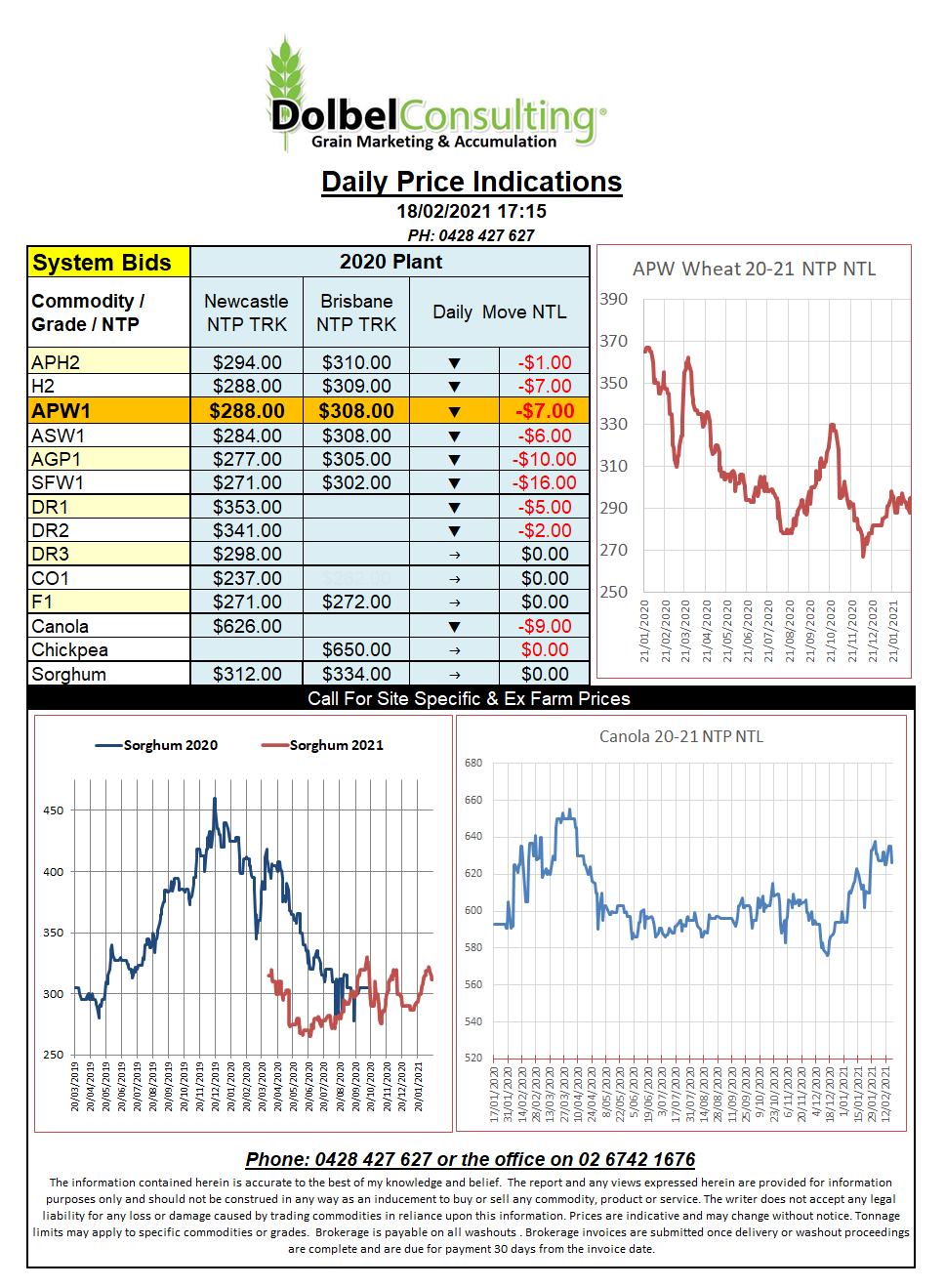

18/2/21 Prices

US futures markets gave back a large slice of the previous sessions gains. Wheat being the hardest hit. Interesting to note that the CME futures contract for Australian Wheat FOB (Platts) closed up US$1.50 in the April slot at US$289.25. Keep in mind that this contract still remains untraded, sorry, there’s 1000 contracts open in the March 21 slot and has been since forever. Just for the sake of a useless exercise this FOB number will basically equate to an ex farm price of about AUD$300 LPP.

The downside in wheat was primarily a function of profit taking after the sharp jump in the prior session.

The punters have come to the conclusion that around 10% of the US SRWW crop will suffer from winter kill damage and around 15% of the HRWW crop is likely to suffer damage. The million dollar question remains unanswered and that is just how much damage. That prediction will take at least another 7 – 10 days to even go close to quantifying.

Algeria picked up 32kt of wheat in their last tender. An unusually low amount for Algeria who in the past usually pick up 300kt – 600kt or more at tender. The business was said to have been done at US$320 CnF and is expected to have been bought from France. The unloading locations seemed to be the issue, with vessel size a concern at the nominated ports, thus increasing the costs.

On the back of an envelope this value would equate to a price comparable to something like AUD$295 – AUD$300 Aussie port. Again highlighting how cheap Aussie wheat is.