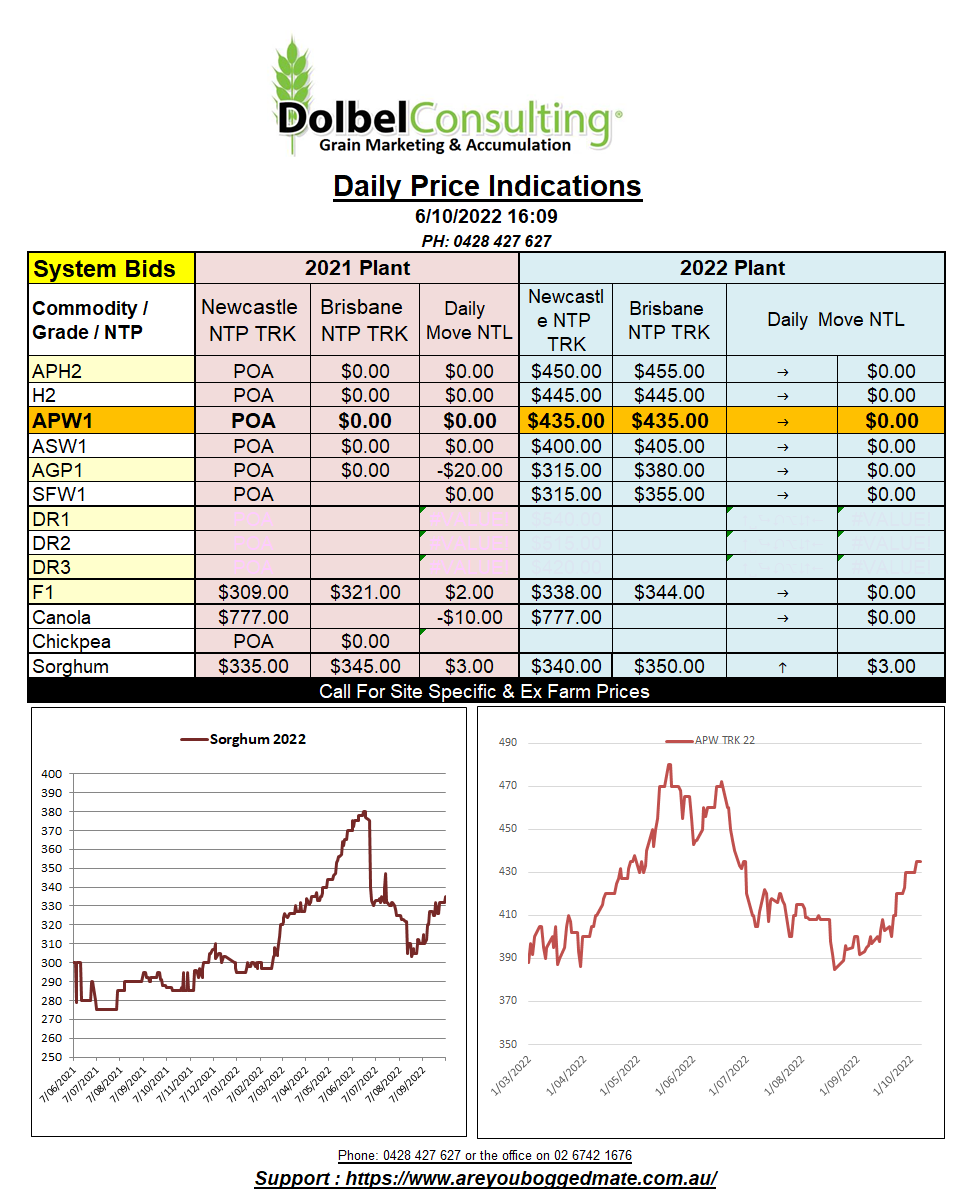

06/10/22 Prices

US futures markets were generally flat to firmer, bar soybeans which slipped 13c/bu on the January contract. It is harvest time for US summer crops and the level of competition the US is facing from both Brazil and Argentina in regards to corn and soybean sales is hurting the US export pace.

Corn values C&F China tell the story. US corn is priced around US$388 C&F China out of the Gulf, US$385 out of the PNW while Brazilian corn C&F China is priced closer to US$344 and Argie corn is even lower at US$343. This could be indicating that US corn futures may struggle to push higher and in fact could come under selling pressure in the short to mid-term unless the US fundamentals change significantly. The impact this may have on world feed values, both SFW1 and SOR1 could be negative. A fall of US$40 is Aussie dollar terms is equivalent to about AUD$61.

This plausible downside in US corn futures may just be one of the reasons we are seeing very large spreads to the lower grade wheat, feed barley and sorghum. One might argue that if this is the case, than buying at better basis now and hedging, selling US corn futures to cover downside risk is also feasible. Or they could decrease grade spreads as corn futures fall ???

Sorghum values out of the US are mixed, at the FOB level generally a little softer week on week. Argie numbers up river are lower in USD terms and C&F China numbers are also a touch lower.

Tunisia picked up 100kt of durum at US$634.89 CFR, March – April in their recent tender. This appears to be a big number, equivalent to well over AUD$650 per tonne at the farm gate LPP. The trade will hopefully also know the results of the 50kt Algerian durum tender by Friday.