5/8/21Prices

It was a bit of a sell wheat / buy soybeans session at Chicago. Technical selling contributed to a round of profit taking in the wheat pit after a generally softer July. It’s harvest in the northern hemisphere after all. All three US wheat grades finished the futures session softer.

In Canada we see cash bids out of SE Saskatchewan slightly lower for bread wheat while durum values skyrocketed to numbers we haven’t seen in years. The average cash bid for 1CWAD13 for a Dec21 lift came in at C$527.42 an increase of C$51.84. I’m not sure if this is sustainable but just a week or so back we saw the durum market rally over C$40 in a day and those gains were sustained.

For the sake of the exercise we can roughly convert this bid to an Aussie port equivalent using somewhere like Italy as the destination port and we come up with a delivered Newcastle number around AUD$644. Durum offered FOB France was as high as E370.25 / tonne. Roughly equivalent to AUD$466 Newcastle port to Italy.

Using Japan as the durum consumer Canadian 1CWAD13 would be comparable to a Newcastle port price of AUD$640 and French durum closer to AUD$530. Yesterday local new crop DR1 values rallied to AUD$450 less rail. Using the above comparisons one can’t help but think there’s a little fat left in the durum price regardless of execution risk. Quality risk is quickly becoming the big issue for producers and consumers alike but Canadian and US crops are said to be quiet good quality wise, if not yield wise.

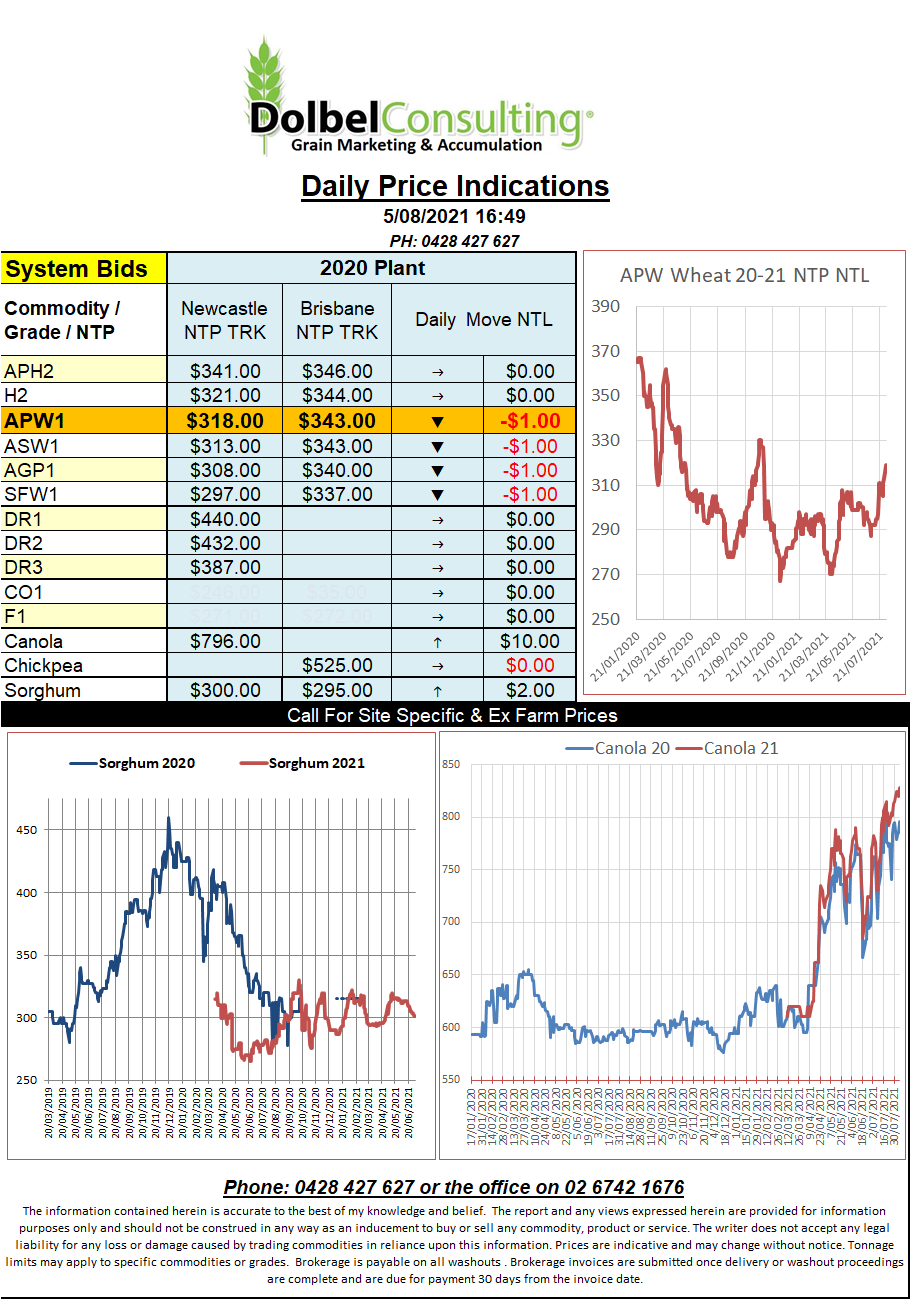

Still in Canada we continue to see cash bids for canola move higher, SE Sask bids up C$14.63 / tonne to C$839.56 Dec21, don’t ask about local basis here, it’s still depressing. At negative AUD$91 on the new crop it’s not as bad as it was though.