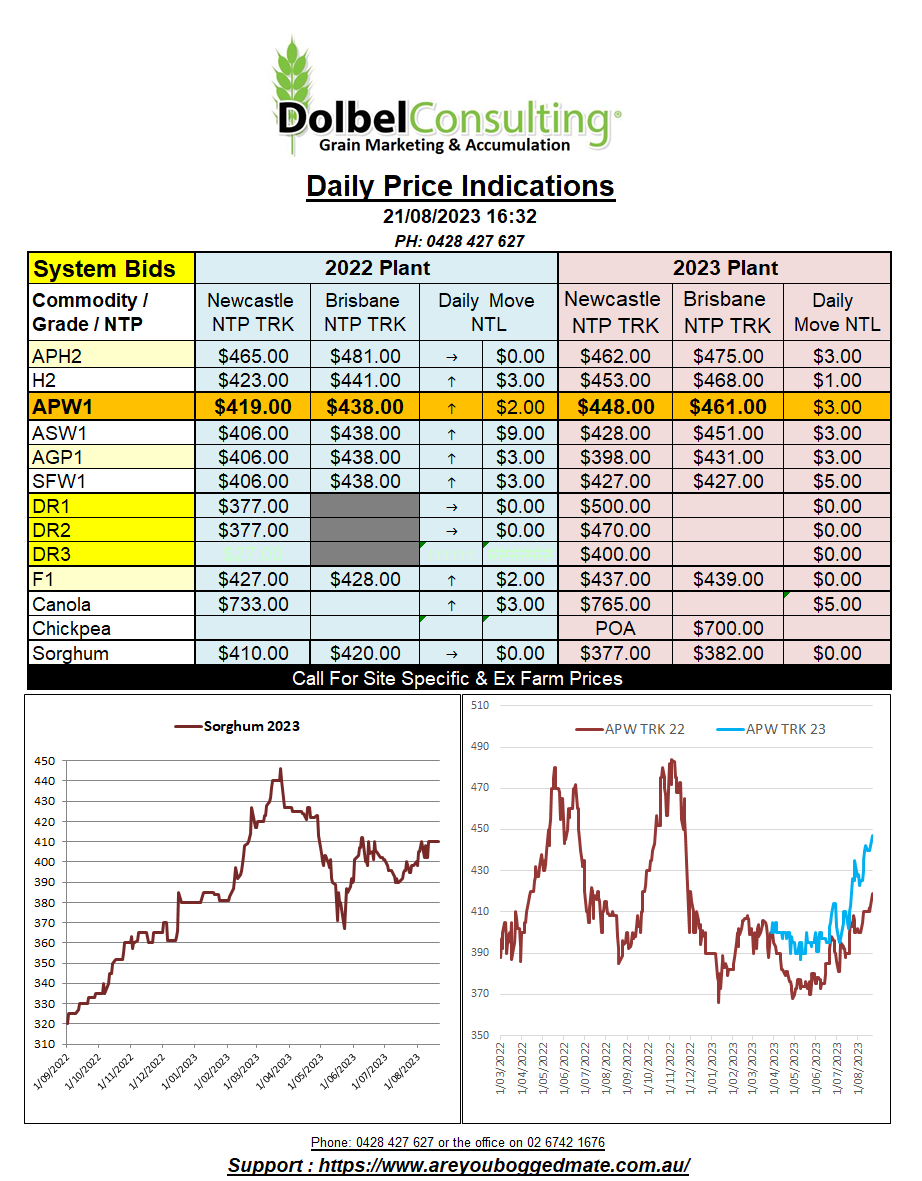

21/8/23 Prices

Wheat futures in the US basically finished the week close to where they started, or a little lower. The Black Sea conflict was used as the catalyst for last night’s rally. Wheat goes up, it’s the Black Sea conflict, wheat goes down, it’s the Black Sea conflict. It’s safe to say that whether it’s the Black Sea conflict or straight up technical trade, the Black Sea conflict is going to be the reason used in most market reports.

Milling wheat values all appear to be converging now that northern hemisphere harvest is generally progressing past the half way mark, or in many cases nearing completion. This leaves the southern hemisphere as the main production region left swinging in regards to quantity and quality.

Take a look at the chart attached that converts major origins to a comparable XF price LPP using the Asian market as a delivery point.

There is likely to be a lot of interest in the Aussie and Argie crops this year. The world is a little low on good milling grades after a poor US and Canadian crop and downgrading to some of the EU milling wheat. India has already started negotiating for up to 9mt of wheat imports at a government to government level. Import barriers are being lifted as the government there attempts to slow food inflation.

Both Winnipeg and Paris canola / rapeseed futures were higher overnight. The Paris Feb24 contract was up E5.75 / tonne, a weekly rally from E467.50 (AUD$787.70) last Friday, to E484 (AUD$821.73) last night, an AUD$34.03 rally when talking fluctuations in the AUD/Euro into account. Locally we saw new crop canola on the Newcastle track move from AUD$740 to AUD$760 during the same window, mind you much of this was on the back of a sharp local rally yesterday. I’d like to hear your thoughts on the latest ISCC hurdle for canola destined to the EU, maybe it’s the straw that breaks it’s back.