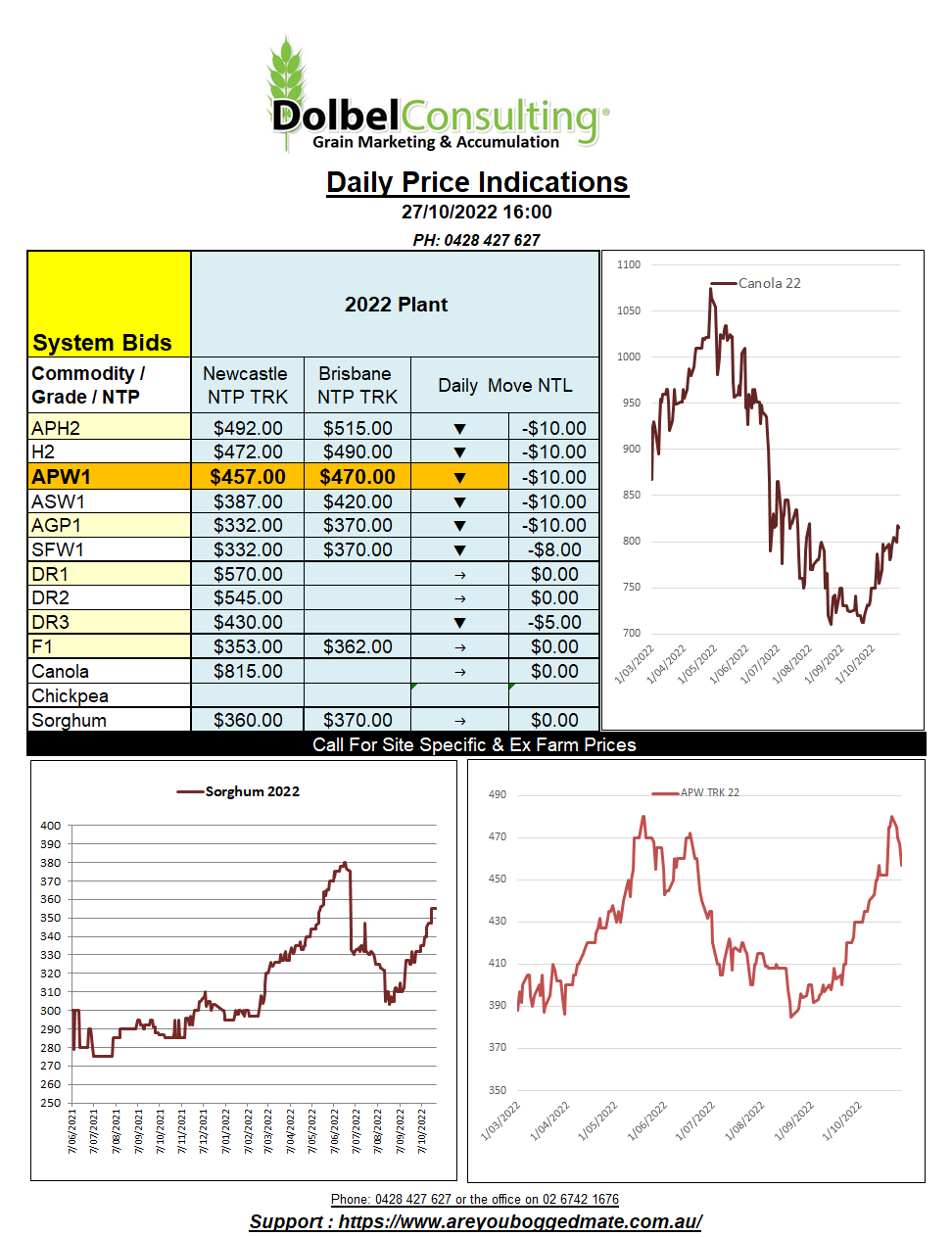

27/10/22 Prices

The weaker USD, hence, the stronger AUD will be the thorn in our side today. The AUD spent the majority of the session trending higher not only against the US dollar but also against many of the other major currencies. Improvements in commodity and mineral prices set up the AUD as a nice buy.

The punters shrugged off an Aussie 7.3% CPI announcement, something I wish the average Australian could do, and continued to buy the AUD.

I’ll deviate a little from grain momentarily, the new CPI report is worth a look. It shows the annual increase in costs from the same quarter last year for some sectors. You can understand the increase in some things like transport and imports. I guess energy costs do roll across every sector too, but I find a YoY increase on things like communication 2%, education 4.6%, insurance 4.2% and alcohol 4%, god forbid, interesting. Food is another, up 9% YoY. As a producer, what are your views on the CPI on food. Has, or will, the increase in production costs been reflected in your sales receipts. Where are the major increases, fuel, power, chemical, fert…. labour ? What’s the difference in your per ha costs between 2021 and 2022

Pakistan saw offers ranging from US$384.40 to US$414.15 in their latest attempt to pick up 500kt of milling wheat. Modified tender terms saw better participation than their last tender. Pakistan is expected to remain a significant importer of wheat in the mid-term after serious flooding in Sept and the high cost of inputs, is expected to hinder sowing. Pakistan usually sow winter wheat in October / November, harvest starts in March and runs through to late May. Annual wheat production is usually about 25mt. Rice in Pakistan is sown in May / June and harvested in Oct / Nov. Rice production is usually 8.5mt, Pakistan expects a record rice crop in 2022 of +9mt. Not sure if all this is adding up right to me.