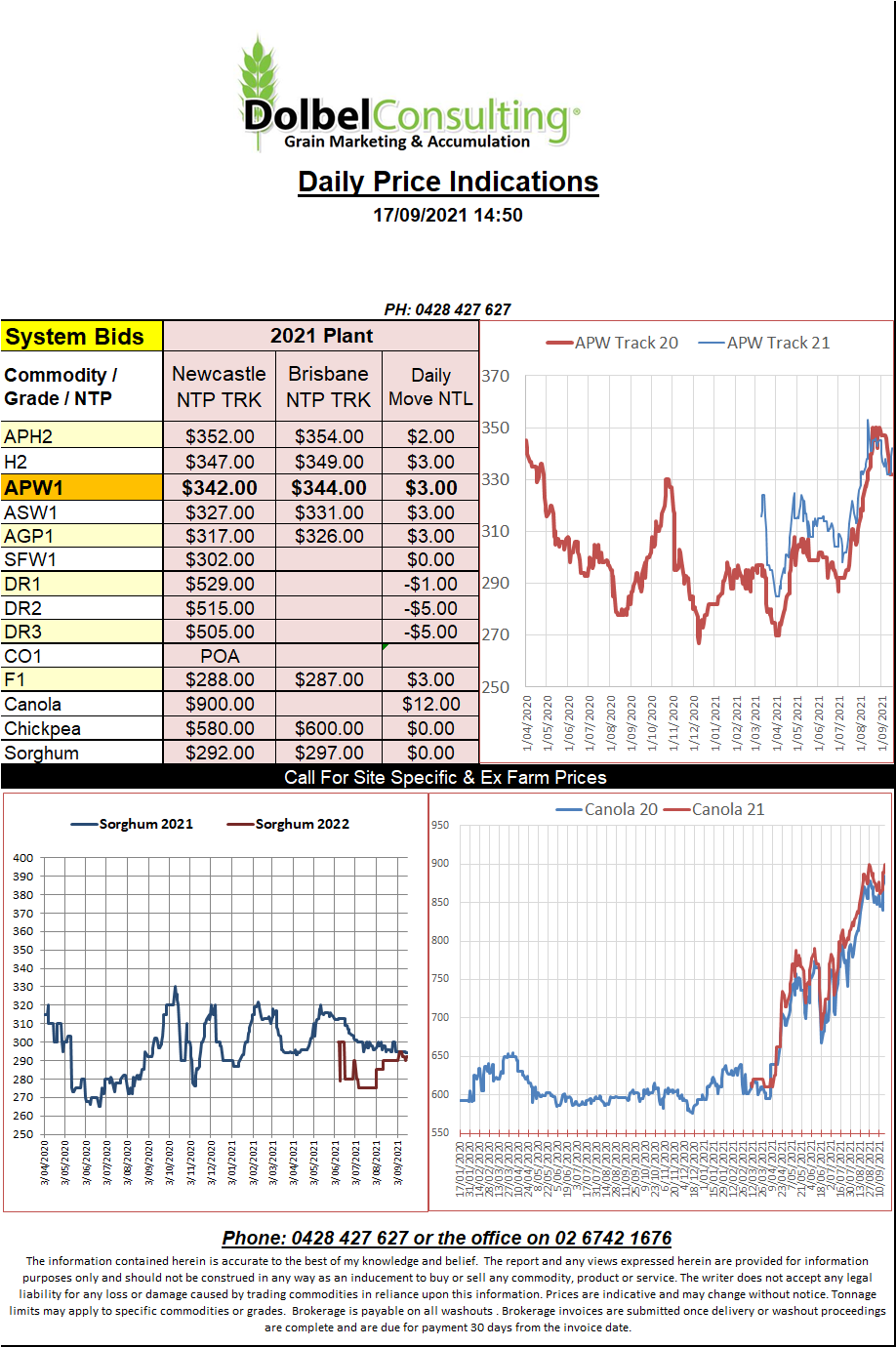

17/9/21 Prices

Weekly US export sales for wheat were good and underpinned the wheat futures markets there in overnight trade. At 617kt it was above the average trade estimate prior to the report. Stronger wheat futures in the US rolled over to higher offers for cash wheat out of the Pacific North West with both hard red winter wheat at 11.5% and spring wheat at 14% improving in value. Soft and club white wheat values out of the PNW were unchanged.

Korea picked up 68kt of corn overnight at US$326.39 C&F. This is interesting from two perspectives, one obviously being the price paid. This confirms current values out of the PNW of the US can and will continue to compete with product out of the Ukraine into the Asian markets. It was also interesting as this purchase was made without a formal tender being called.

Still on corn we see C&F values for China indicating that the S.Korea purchase was pretty much bang on the money. The cheapest corn for China continues to be from either the US PNW or from Argentina. Brazil, French and Ukraine corn all some US$10 – US$15 more expensive at this stage. Roughly the S.Korean corn sale at US$326 would equate to about AUD$350 – 60 XFLPP. Not painting a great picture for new crop corn values here compared to sorghum at AUD$270+ XF for some farms.

Paris rapeseed futures were sharply higher putting on E8.25 on the nearby. ICE canola appeared to be caught up in the sluggish US soybean market and struggled, eventually closing lower. Slow exports out of the US Gulf is hurting export pace for most grains. The failure of the Australian price to reflect recent moves higher in Paris rape 100% has seen basis blow out by about AUD$13/t, now back to neg $53.