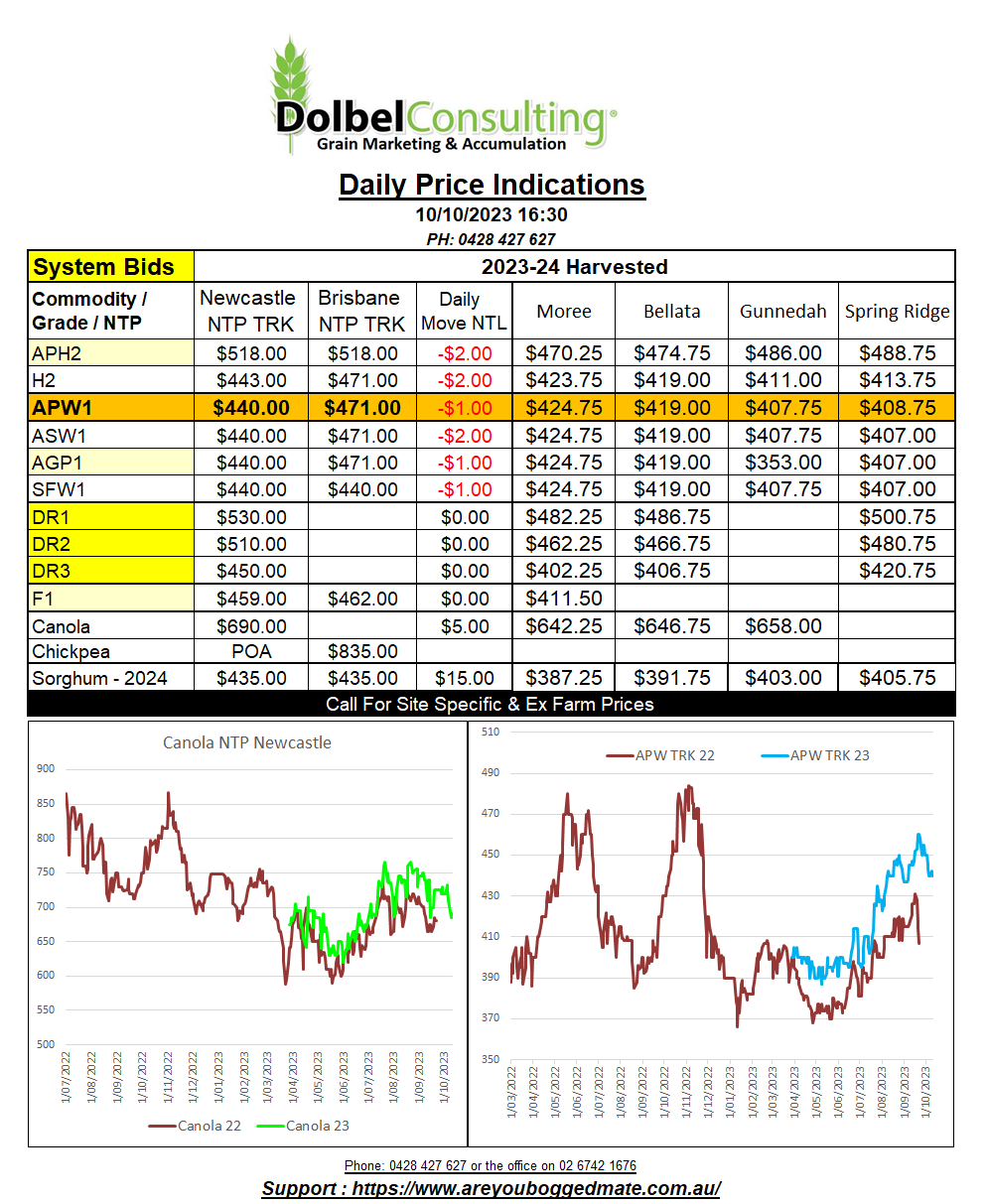

10/10/23 Prices

Monday:

Dry weather across the Western Australian wheat belt, especially in the north around Geraldton, is creating a few issues that are now becoming more evident as harvest starts. Wheat there is a reasonable test weight for some, around 76kg, and moisture is low and protein high, generally a good thing too, but growers across the eastern side are seeing excessive screenings. With dry weather across SQLD and NSW also a major issue this year, the problems now appearing in WA around Geraldton, are likely to be experienced on both sides of Australia this year.

US wheat futures closed lower, the funds proving they are not yet ready to stop selling US wheat futures at every opportunity. Hard red winter wheat futures were again hit hard. US HRWW supply was reduced this year, lower opening stocks decreased US supply of HRW from 24.79mt last year to 22.64mt this year. Initial increases in the value of HRW saw reduced US domestic demand and also a reduction in HRW exports year on year, from 6.09mt last year to 4.21mt this year. The nett result is expected increase in US HRW stocks from a low of 6.31mt last year, up to 6.96mt this year. That’s not a huge change, and unexpected export sales could see these numbers change quickly. The next USDA World Ag Supply and Demand Estimate report is due out on October 12th, it will be interesting to see what Chinese demand is now penciled in at.

Russia continues to bomb Ukraine grain export facilities. There was also a report of a Turkish cargo vessel striking a sea mine at the entrance of the Sulina Channel, one of the entry points to the Danube River in Romanian waters.

Canadian durum prices have shown signs of weakening for the first time in weeks. SE Sask values were back C$4.49 XF on average.

Tuesday:

With insurance now available for Black Sea ships loading from Ukraine, vessel booking are increasing. Some report suggest up to 800kt is now booked to arrive at Black Sea ports in the near term.

The media are in frenzy mode now, look, look Russia bad, no, yes, no, look, look, Palestine bad. Seriously it’s getting harder to stay focused on the fundamentals some days. It wasn’t that bad driving around listening to music, looking at crops and being out of phone range yesterday, sometimes I think these agronomist might just be onto something………sometimes.

The markets wires have somehow spun the Israel / Palestine war to be bullish wheat, bearish stocks this morning. The US has pumped a bunch of money into helping Ukraine be more competitive against other wheat exporters, including themselves, over the mid term. At least Israel doesn’t export wheat, diamonds yes. I’m pretty well insulated there, I can’t afford potch at the moment.

The issues with the Israel / Palestine war is spillover involvement. Who will support (fund) who, the world really doesn’t need another proxy war just now.

We have a USDA report out later this week. The market may see some minor adjustments leading up to this report but with the bulk of the northern hemisphere wheat now in the bin speculation on grades and yields are going to have less of an impact. We should see some further adjustments lower for both Australian and Argentine wheat. I’ll put my money on any decreases in the S.Hemisphere being met with increases in Russian production. With headers now in the field in NNSW, any El Nino created rainfall deficit will now be reflected in declining summer crop area.

Brazil corn and soybean basis continues to be very, very low as logistics there continues fail to move products to export facilities, carry over may build.