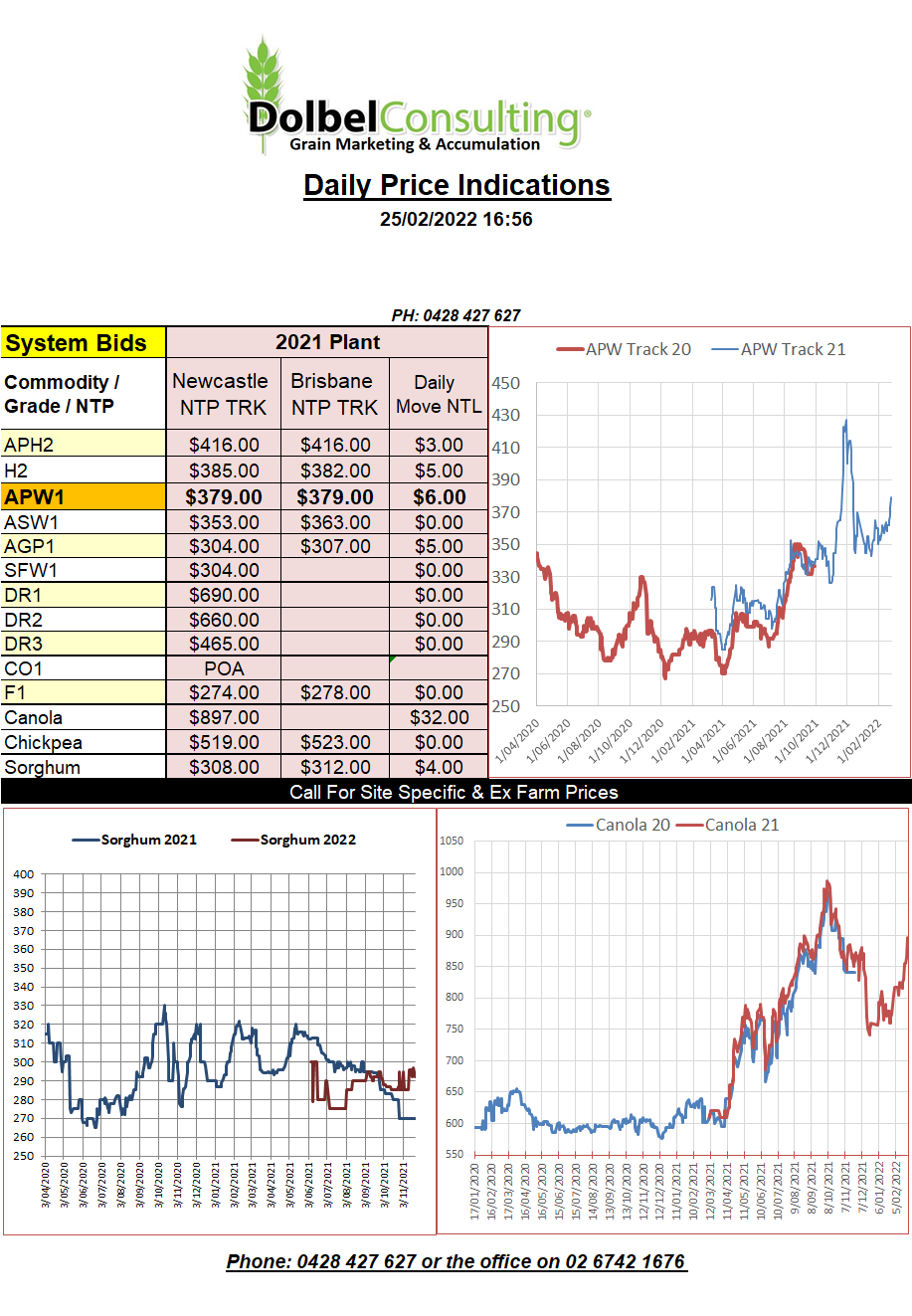

25/2/22 Prices

Chicago wheat futures took the lead from the overnight session and pushed to 50c/bu higher in both the March and May 22 contracts. Hard red winter wheat futures at Chicago were not too far behind. Paris milling wheat futures also moved sharply higher, the nearby March contract up E29.50 per tonne by the close the Dec22 slot up E12.50 to close at E291.35, a discount of E24.75 to the nearby.

It’s all about the Ukraine / Russia conflict. Ukraine has asked Turkey to close the Bosporus and Dardanelles to Russian war ships. I can’t see that happening but if it did that would drag a whole new pile of wood into the fire. There’s talk of some WW2 pact that is preventing that from happening unless Turkey is directly involved so let’s hope that pact stays honoured.

Global FOB grain values are responding but not to the same degree that futures markets have. Chart Attached for cash FOB grain markets around the world converted to AUD / tonne XF LPP price equivalent. That’s a pretty grey chart but you get the picture.

Interesting to note a Ukraine / Russian war can’t even rally FOB durum.

Looking at PDQ cash prices for Canadian wheat this morning shows that old crop 1CWRS13.5 wheat is actually softer across SE Saskatchewan. We are tending to see basis erosion here too, the cash market not as keen to follow futures higher.

Unsurprisingly Egypt cancelled their wheat tender, participation was a little low for some reason.