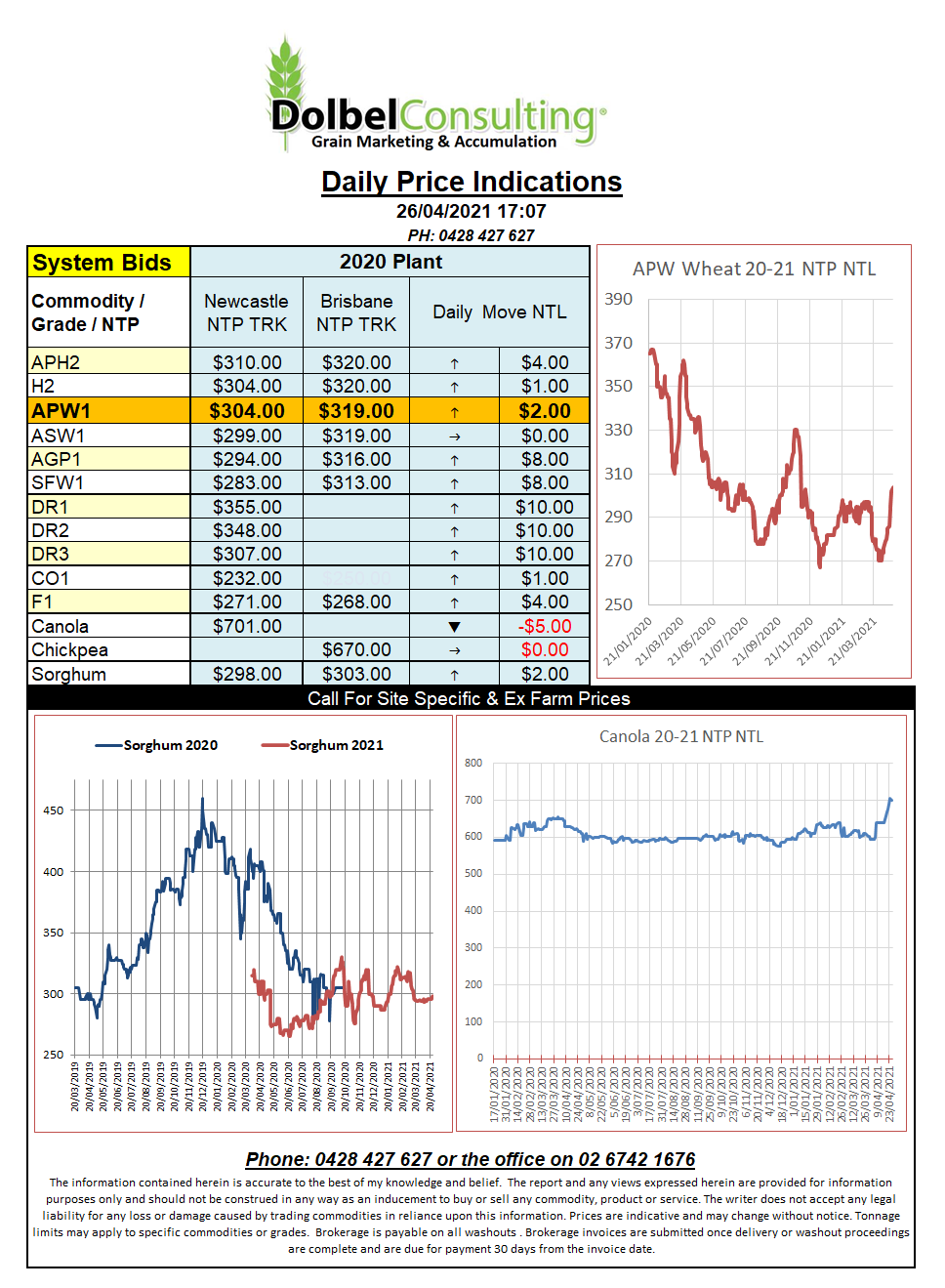

26/4/21 Prices

Profit taking was an early feature of the corn and soybean pits at Chicago but this gave way to a late session rally that saw the nearby contract close in the black.

The US weather map for this week isn’t great for the driest locations. The durum belt of the USA and Canada is especially dry and worth a mention. Further to the SE the soybean and eastern corn belt is expected to see some useful rainfall this week. Temperatures are also expected to climb back to normal to slightly above normal across the western corn belt and northern hard red winter wheat belt. Keep an eye on the US crop condition report this week to see if last week’s cold snap had an impact on winter wheat or early corn.

If the recent rally in prices was weather driven than the current forecast isn’t exactly bearish so may counter the round of profit taking that is so often a feature after such a rally as last week.

Back in the land of cash markets we see bids for hard red winter wheat out of the Pacific North West of the USA pushing higher. A June lift was bid at US$8.00/bu, roughly comparable to a Newcastle port price of about AUD$340-5 for H2. Spring wheat was bid at a premium of about 40c/bu to HRW, about AUD$19/t. Club white wheat was bid at -20c/bu to HRW, lower transport costs to port. This does still indicate that our local values are some $20 under US values at this stage and may be the thing that caps further advances in US values this week.

Good conditions across Russia is seeing some pressure to increase Black Sea production.