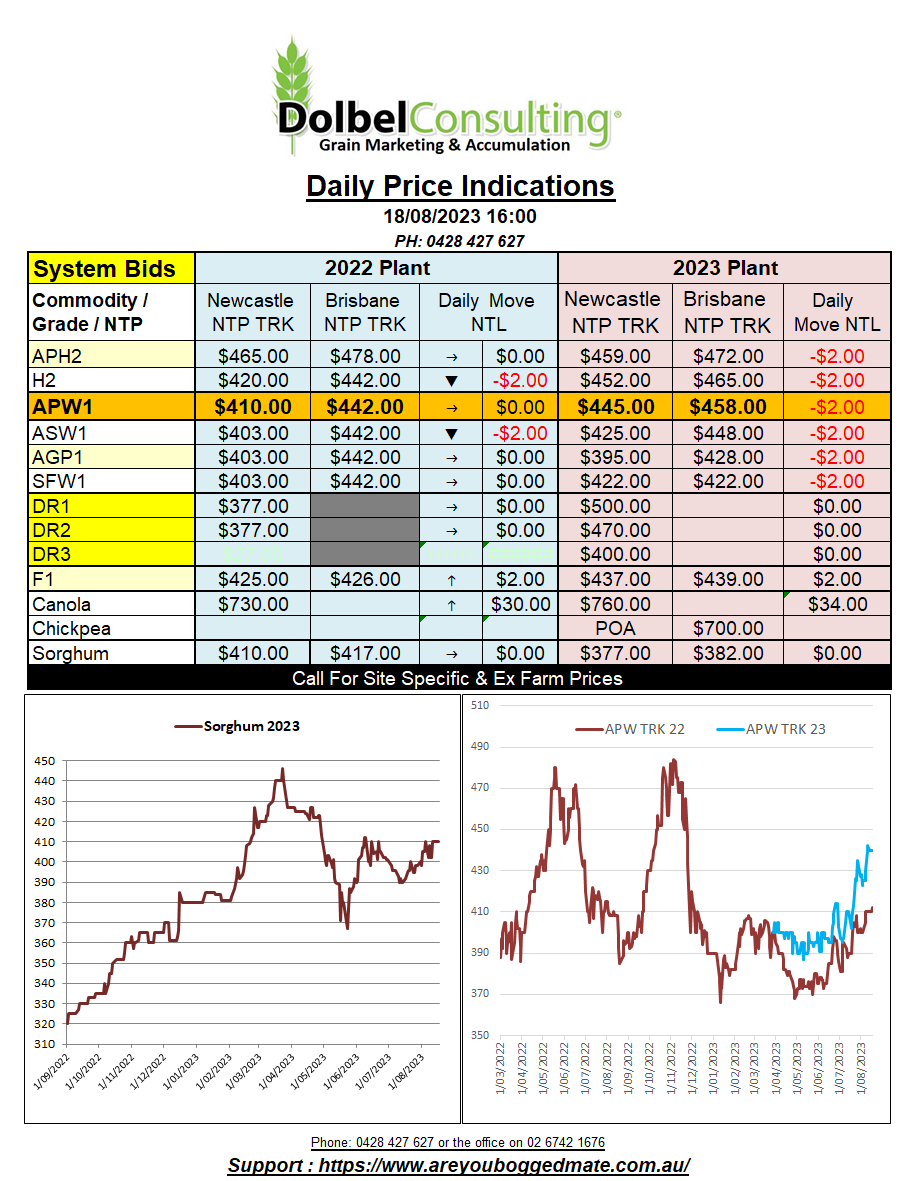

18/8/23 Prices

US wheat futures found some pressure from technical selling last night. Weekly US wheat export sales were within trade estimates, which were not enough to keep the momentum of the previous session alive.

News of a ship leaving Odessa with Ukraine naval assistance my also suggest that the glut of grain that has been stuck at Odessa may again start to move to market. Volume of Ukraine grain through the Danube ports is well back on where it was expected to be. Continued attacks on facilities along the Danube, higher freight and insurance costs, are all taking their toll on volume.

Paris milling wheat futures were lower, slipping E1.75/t in the December slot. Surprising given the expected final outcome in average quality. Official quality estimates has production of bread wheat at 35.6mt, up 3.5% on the 5 year average. Millers seeing this data feel no need to worry about quality. The malt industry also shows little concern over quality, the bulk of the barley crop also expected to be usable in the brewing industry.

There is concern over soft wheat production though. Slow harvest progress in both the Normandy and Brittany regions resulted in up to 40% of the crop in the north east being exposed to adverse weather. Up to 70% of that unharvested wheat is expected to only make feed grade, yields also suffering.

A front ended Russian export program has kept the lid on international values over the last week or two. French exports feeling the pressure of a competitive Black Sea crop as well as French storage facilities in the north east filling up with off grade wheat, wheat that will not move to market as freely as milling wheat might have. This in turn drags stocks out further than usual.

Canadian durum and canola values were flat to firmer in overnight trade. Durum pushing a couple of dollars higher nearby while canola for a December lift XF SE Sask was roughly C$4.40 firmer. Italy imported roughly 41kt of durum from Russia last week, that’s 93.5kt from Russia since July 1st.