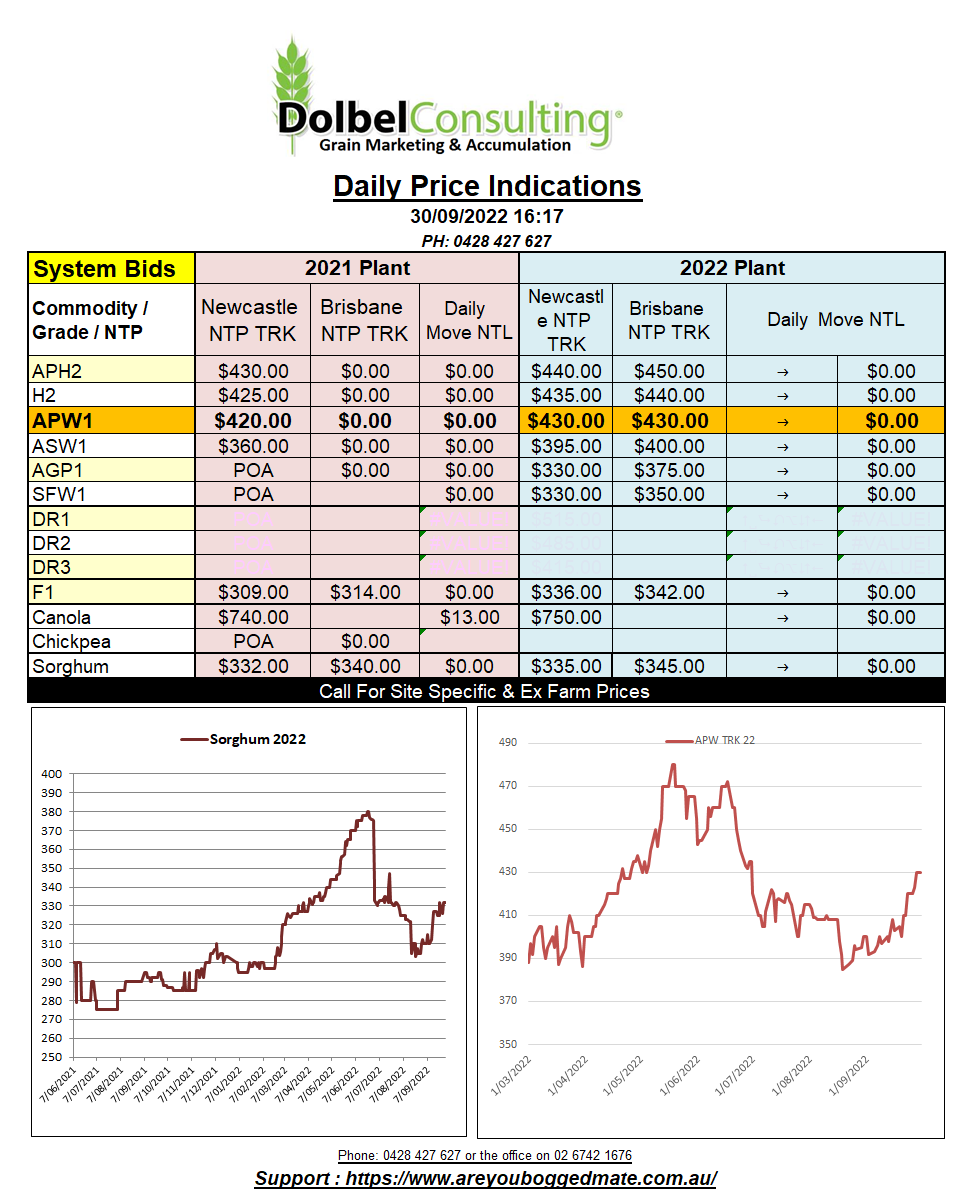

30/9/22 Prices

The bombardment of complex outside market influences continues to take the lead over fundamental influence in world grain markets. The world will continue to eat, probably grains and meat, (maybe bugs). So, keeping a close eye on fundamentals is going to head you right in the long run… but.

The main problem with relying wholly on fundamentals is that this may not consider all outside influences that can affect demand or supply.

For instance, the ability of a buyer to be able to pay for what they are buying is a crucial part of the demand side of any S&D table.

As is the cost of production on the supply side. Ukraine is a prime example of restrictions on the supply side due to access and costs. On the flip side we see things like the EBRD loan to Tunisia actually helping to prop up or stimulate the demand side.

Paris milling wheat futures continue to find resistance above current levels. The Dec 22 contract closed E1.50 lower overnight, down to E352.25 (AUD$531.89) per tonne.

Algeria picked up 300kt of 11.5% milling wheat for November shipment at US$370 C&F. Still confirming counterparties but there is speculation that a portion will be Black Sea, probably Russian. This number would roughly convert back to an AUD / tonne price XF LPP of something close to AUD$390. This actually compares better than expected to the current AUD$435 track NTL number.

Taiwan picked up 51.8kt of US milling wheat at US$440.55 for DNS 14.5% and US$456.35 for 12.5% HRWW and there was also a parcel of soft white 9.5% wheat booked at US$374.04. These are FOB US numbers and would attract about US$41 in frieght out of the PNW to Taiwan. The white wheat value is good, currently 10.5% soft white wheat is priced at roughly US$345 port, leaving US$30 to FOB it.