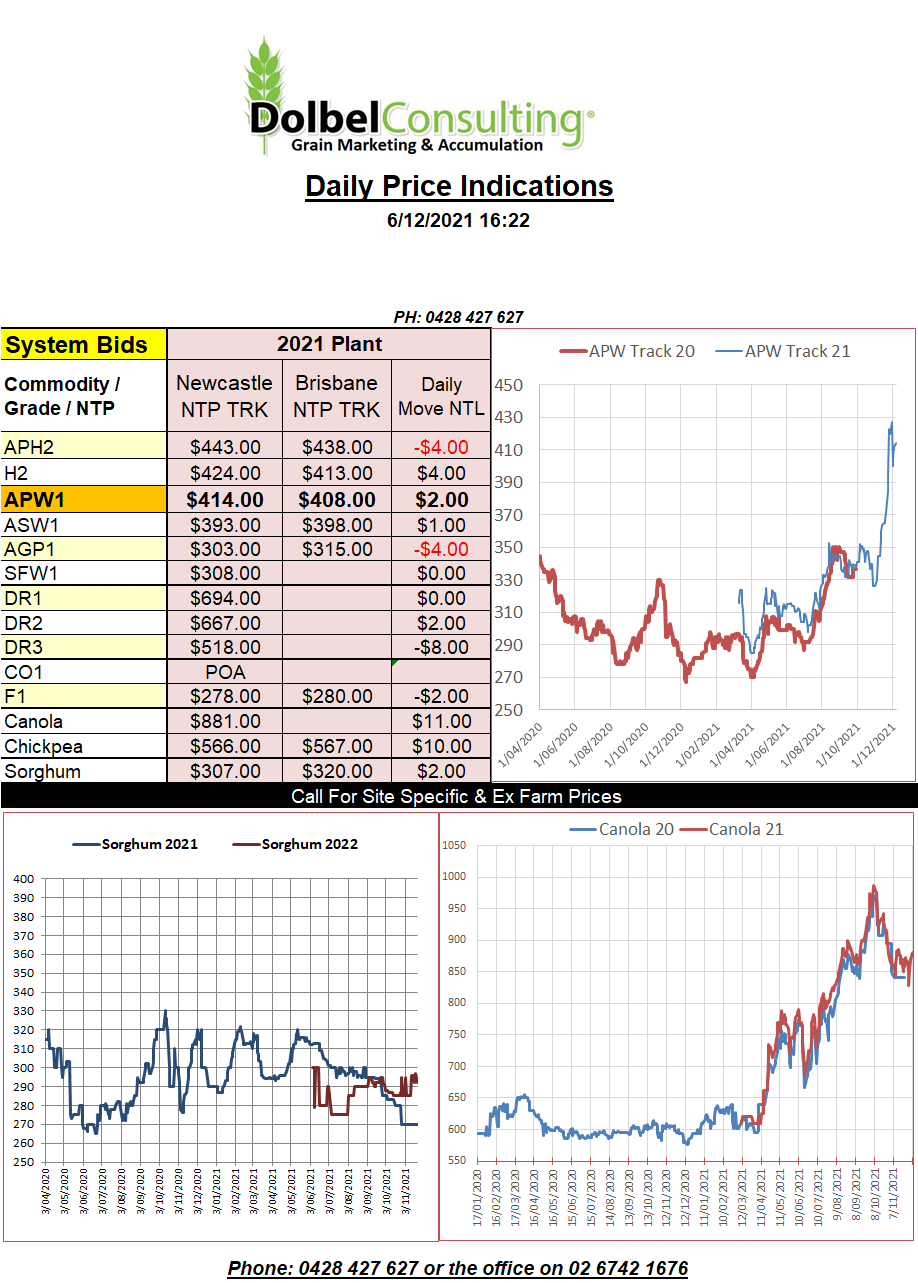

6/12/21 Prices

The Aussie dollar pushed lower overnight, briefly slipping to 69.95 before closing fractionally over 70c. The fall in the AUD will help act as a buffer for export wheat and sorghum values on Monday. The move countering a potential AUD$6.30 per tonne reduction in wheat, if Chicago SRWW futures were tracked dollar for dollar, by as much a AUD$5.12. Resulting in a plausible AUD/t reduction of just AUD$1.18. a move unlikely to be reflected at all.

The fall in the AUD against the USD is not as easy to explain as one might hope. Some say that the sudden decline in the US jobless rate and the increase in both US wage growth and cost of living in general will lift inflation by as much as double the current US projection. The US FED will be forced to acknowledge that the current trend isn’t transitionary and that inflation is indeed slotting in for the mid to longer term. This feeds the punters expectations of interest rate rises in the US during 2022.

Compounding the pressure on the AUD is the fact that the Aussie swap rate is now up 100 points in two months. Consumers in Australia now facing not only higher purchase prices but also higher borrowing costs. To make this even worse here in Australia is the fact that real wages have remained flat to slightly higher, not rising sharply as they are in the US. The perfect storm for private debt problems.

In the US corn and soybean futures were higher while wheat continued the roller coaster ride, shedding double digits at Chicago. Week on week losses for both SRWW and HRWW at Chicago have been significant, spring wheat has weathered the storm well, falling less than $2.