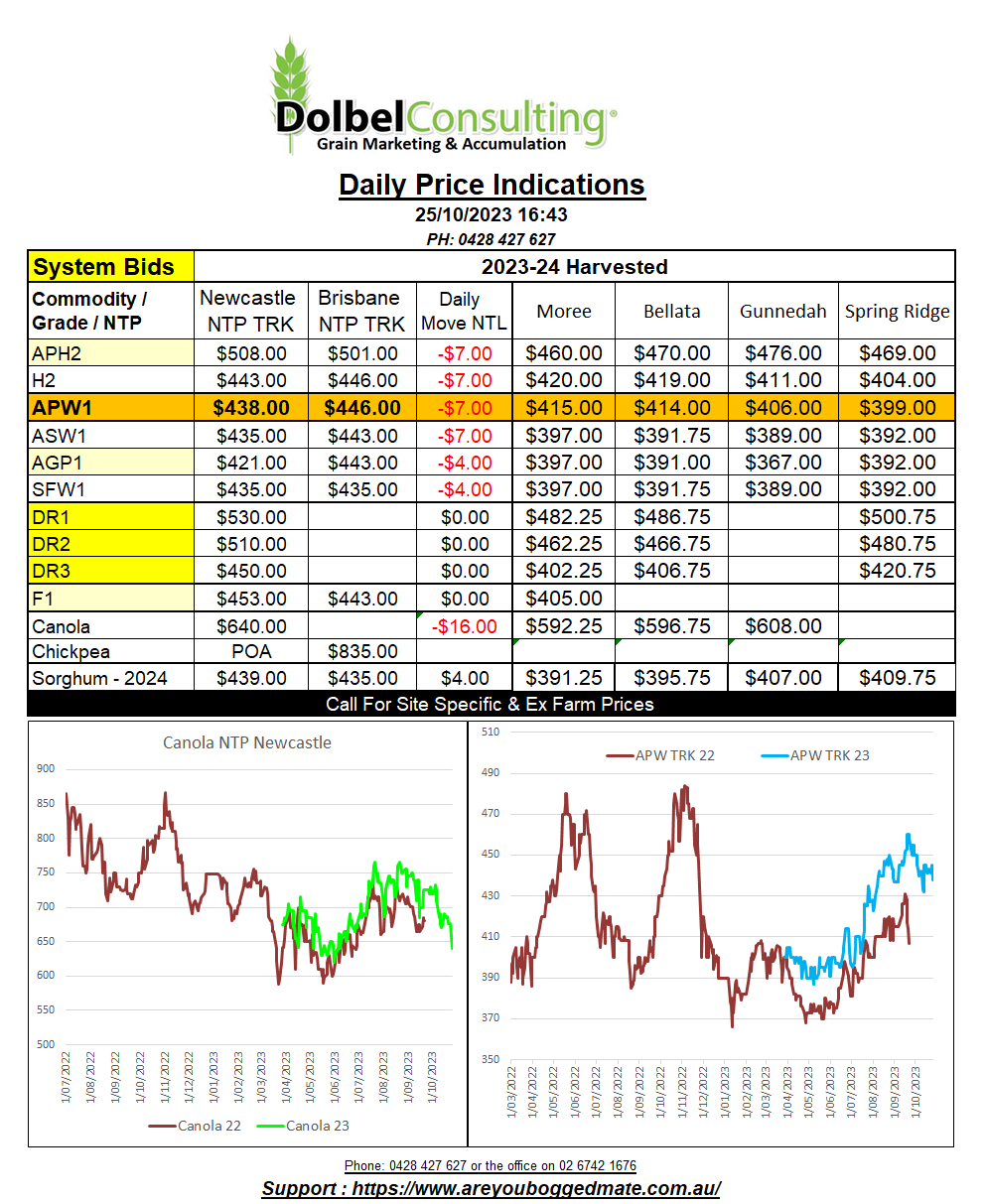

25/10/23 Prices

Higher execution costs out of the Danube for Ukraine grain is pushing some Black Sea offers higher. Corn FOB Danube ports has moved about US$5.00 higher over the last week, from about US$155 to US$160 FOB. Danube ports carry an additional cost to execute of roughly US$12.00 compared to deeper ports on the Black Sea like Odessa.

US corn out of the Gulf continues to slip away on the back of cheaper upcountry values. Although generally higher than a week ago, corn has bounced around these values FOB US for a while now. At roughly US$215 – $US216 FOB NOLA, US corn works into the Chinese feed market for about US$275 C&F China. Converting this corn value to an ex farm equivalent price here on the plains gives you a number somewhere around AUD$320. At the moment new crop sorghum here is bid at AUD$380 XF, so realistically a AUD$60.00 premium to US corn. That’s pretty close to where we traditionally see the corn / sorghum spread (+$25 – +$50). US corn is a little more expensive than S.American corn but there’s not a heap in it.

Sorghum values C&F China have generally followed corn a little lower over the last week but are still trading at a good premium to corn. Not so in the US Gulf though, sorghum there offered at numbers much closer to current US corn values.

A quick look at the weather for the major wheat producing regions. Russia is getting a little dry in the lower Volga Valley but central Russia and Ukraine are both seeing some good weather now. Romania and Bulgaria are both dry, the driest regions are the major wheat regions too. Not ideal sowing conditions. Europe is generally in good shape, France, Germany, Spain and Poland a little wet if anything. Argentina has seen a few showers across the drier parts of Cordoba over the last week. Most feel it’s too late for the wheat but should help corn. Brazil remains drier than average during bean sowing.