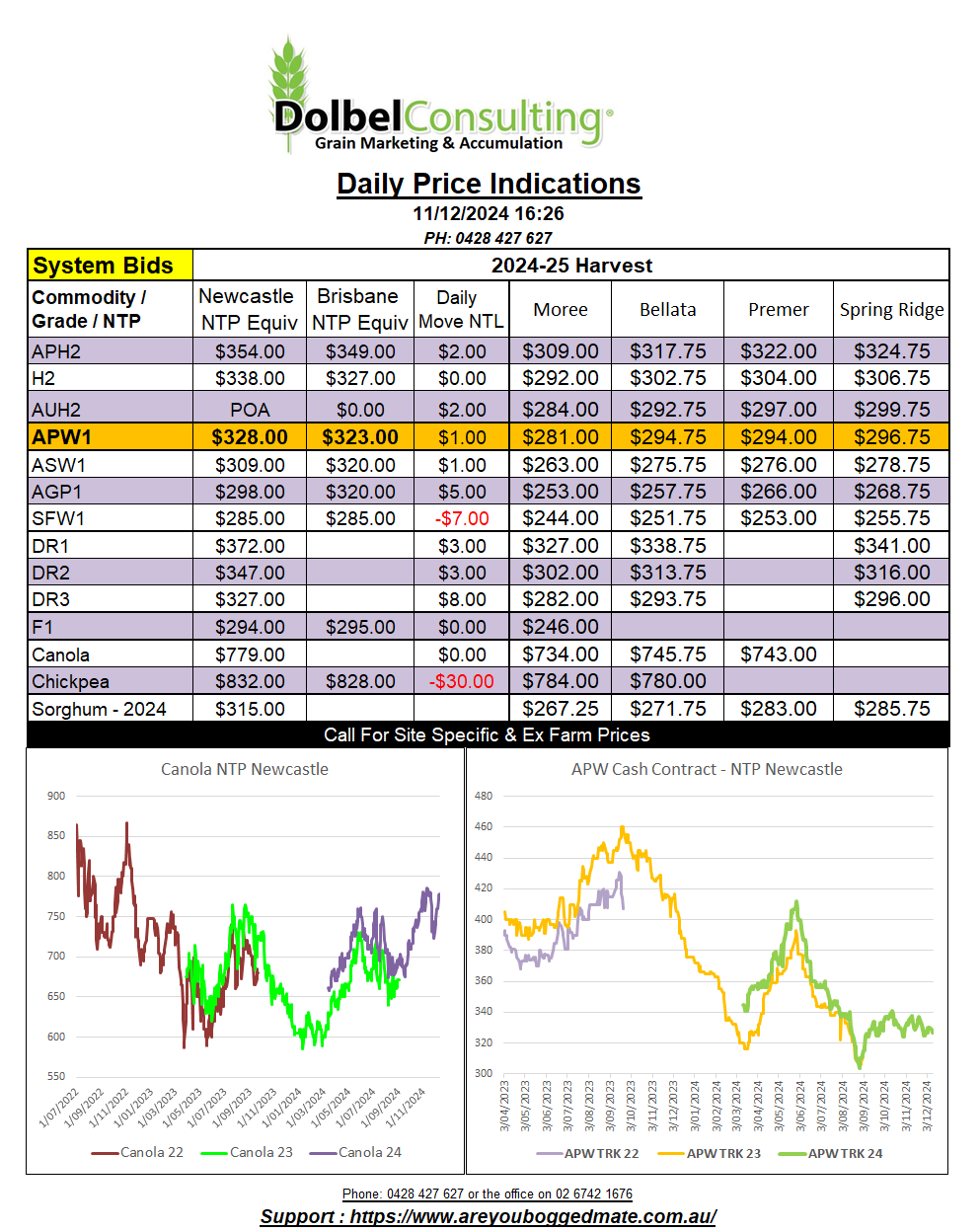

11/12/24 Prices

International Commentary

It was a USDA World Ag Supply and Demand Estimates reports night last night. A quick look at the USDA number for wheat shows a decline in world production of 1.78mt from the November estimate, now estimated at 792.95mt. A 1.16mt increase in carry in and a reduction in usage actually rolled through to an increase in carry out of 310kt, not much, but not a reduction. The biggest negative is the increase of 1mt in major exporters carry out stock to 30.13mt. Indicating that the major importers don’t have much to worry about.

Australian wheat production was left unchanged at 32mt, but the USDA reduced carry in 170kt to just 2.88mt, this rolled through to a reduction in carry out, leaving opening stocks projected at just 2.58mt next year. Argentina saw no adjustments, Canada saw carry in lower by 5,000t and a slight adjustment lower to production from 35mt to 34.96mt, shrinking carry out by 100kt. Russian exports were reduced from 48mt to 47mt, the USDA left every other number in the Russian table unchanged thus carry out was increased by 1mt. Ukraine saw reduced usage, the difference being more than countered in increased exports. There were no major changes to the major importers. This report tends to point towards a very flat range bound market in the short to mid term. We’ll need more than this report to put a pulse back in wheat before sowing.

The winner in overnight trade was the oilseed market. Slight gains in Chicago soybeans helped start the ball rolling in the canola and rapeseed markets. A Reuters news article stating that Malaysian palm oil stocks are at a 4 year low also helped, although stating the obvious to those watching that market, but helpful. Paris put on €3.75 in the Feb 25 slot while Winnipeg gained C$3.00 in the Jan slot. The weaker AUD could compound these gains today. Palm oil futures were a tad lower, back about AUD$3.89/t nearby. Cash bids across SE Saskatchewan were higher for canola, a Feb lift up C$5.58 on average. Narrowing the spread C&F Europe between Australian and Canadian canola to less that AUD$80.00.

Domestic Commentary

The trade continue to offer the local feed market lower than the producer, selling the price lower to both the trade and the consumer and creating consumer coverage now well into Q2 2025.

January slots for SFW1 were hard to find, the trade carrying the position and also being very difficult to negotiate with as they have supply coming from the trade side as well as the consumer side. Business for SFW1 ex farm SE LPP was eventually conducted at $291 ex farm for a Dec / Jan lift. SFW1 was also bid at $305 delivered LPP end user for a March / April slot. There were plenty of bids out there at much lower values too.

ASW was bid at $320 delivered Tangaratta for Feb / March, less $5.00 for Jan / Feb but tonnage in both slots is limited. The arbitrage for the trade for accumulation at western sites like Walgett is harder. The best bid for ASW out there is $258 delivered site, but there are plenty of lower bids too. At $258 it could be executed and shipped by road to Tamworth for roughly $328 delivered end user. This indicates that the $320 or less numbers into Tamworth are lower than the execution cost of grain from Walgett. Coonamble site is bid $259 for ASW, the road rate is about $6.00 less than from Walgett, making grain from Coonamble site equivalent to about $324 delivered Tamworth. Closer to home CropConnect lists JBS at $273.50 delivered Gunnedah silo. If this was to be executed by road and taken to Tamworth this would cost the buyer roughly $319 delivered. This does tend to indicate why the trade is looking to buy ex farm LPP as opposed to executing from the western sites. But does it indicate the trade assume prices may increase early next year.

Canola continued to push higher, gaining $54.00 in two weeks. The AUD is back under 64c this morning. RBA left rates unchanged, Merry Xmas peasants.