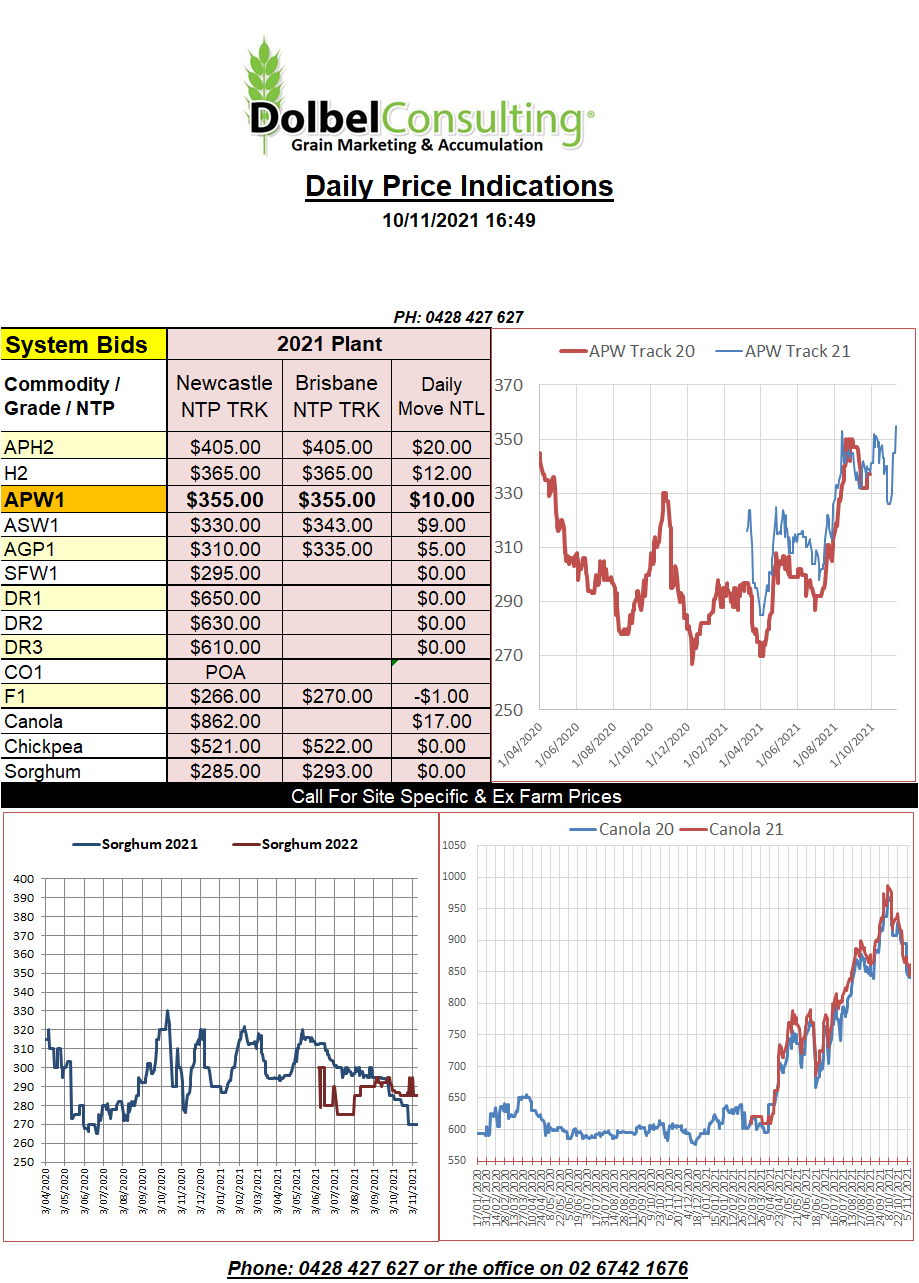

10/11/21 Prices

Soybeans were a clear winner in last night’s USDA World Ag Supply and Demand Estimates report. US soybean average yields were lower than expected resulting in lower production estimates. The trade had guessed yields would increase to 3.49t/ha but the USDA adjusted yields lower to roughly 3.44t/ha. Not a huge drop but enough to prove the punters wrong and reduce US production by about 625kt as opposed to an expected increase of more than that over last month’s number.

The rally in soybeans rolled through the oilseed market increasing futures and cash bids for both ICE canola in Canada and Paris rapeseed futures in Europe. Black Sea rapeseed prices were also higher.

For wheat there were adjustments to US grades, HRWW ending stocks were reduced, spring and white wheat ending stocks were increased a little, high prices stifling demand obviously for white and spring and durum ending stocks were projected at just 462kt.

World wheat production was a smidge lower 775.87mt last month, down to 775.28mt this month. Minor adjustments to the demand side saw the USDA projecting an world ending stocks level of 275.8mt, down 1.38mt on the October number.

The soybean data rallied futures, dragging both corn and wheat higher on the night. World cash prices were mixed but we generally see values higher in Aussie dollar terms this morning as we had some nice slippage in the AUD / USD exchange rate overnight.