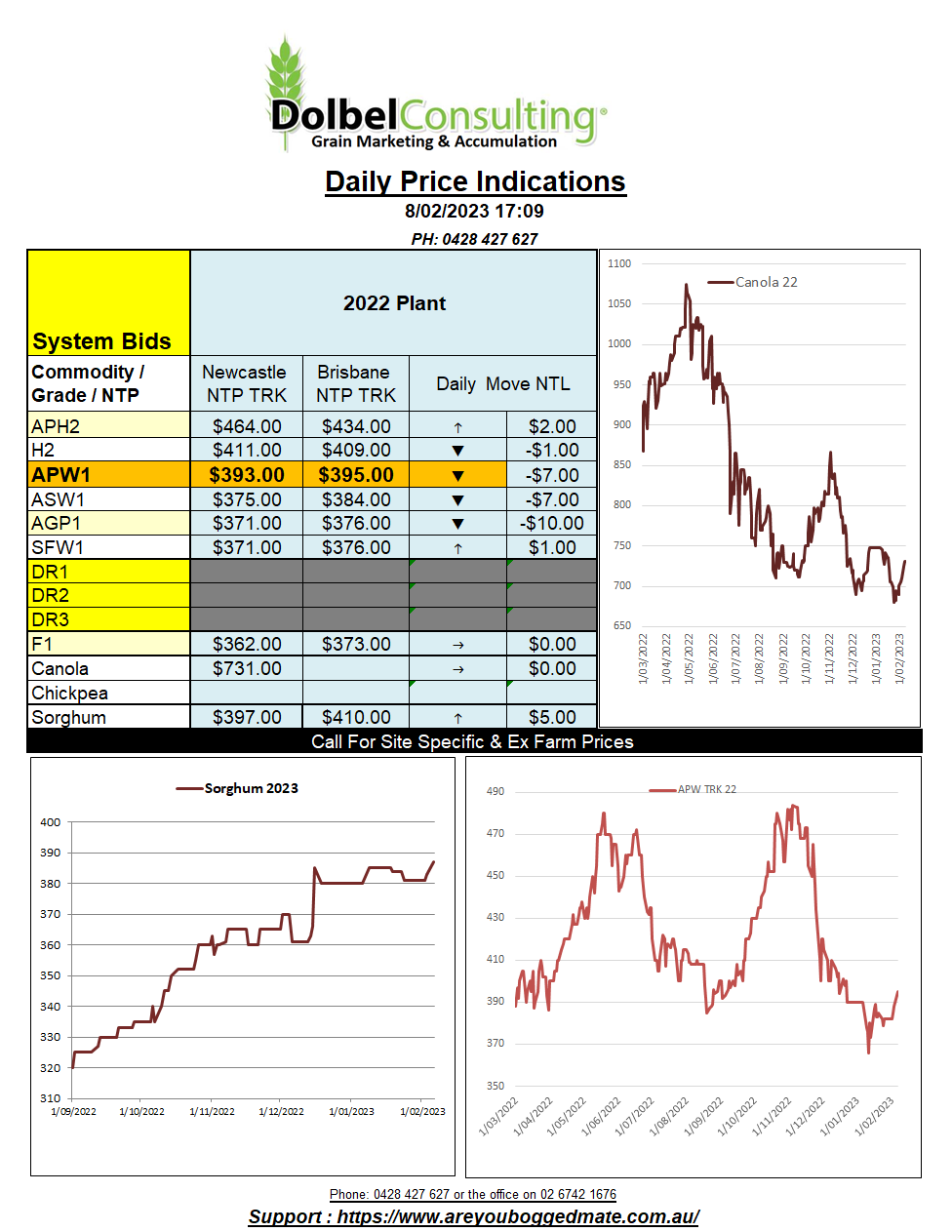

8/2/23 Prices

The bullish news was in the oilseed pit. Nothing overly optimistic, good weekly US exports prior to the mass arrival of S.American soybeans was viewed as positive. Talk of Indonesia suspending some palm oil export permits to make sure domestic supply is met was bullish.

Indonesia has a program called the DMO, Domestic Market Obligation. This is a quota of production that must be sold onto the domestic market prior to commencing export sales. There was talk that the current ratio could be amended soon. The regulated domestic price for palm oil in Indonesia is well under current export values. Product is being held off the domestic market, but the trade ministry is demanding domestic supply is increased from 300kt/m to 450kt/m to help supplies.

The movement in palm oil, the size of the Brazilian soybean crop and the way the S.American bean crop comes to market this year will be the key to short term prices for oilseeds. It may even have an impact on international canola values. Locally we may not see the impact as much as we feel the effects of the fluctuating AUD, but the impact is being seen on international futures market for rapeseed and canola.

Strength in the AUD overnight will likely counter the slight rally in Paris rapeseed, the combination signalling a potential AUD$2.00 decline in bids if local basis remains unchanged.

US wheat futures were mixed, nothing really pushing soft and spring wheat one way or the other. Hard red winter wheat continued to find support. The US HRW crop went into winter in very bad shape, the worst in years. The winter hasn’t been overly kind to the crop. Limited snow cover and some very cold conditions may see a higher percentage of winter kill come April 2023. 30-day precipitation across S.Kansas and the Panhandle is just 60% of normal.