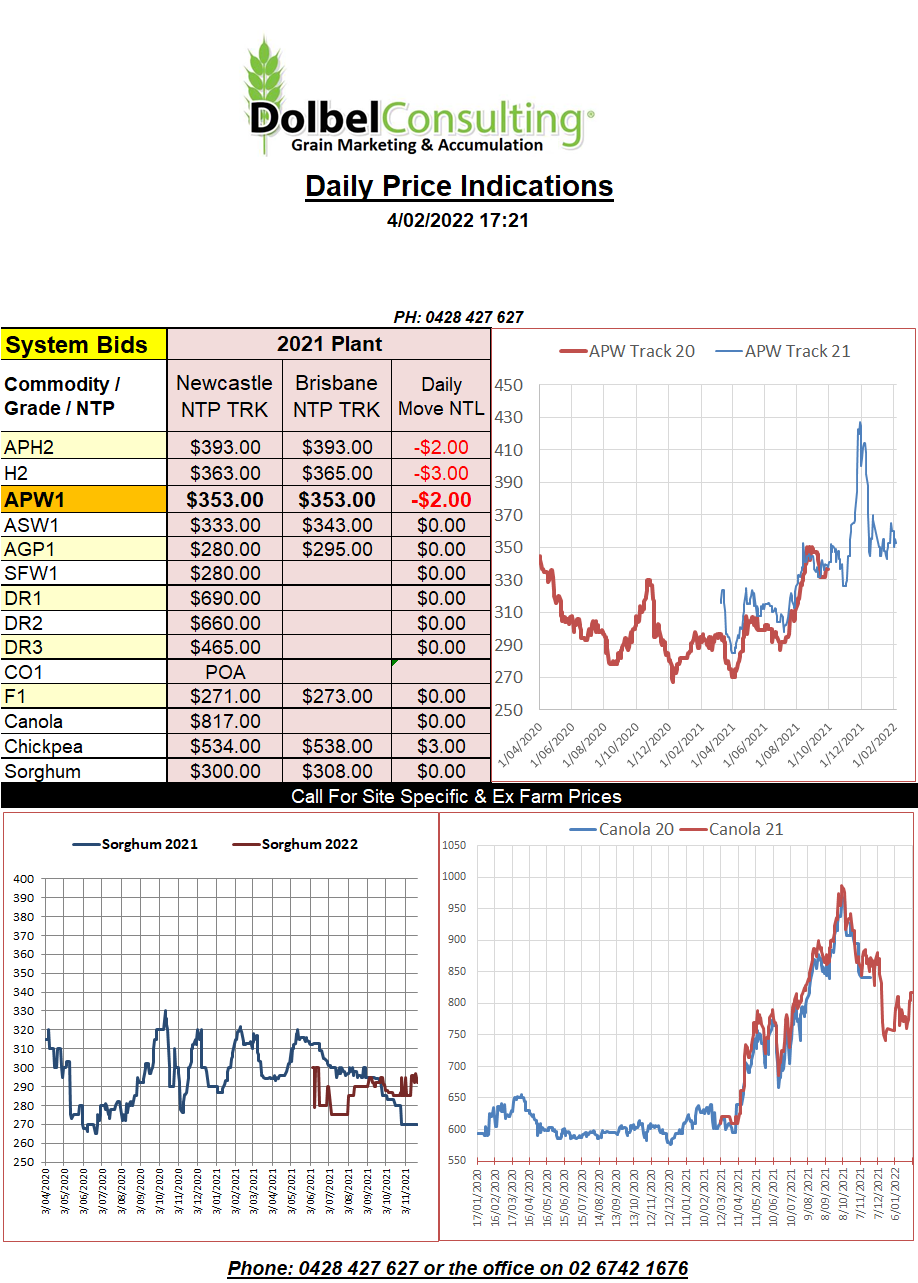

4/2/22 Prices

US wheat futures are now almost back to levels prior to when the Ukraine / Russia conflict talk first arose.

Global fundamentals remain relatively unchanged so one can only assume, in the short term, we are more likely to push 20c/bu lower, rather than 20c/bu higher, in order to complete this circle.

Weather in the US is improving from a moisture perspective but the winter hasn’t been soft on crops and spring may yet prove to be volatile as agronomist get back in the field and do some number crunching.

Spring wheat values probably have the most to lose at this stage when talking convergence with new crop values. Soft red winter wheat at Chicago shows just a 6.5c/bu difference between March and Dec, HRW futures at Chicago 18.5c/bu and Minneapolis spring wheat futures a difference of 35c/bu (AUD$18.00). If current weather conditions persist and spring crops in N.America get sown on time and look good to produce average tonnage, not only will this convergence occur but one would also expect to see some pressure on December values.

An average season in the N.Hemisphere does lead one to assume price pressure might be seen in Aussie markets from around May / June onwards as US / Canadian winter crop estimates and spring sown acres are determined.

Chicago corn futures are “apparently” a great litmus paper for sorghum. If this is the case than we see a difference of 49c/bu between nearby and December and 37c between nearby and September futures, roughly -AUD$20 on the later spread.

This might be telling us that unless you are punting a bit of sorghum on farm as a tax dodge or a drought hedge, then nearby pricing may well be the smartest move here this year. The issues expected with local / global execution & logistics may also weigh in on this decision.