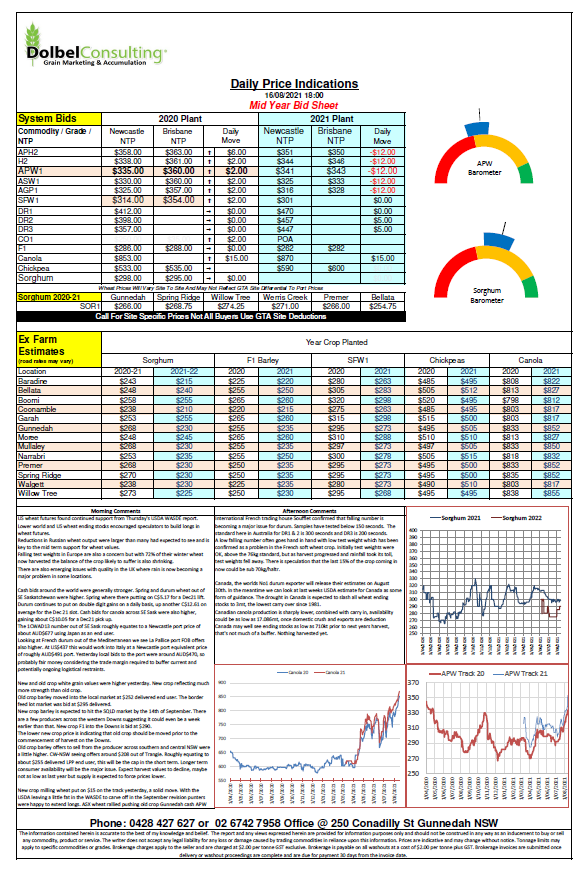

16/8/21 Prices

US wheat futures found continued support from Thursday’s USDA WASDE report. Lower world and US wheat ending stocks encouraged speculators to build longs in wheat futures.

Reductions in Russian wheat output were larger than many had expected to see and is key to the mid-term support for wheat values.

Falling test weights in Europe are also a concern but with 72% of their winter wheat now harvested the balance of the crop likely to suffer is also shrinking.

There are also emerging issues with quality in the UK where rain is now becoming a major problem in some locations.

Cash bids around the world were generally stronger. Spring and durum wheat out of SE Saskatchewan were higher. Spring where there putting on C$5.17 for a Dec21 lift. Durum continues to put on double digit gains on a daily basis, up another C$12.61 on average for the Dec 21 slot. Cash bids for canola across SE Sask were also higher, gaining about C$10.05 for a Dec21 pick up.

The 1CWAD13 number out of SE Sask roughly equates to a Newcastle port price of about AUD$677 using Japan as an end user.

Looking at French durum out of the Mediterranean we see La Pallice port FOB offers also higher. At US$437 this would work into Italy at a Newcastle port equivalent price of roughly AUD$491 port. Yesterday local bids to the port were around AUD$470, so probably fair money considering the trade margin required to buffer current and potentially ongoing logistical restraints.