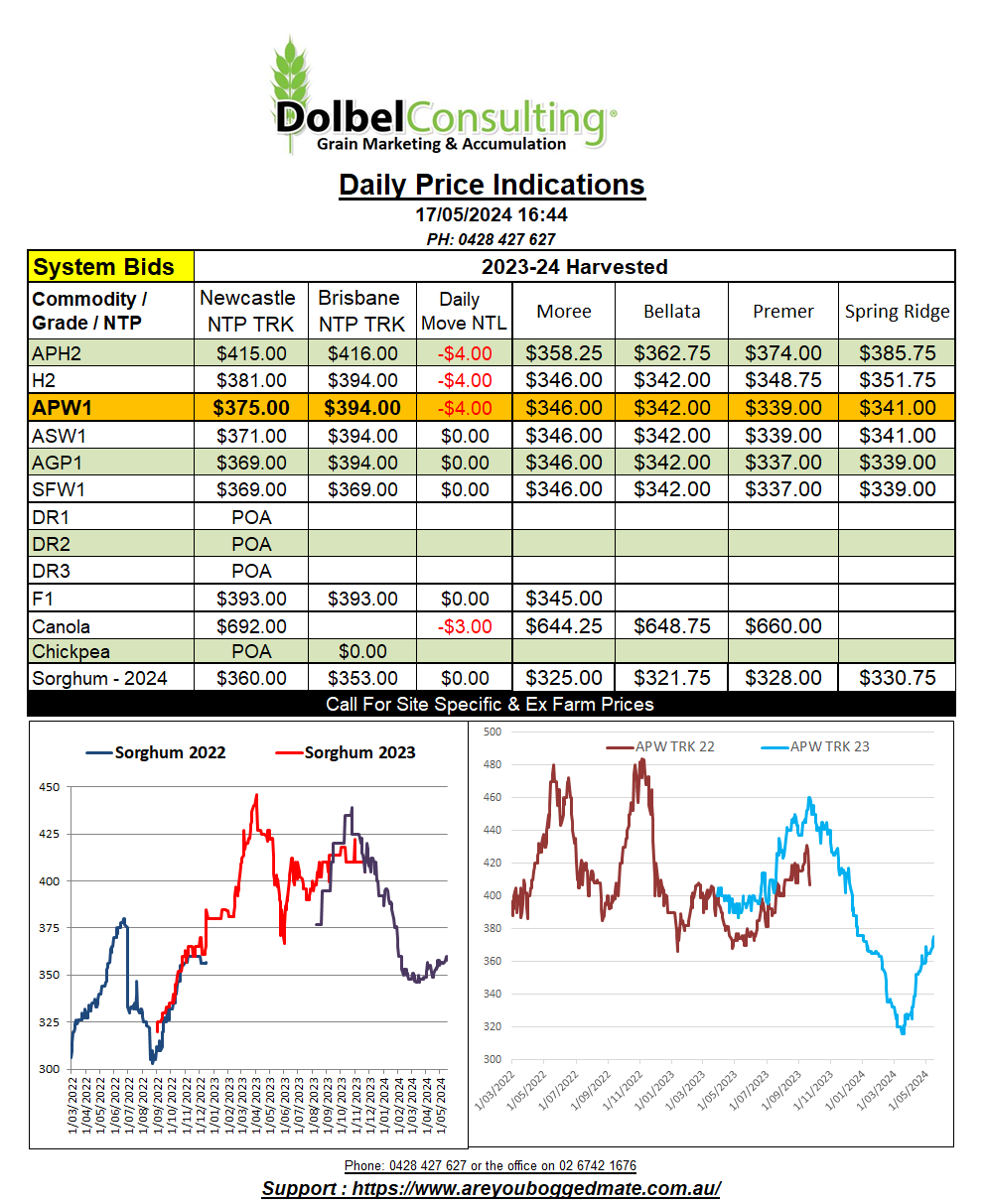

17/5/24 Prices

US wheat, corn and soybean futures closed lower in overnight trade, not by much, the weaker AUD almost taking care of much of the move in grain values once converted to AUD / tonne. The futures markets in the states are still seeing a little profit taking after the recent run up in values from the March lows. Weaker than expected weekly US sales data for wheat may continue to weigh on US values in the short term.

International wheat values CiF Asian clients are not that different between N.American, S.American and Aussie suppliers now. A recent run up in Argie FOB wheat values on the back of some production issues in their major trade partner Brazil, has seen prices there rally roughly AUD$40.00 since the start of May.

There are a number of bullish fundamentals still at play in the international wheat market. Russian frost, wet weather in Europe, dry weather in Western Australia and the above mentioned issue for Brazil. All these things should prevent a huge slip in prices in the mid term but longer term we must also acknowledge that the global stocks to use ratio is likely to remain above 30%. Thus prices are unlikely to rally by $100’s of dollars unless we see another major fundamental issue unfold. Even with India now being forecast to import 3mt to 4mt of wheat.

Chickpea values delivered Delhi market were higher again yesterday, taking back some of the losses made on Tuesday and Wednesday after a big rally on Monday, chart attached. Local contract prices here for the new crop remain strong but not suited to all producers. The premiums are really there for the October / November slot. Later delivery means later execution to export. Keep in mind the Indian crop usually arrives on the market late February and March. At these values one would expect to see pulse sowing increase in India.

Australian Crop Forecasters have estimated the 2024-25 Aussie wheat crop at 29.5mt +12% on last year, barley at 11mt +6%, and canola at 5.3mt, -6%.