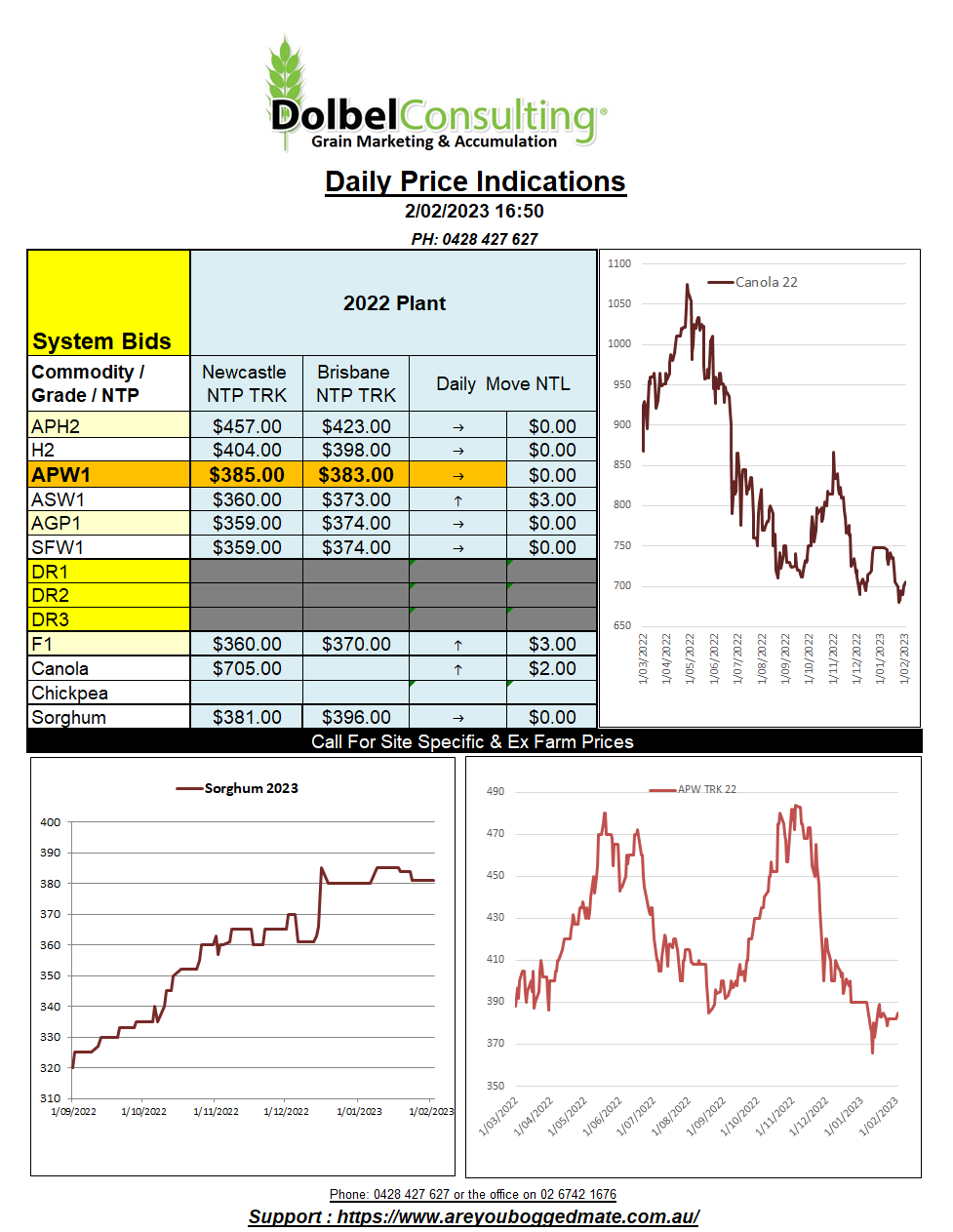

2/2/23 Prices

The funds continue to sell Chicago SRW wheat futures lower, happy extending their short positions for the time being. Some analysts continue to talk this market up, it’s easy to see why with the volatility of the Black Sea market and poor conditions in the US and the chance of some winter kill in Russia. From a fundamental perspective these all sound like reasonably bullish reasons.

With wheat at 760c/bu, what is the upside potential. Last year we saw the media really push the narrative that the world was going to starve unless Ukraine could export some wheat. Anyone who knew how to read an S&D table called this rubbish, a media beat-up, as it was later proven to be, and prices fell. This simple S&D analysis was muddied somewhat by the implementation of the Black Sea Grain Corridor deal though. The media sprouting that the deal had saved millions of lives, not mentioning the fact the deal had brought in a bit of income to Ukraine to help pay the interest bills and buy some more ammo. India lined up to save the world, pulling on the cape and mask in true superhero fashion, a crate paper outfit as time would prove. Now India is expected to be an importer, along with neighbouring Pakistan.

Then there’s China, don’t mention China, no market analysis would be complete without a huge amount of speculation about China. China carries 53.68% of the world wheat ending stocks ……. that’s 144.08mt of wheat according to the USDA. Yet China is importing wheat and selling state stocks at auction on a weekly basis now, in an attempt to lower the internal price of wheat. Stocks 144mt, local demand is 144mt…… production was138mt….. Then there’s Russia, a record crop according to Russia, no wonder really considering the additional tonnage acquired nearby, even so we see Russia increasing their export tax to keep local wheat in Russia, to help stabilise their price of wheat. How grey do we need this market, Russia, China, and India, all three contribute 42% of world wheat production and 64% of world ending stocks. Just how volatile would a small US HRW crop make this market.