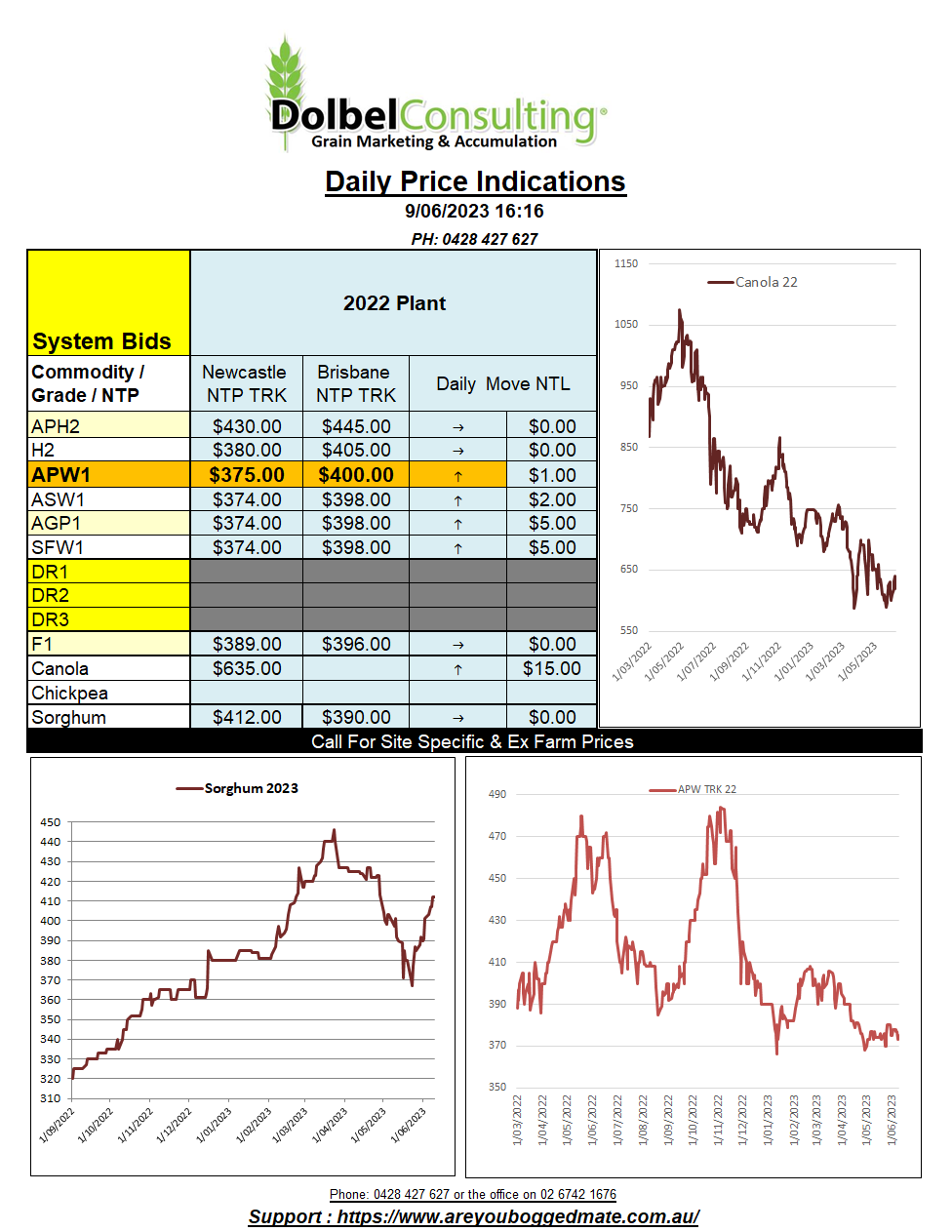

9/6/23 Prices

US wheat futures bounced back strongly last night. Was it a dead cat bounce or has the fund shorts finally saw the writing on the wall and are deciding to change strategy and get on board with the rest of the fundamental analysis and call this wheat market more bullish than bearish, who knows. The odds are probably more in favour of a rally based off the weaker US dollar; funds rarely let reality intervene over a position.

The increased tension in the Black Sea region is hard to ignore. The demolition of the Khakovka dam near the Black Sea port city Kherson has implications for grain production in that region as well as supplying water to the Zaporizhia nuclear power plant about 60ks north of the breach. The region between the lake and Crimea is a major irrigation region. With that irrigation system now compromised it will have an impact on what was sown. Which I guess is a major question in itself, what was sown in that region. It’s been part of the major conflict zone for some time.

Paris milling wheat futures followed the US market higher, gaining E3.75 in the Dec23 contract and E4.50 on the nearby. London feed wheat was higher in the new crop contracts and Paris corn futures were also higher, as was rapeseed. Both Winnipeg canola and Paris rapeseed futures closed in the green. The move in Paris rapeseed for the Feb24 slot when taking fluctuations between the AUD and Euro into account is worth about AUD$5.42 here today. The $20 fall in local bids yesterday resulted in basis losses here, slipping from AUD$48.30 under to AUD$56.96 under for the old crop. Strength in new crop rapeseed futures is said to be encouraged in part to a sharply lower sown area in Australia, back 35% to 40% on last year, a combination of weather, price, and I’d love to be able to say compliance laws for export to the EU all forcing Aussie acres to other grains or forced fallow.