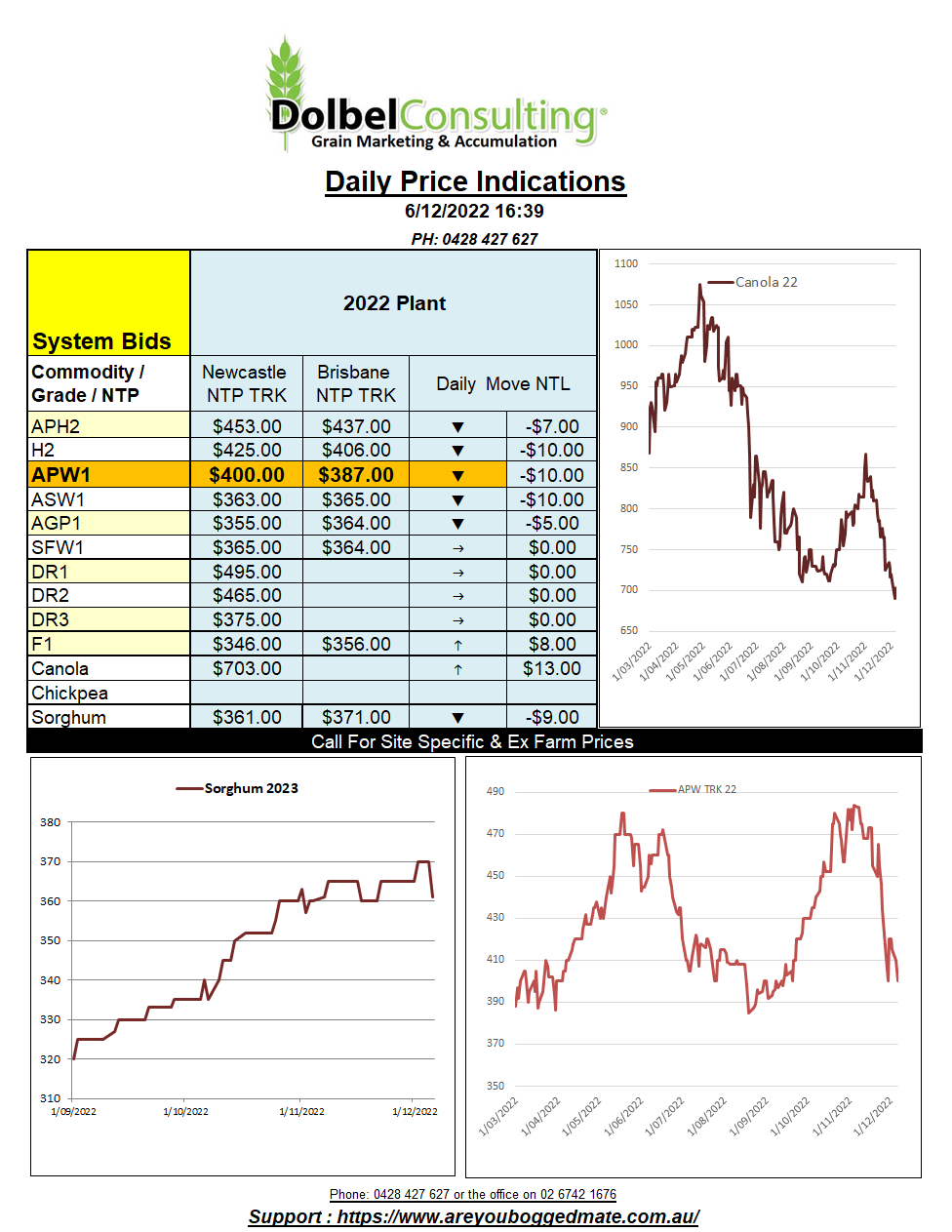

6/12/22 Prices

Outside markets had a large influence on US grain futures overnight. A stronger US dollar, a sell off on Wall St and softer energy markets all helping to set the mood in commodities. With the US FED now talking a slowing in rate hikes and much of the financial the data now pointing to recession (wow no one saw that coming) the trade overlooked the potential for increased demand from China and instead pushed wheat sharply lower, corn lower and soybeans flat to lower.

The week ahead also predicts some rainfall for east of the Mississippi. Modelling indicates that much of the drier regions of the US, west of the Mississippi will again miss out. In Argentina there’s the prospect of some light rain across the central north, did someone pull a header out of the shed. The eastern soybean districts of Brazil have seen some very heavy rain over the last week. Bahia State, which produces around 12% of the Brazilian soybean crop is suffering severe flooding.

Speculation that China is about to downgrade the threat level, thus management strategies needed to live with COVID, has a few punters expecting to see a revival in demand for grains into China. News of 130kt sale of US soybeans to China overnight helped stabilise the Chicago soybean market towards the close. Dry weather in the far south of Brazil, closer to Argentina, is hampering soybean sowing there but the forecast is for some useful falls in the next 7 days.

US wheat futures were basically a casualty of spill over selling from the outside markets and corn last night. Wheat futures in the US have been under constant pressure for a while but are now trading at an 86.75c/bu (AUD$4760) spread to corn. Given the production issues in Australia and Argentina, and the dry weather in the USA, fundamental support should begin to kick in. Look for some bargain hunters in the wheat pit this evening.