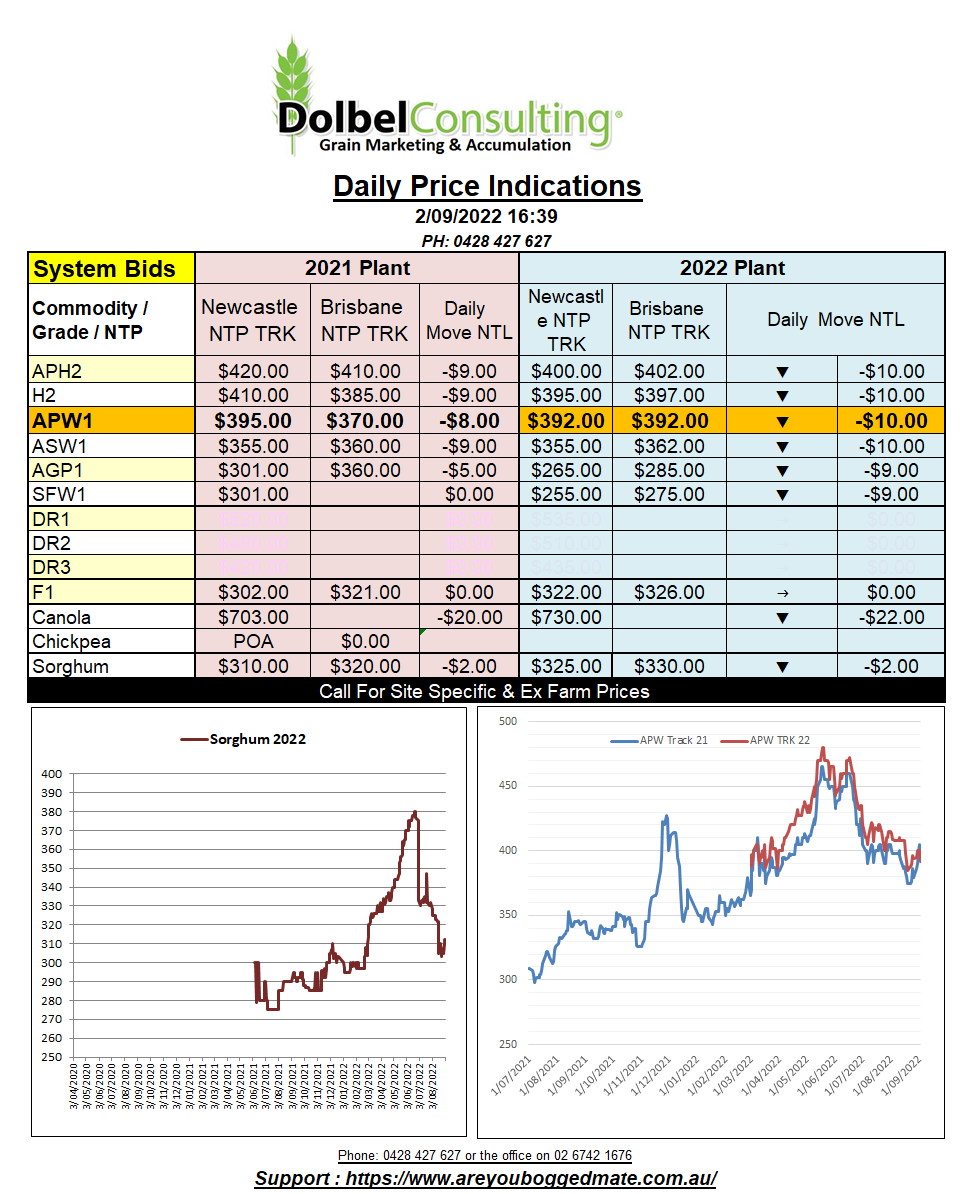

2/9/22 Prices

US wheat futures took direction from the obvious fundamentals developing around the world and fell sharply.

A huge Russian wheat crop, talk of a global recession and a stronger US dollar all very bearish factors today. Back in 2019 the world was on the brink of a major recession. Not driven by covid, but in the end cloaked by covid. The efforts of the reserve banks and some governments to combat the “impact of covid” appears to have delayed and now potentially exacerbated the inevitable outcome we were heading towards a few years ago.

The decline in the buying power of the general population will in theory reduce demand for many commodities as income is rationed to pay for the essentials.

It is important not to lose sight of the bigger picture though, wheat is an essential item and a fall in global production will impact the price of wheat. Maybe not this week but definately in the mid to longer term. For instance, the current cost of production and the problems being faced in the EU regarding environmental policies may result in a reduced EU plant for 2022-23. Already we see Ukraine officials reducing the prospective planting area for the next wheat crop by 30% to 40%, simply from lack of funds.

Egypt finalised negotiations to buy 120kt of Russian wheat. Egypt has opted to walk away from their traditional tender system and instead negotiate behind closed doors. The total volume of wheat being sought is said to be around 1.5mt in total. Probably mostly Russian now that India has “banned” wheat exports. This lack of transparency to purchases is exacerbating another problem, one the USDA is having. Yesterday the USDA said that the new reporting platform for US export sales and shipments will not produce reports for the public until the 15th of September.