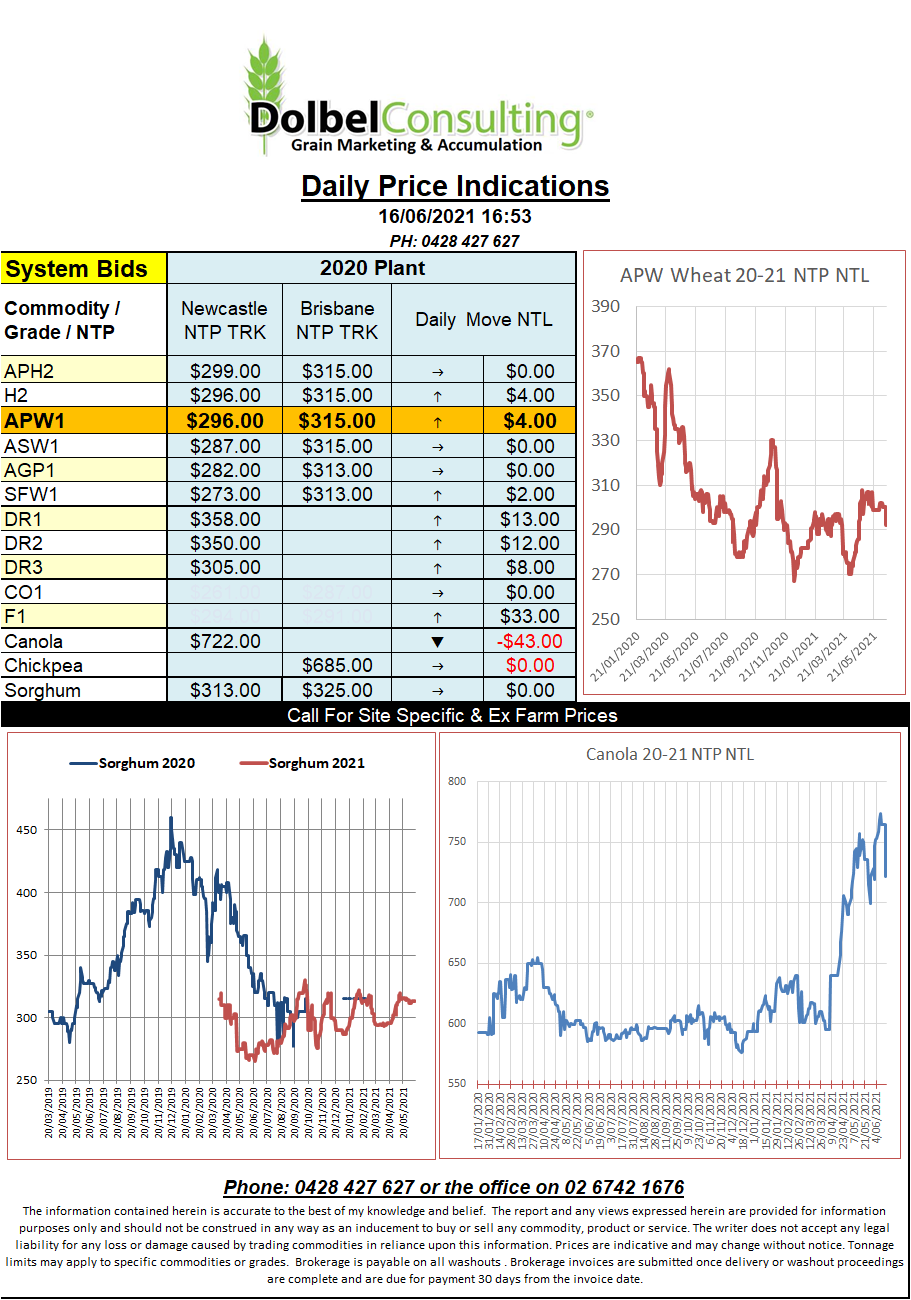

16/6/21 Prices

Pressure came from a better weather outlook in the US and outside markets. The negativity was aided by speculation the US Fed were talking higher interest rates and inflation.

One thing I’ve certainly noticed here in retail land is the cost of goods are definitely up. Probably to the tune of 10% – 15% at least over the last 6 months. It’s a shame the average person’s buying power hasn’t increased in unison, I mean excluding government hand-outs. The assistance packages may help stop the blood flow but they are merely a band aid on what is likely to become an axe wound in the longer term.

Technically the selling in Dec 21 CME SRW wheat over the last few sessions has seen the stochastic slip back into a more neutral position. If the funds find greener fields elsewhere from here selling is likely to continue but one would think that at some point in the near future support would start to creep back in.

Cash wheat out of the PNW of the USA was flat to firmer for spring wheat. With 14% DNS bid at 856c/bu for a Sept lift it would be comparable to our APH1 at Newcastle being bid at roughly AUD$367/t. Yesterday we saw the new crop bid at $318 NTP NTL indicating trade basis is still relatively low for a new crop contract. Old crop basis is -49c/bu under nearby for APW, that’s still very low.

Egypt has walked away from its last tender when the cheapest wheat was Russian at US$250.88 + C&F and was deemed too expensive.