6/2/24 Prices

Most punters were blaming the stronger US dollar for the weaker close for Chicago wheat. It didn’t seem to worry soybeans much though, the nearby contract for beans closing 7.75c/bu higher.

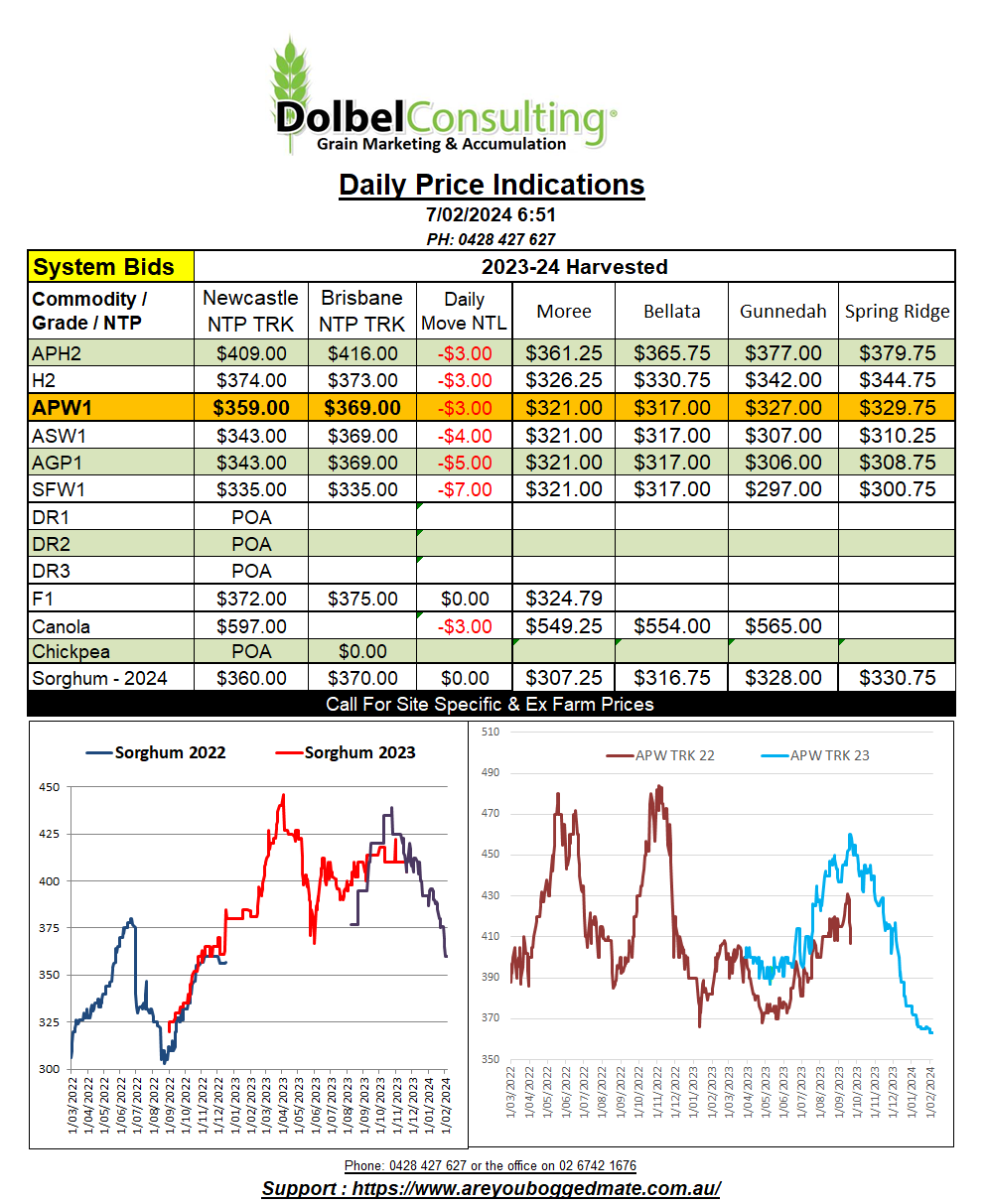

Wheat found no love, SRWW back 9.5c/bu (AUD$5.38/t) while HRWW was back 11c/bu (AUD$6.23). The weaker AUD did have an impact, not much, but was equivalent to AUD$1.64, so may help a little today.

The punters are mixed when it comes to predicting the future direction of the AUD. Most are seeing better than expected data out of the USA and worse than expected data out of Australia. This may cause one to expected a further weakening in the AUD. Any significant move in the AUD will most likely come on the back of poor news out of China though. Wouldn’t it be surprising if that poor news weakened the AUD just prior to some major import purchases from China.

Paris rapeseed futures were lower across the board, the nearby shedding E1.75. The Feb25 slot fared a little better, falling just E0.75/t. Winnipeg saw the move in Chicago beans and appeared to follow. The longer term chart for canola is still pointing lower after hitting a three year low.

Brazilian wheat imports are up 18% from this time last year. Argentina is the main supplier of wheat to Brazil. Brazil saw heavy rain at harvest, downgrading a lot of their wheat crop. The question now is, will the Chinese decision to allow wheat imports from Argentina hurt the price and availability of Argentine wheat into Brazil. With the Argie crop estimated at 15.1mt, it’s not huge. Brazil usually import around 7mt of wheat +/- (Jan WASDE 5.6mt). Argentina supply upwards of 80% of that import volume. Argentine domestic demand is just under 7mt. Argie ending stocks could shrink year on year by 1.7mt, possibly more if China take a slice of Argie wheat too. At China, Argie wheat and Aussie wheat are very closely priced using track values and no white wheat premium.