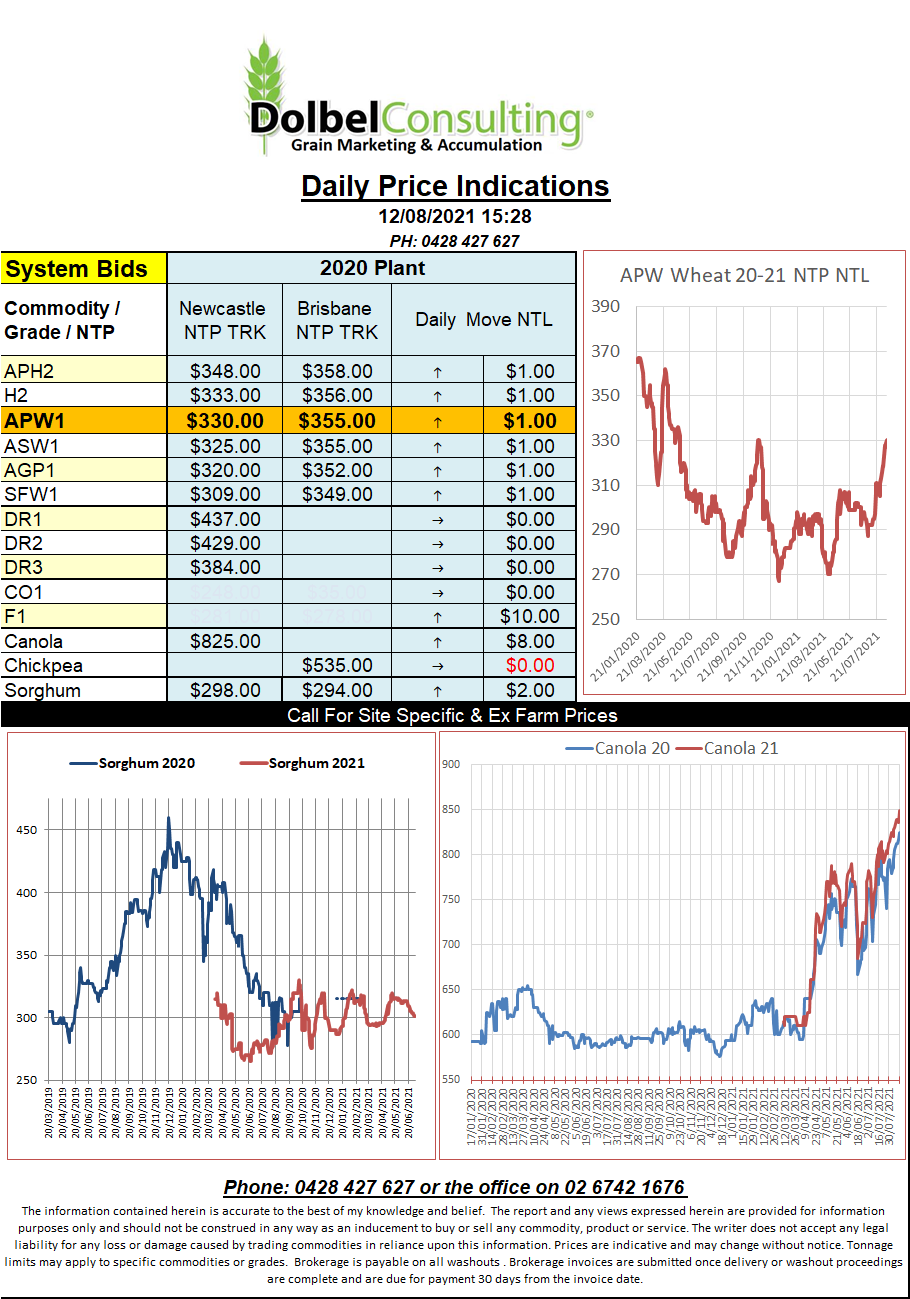

12/8/21 Prices

Spring wheat futures in the US were a little weaker overnight, Minneapolis shed 1.75c/bu (AUD$0.90) as the punters continue to “square up” ahead of tonight’s WASDE report.

North of the US border we see cash bids for spring wheat in SE Saskatchewan were reflecting the move in futures with spot cash up C$1.12 and a Dec21 lift slipping C$0.72c/t.

Durum and canola bids in SE Sask were higher. Canola both at the ICE and the cash market rallied over C$10. A Dec21 lift XF SE Sask was up C$13.20 to C$858.34/t. If you want to compare that price to an Aussie port equivalent price using Europe as a home it would come in somewhere around AUD$980.

Currently we see the trade offering Aussie canola CNF China at about US$687, Dec21. This would compare to a Newcastle price of roughly AUD$860, about AUD$24 above current cash bids to the grower, potentially a very small margin.

The global trade is basically stalling until after tonight’s USDA report. I’ve seen punters expecting 25mt less wheat than last month and other reports suggesting that the overall drop in demand will counter the lower production and we’ll end up with a net increase in ending stocks. If you look hard enough someone will produce an “analysis” that suites your book. Overnight Jordan and the Philippines both passed on wheat tenders, prices too high. Thailand issued a tender for 140kt of feed wheat and IKAR dropped their Russian wheat estimate to 77mt.