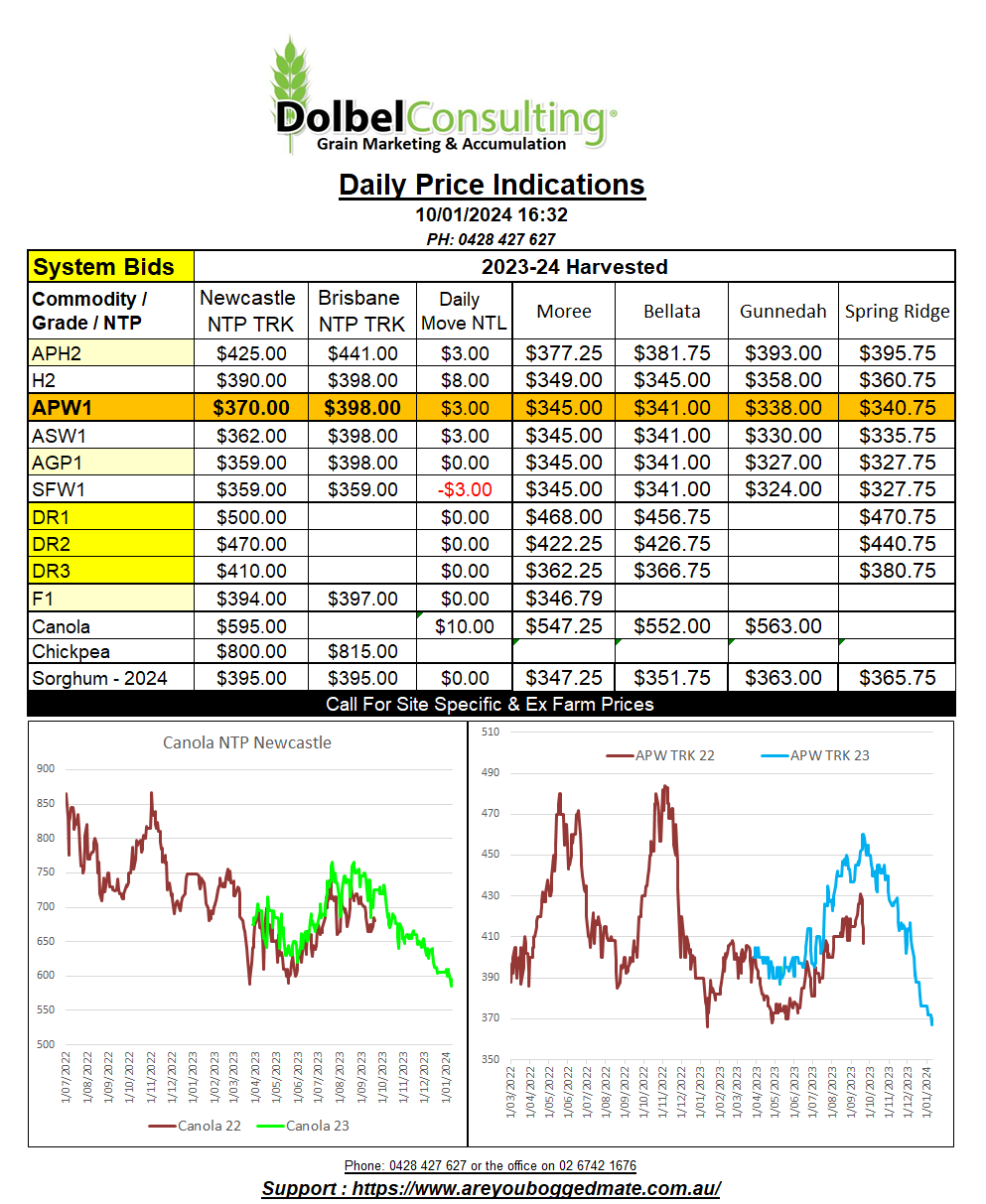

10/1/24 Prices

Technical trade saw most grain futures markets close in the green last night. Even US soybeans closed higher, dragging both Paris rapeseed and Winnipeg canola higher by the close.

Harvest of soybeans has commenced in Brazil, there’s not a lot off as yet, and the fields that are now being harvested would have been the fields most likely to have been affected by the drought conditions in Mato Grosso. So it comes as no real surprise that average yields are poor. The rate of soybean exports from Brazil is expected to remain strong in 2024. Already Brazil has exceeded the previous annual export record by almost 30mt.

Farmer protests across Germany continue with farmers from neighboring countries now joining the fight again government overreach. Thousands of tractors now block major highways and are clogging up cities across Germany. Ancillary industries, like trucking, are also joining the battle against policies that will cripple industries and force long held farmland out of the hands of families and potentially into the hands of larger corporate investors. The fact that this is not on every international news station is disturbing, not unlike when the French demonstrated against Macron last year.

Grain basis in the US was generally flat, happy to move higher with the futures market. Wheat values out of the Pacific Northwest were higher in both US dollar and Aussie dollar terms. HRWW was as much as AUD$8.45 higher when taking the weaker AUD into account.

On the AUD, AMP chief economist, Shane Oliver, has stated he expects to see world and Australian inflation fall in 2024, which he expects will influence the RBA enough to see a reduction in interest rates, thanks for that Capt. Obvious…. shows little interest in grain values or the retail sector.