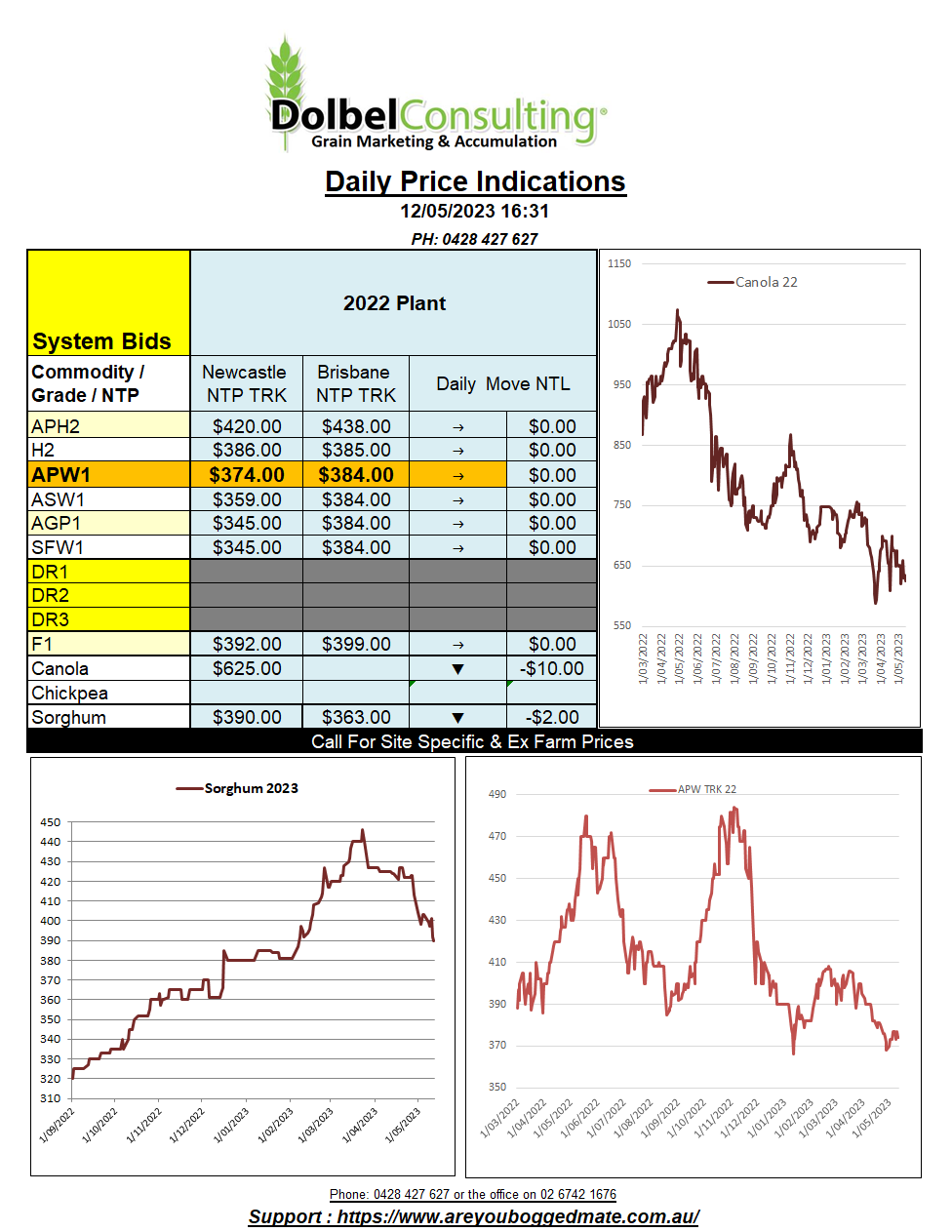

12/5/23 Prices

Chicago soybean and soymeal futures were some of the only green numbers on the screen this morning. Chicago wheat, corn, MGEX wheat, Paris and London wheat, all lower, as was Paris rapeseed and Winnipeg canola futures.

A combination of poor weekly US export numbers and the prospect of some rain in the US spring wheat belt and corn and soybean states was said to be the catalyst for the weaker close. There were rumours that the Black Sea Grain Corridor was going to be extended for another 60 days, nothing official as yet, but some wires were reporting leaked confirmation from a Turkish participant.

There’s a USDA World Ag Supply and Demand report due out tonight. No doubt there was a little squaring up being done in futures, but I’d imagine most punters are pretty happy with their current net short position, a position that’s been hard to budge over the last few months.

The punters are expecting to see old crop US corn stocks increased due to slower than expected export sales. There is expected to be a stark contrast to new crop carry out in US corn to old crop, new crop is expected to be huge. This could continue to pressure later month corn futures, thus world feed grain values in the mid to longer term.

US soybean ending stocks year on year are also expected to increase, nothing like the huge increase expected in corn though. Competition from S.American supply after a record crop in Brazil, and increased supply from the USA, may have a bearish influence on world oilseed prices going forward, unless there are production issues throughout the N.Hemisphere summer.

Wheat is a different story, a lot will depend on Kansas and Oklahoma. Currently the wheat crop is to see similar carry in / out year on year, big call.

StrategieGrains increased their estimate for the current European wheat crop, production increased by 4% to just over 130mt.