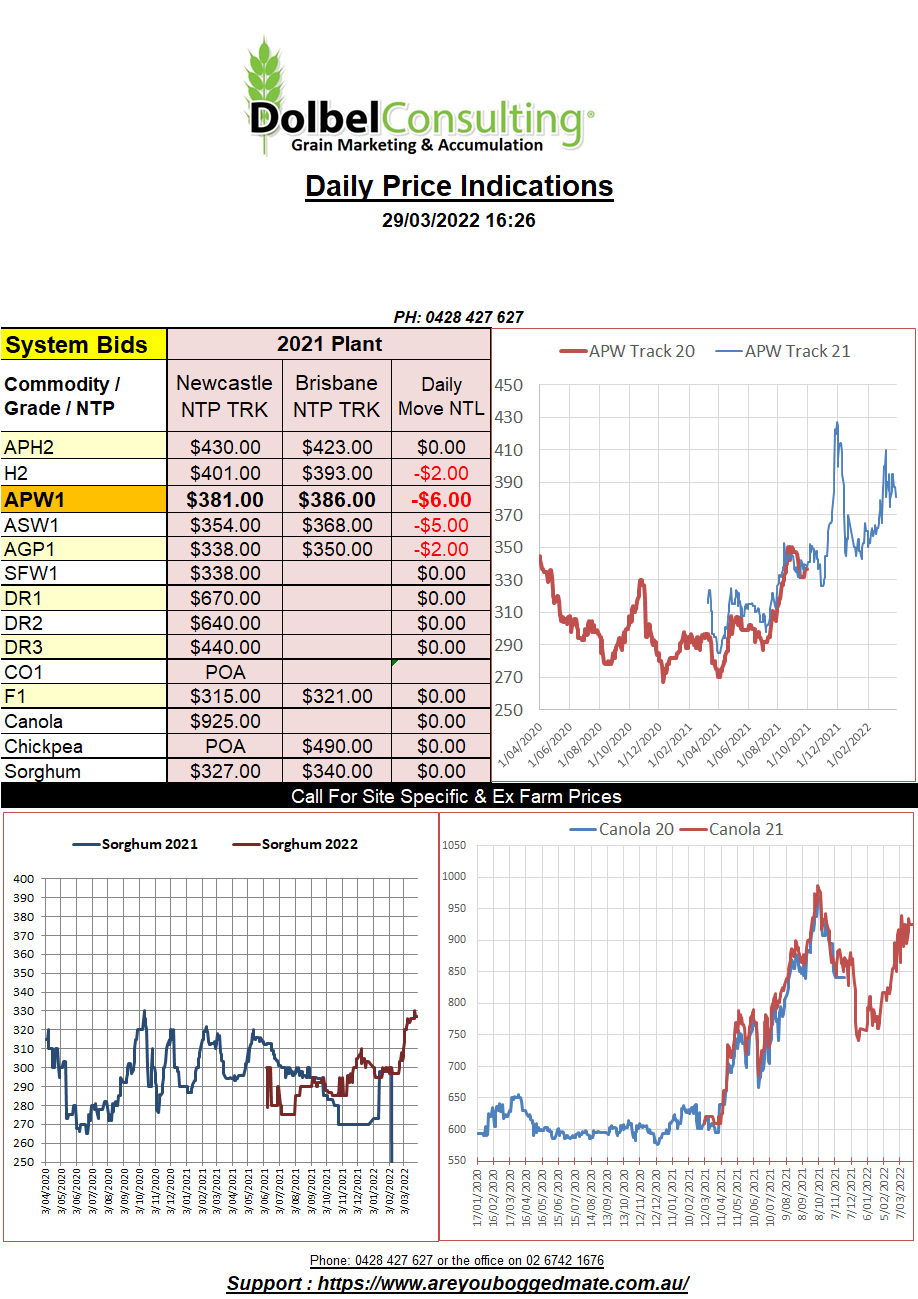

29/3/22 Prices

Both US and European wheat futures pushed lower overnight. Nearby milling wheat at Paris some E11.50 lower (AUD$16.86). Outer months at Paris were not as hard hit but still fell away E8.50 in the December slot.

US futures were lower across all three exchanged. The weaker AUD countering the move a little, AUD$1.14, but unable to have much of an impact on the conversion with the net decline for nearby Chicago SRWW futures equating to roughly AUD$21 after taking currency moves into account.

The Yen dropped to a seven year low, good for exporters, not so good for importers there. The 7% decline against the USD during March has been a result of a stark contrast to the economic policies currently being seen in the US. The Bank of Japan will hold all stimulus measures in place and keeping rates low thus allowing the Yen to slip but also preventing Japanese bonds being picked up by the punters. Japan does have a view that it’s better to have a low currency than a high currency though, so what is happening in the US does appear to be making this easy for Japan.

China sold 546kt, 98.41% of the offer volume, of state wheat at auction on March 23rd. At an average price of US$453.05 per tonne. Just a week ago China officially confirmed that their current winter wheat crop was in less than ideal shape and could potentially be the worse crop they have had for some time. This news combined with increased imports of wheat in both 2020 and 2021 does tend to indicate that this “problem” may have been longer in the making than the last few months though. If China do not hold 50% of the world wheat stocks, as they are currently written into the WASDE report to hold, then we may see an even more aggressive purchase program in 2022. It’s hard to be bearish milling wheat in 2022, are these prices sustainable.