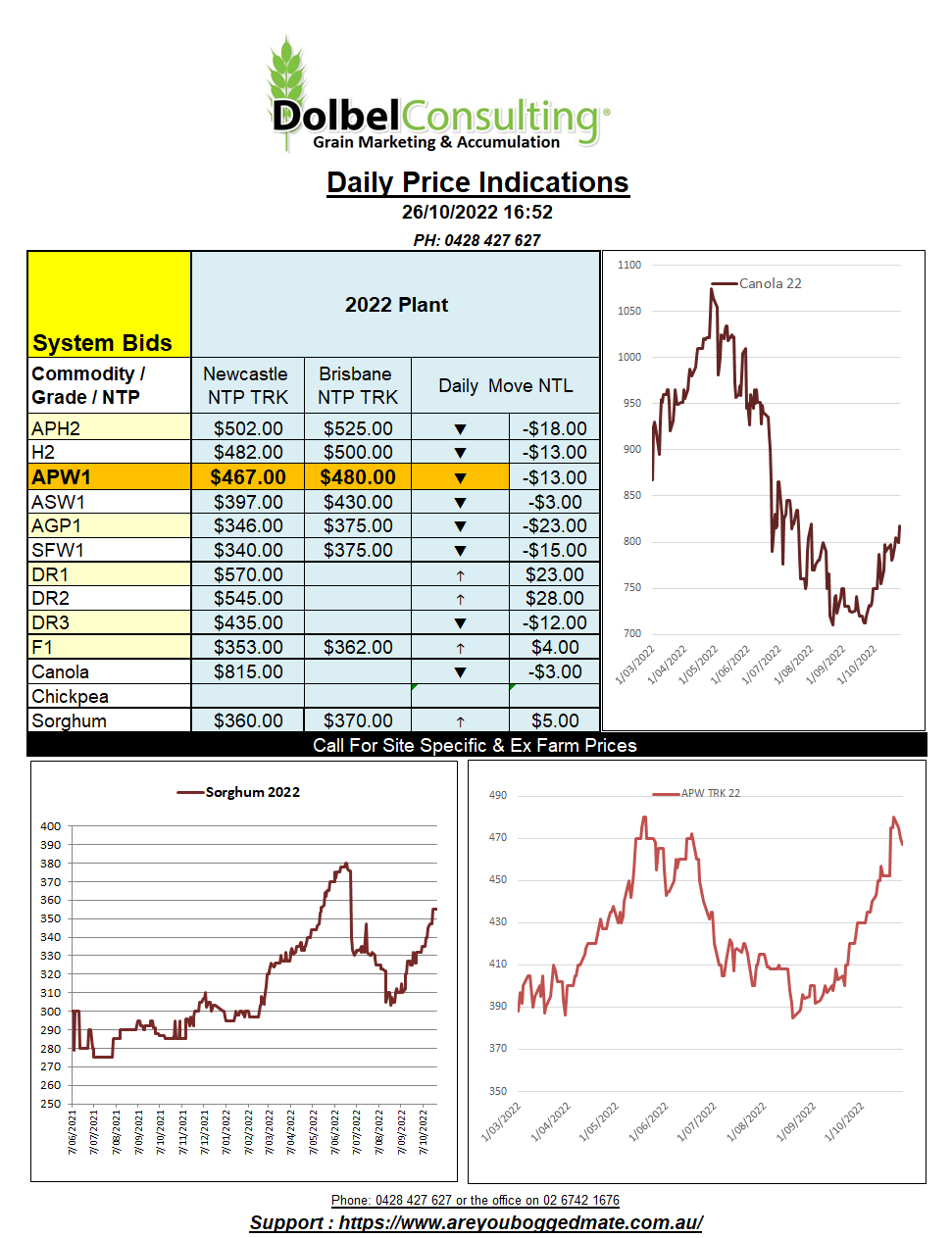

26/10/22 Prices

US soybean futures made double digit gains overnight, one of the few grains that closed in the black, corn the other.

The upside in soybeans did not flow through to the canola and rapeseed futures market. Both canola and rapeseed contracts closed softer. Paris rapeseed for the Feb 23 slot was back AUD$12.08 by the close, Winnipeg slipped AUD$16.21. The strength in the AUD will not help either, that alone is worth AUD$5.75 additional downside to the Winnipeg close.

Wheat futures were generally lower, after months of huge daily volatility you can almost consider a 5c/bu change in futures a flat market now days. Technical selling at Chicago saw wheat set a one month low. The IGC monthly S&D data, and the USDA weekly crop progress report showing sowing pace for US winter wheat at 79%, done nothing to fuel the market.

A raft of international tenders over the last few days have continued to indicate that US wheat remains the most expensive in the world. Russian wheat continues to dominate many of the tenders, even business into Algeria. I wonder if the Algerian’s will ever forgive Macron.

The USDA attaché to Australia has called the national wheat crop 34mt, maybe their data is a little old. The past week may have peeled a couple of million tonnes off the NNSW estimate. I’ve attached the satellite image of Moree. It’s an impressive amount of water heading west across the watercourse country. One needs to remember that that country was not all that long ago left to grazing as it was prone to severe flooding. Cotton development in the west created a lot of the infrastructure needed to control the flow but as you can see from the satellite data that control, or much of it, was handed back to Mother Nature this week. This flooding is being repeated across many of the flood plains of western NSW this October.