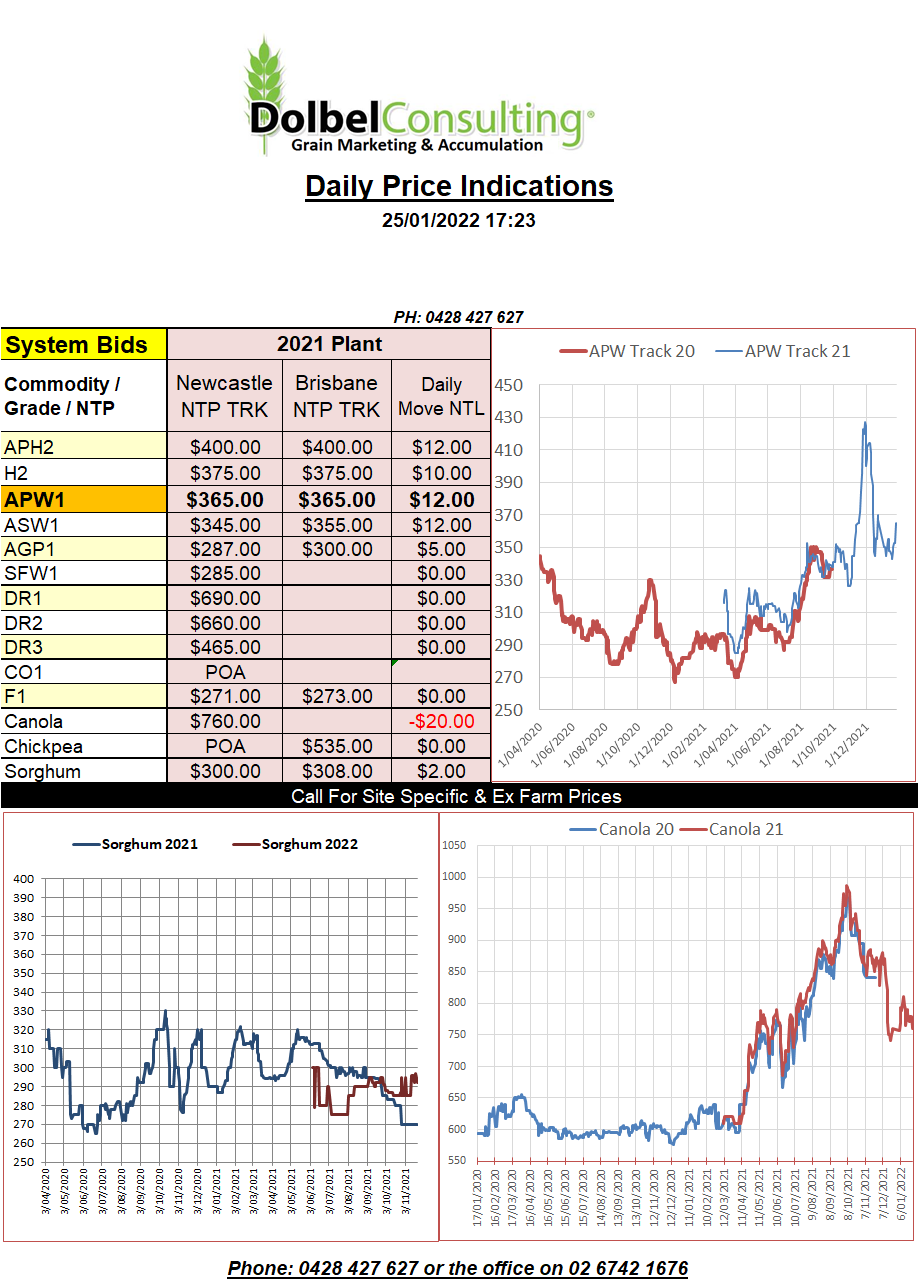

25/1/22 Prices

Overnight Chicago wheat futures pushed higher taking both HRW and spring wheat at Minneapolis for the ride. The rally appeared in the Chicago overnight session with good gains prior to the day session opening.

The fundamentals haven’t really changed much, which would indicate that the basis for this move remains geo-political. Fuelled by speculation on the outcome of the Ukraine / Russia situation. Which at present appears to be little more than sabre rattling and some diversional tactics from America and the UK as they divert people’s attention away from the unravelling of the retail side of the COVID19 pandemic, with policy now changing daily.

To be fair though there has been a slight increase in both outloading of wheat from many exporters, bar France, and some good tenders of late. I mention France in particular as it appears Macrons ability to offend it’s major wheat buyer, Algeria, is playing out as one might expect, exclusion from import tenders. US weekly wheat export inspections were about 400kt, a 4% week on week increase. US weekly sales were also higher at 380kt last week.

Maybe the biggest opportunity is in the Russian stock market, values have collapsed over the last few days, bargain hunters, hedge your roubles, grab a bottle of vodka and call your broker, prices are back to early 2020 levels. This could get interesting.

Algeria are back in with another tender, this time for a smaller amount into shallower ports in Feb / March. Algeria usually buy more than their tender volume, in this case 50kt, but the timing and minimum volume have most punters believing this will not be a large purchase.

Severe heat continues to devastate parts of Argentina, much of the north seeing 42C+ over the last 5 days. Livestock now also casualties.