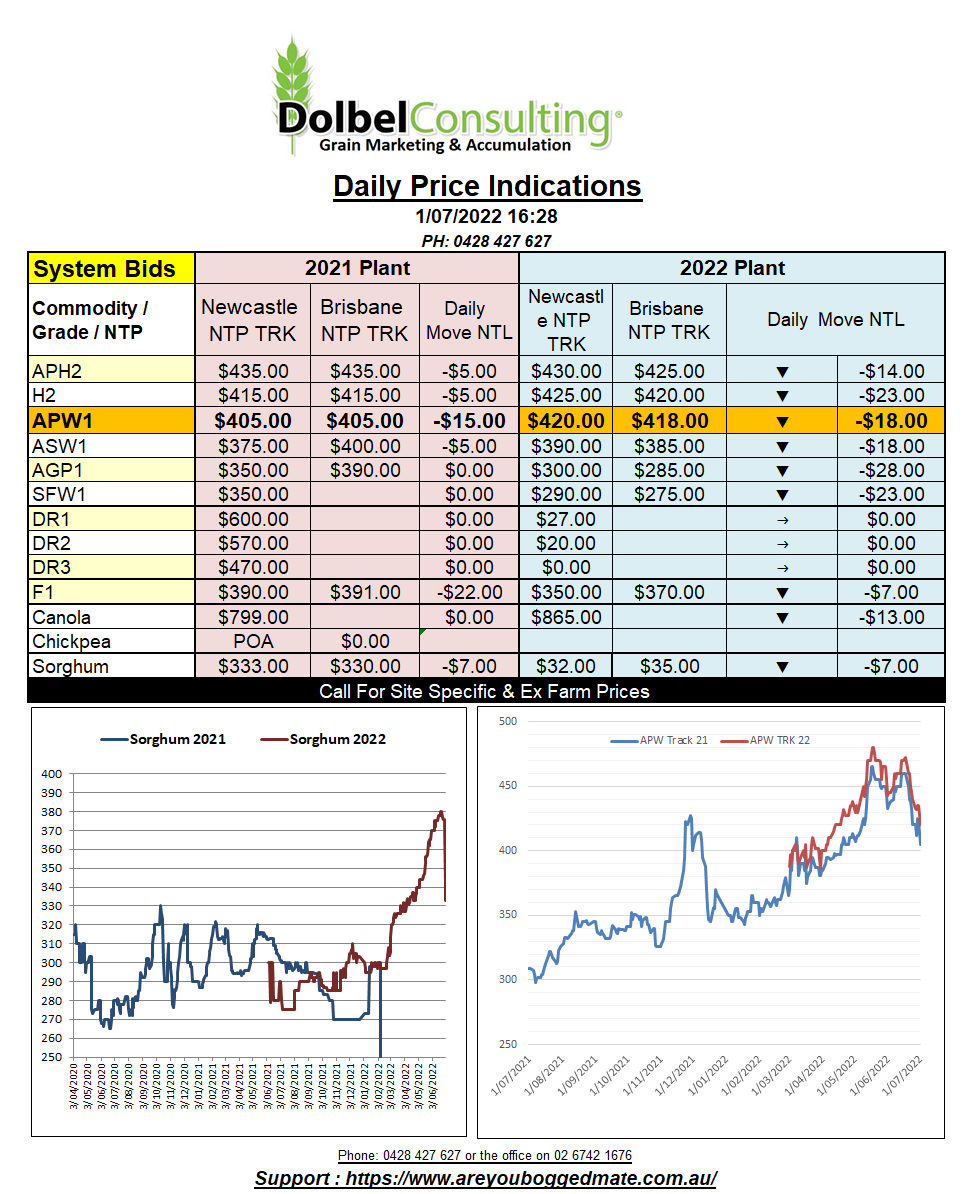

1/7/22 Prices

US wheat, corn and soybean futures were all sold off in overnight trade, corn and wheat getting hit the hardest. The catalyst was the USDA quarterly stocks and acres report. Corn found pressure from both higher than expected sown area and higher than expected US stocks. Sowing for corn was estimated by the USDA at 89.9 million acres. Although 3.44 million acres lower than last year this number was a little above both the average trade estimate going into the report and the June WASDE. A year on year increase in stocks of 6% was also a little higher than expected but not by much. The combination of the confirmation of increasing stocks and poor weekly export sales volume was too hard to ignore.

US wheat, like corn, saw an increase in both sown area and stocks. All wheat acres were increased to 47.1 million, 1.98m of durum, 11.1 million of spring and 34 million of winter. Both the spring and durum area could be questioned after such a wet sowing window. The late sowing date may also hurt potential yields if the growing season closes early. So spring wheat still has a long way to go. Much of the eastern US spring wheat belt has growth some 3 – 4 weeks behind normal. Weekly US wheat export sales came in around the higher end of expectations at just under 500kt, a good effort.

StatsCanada will keep the data coming with the release of their planting estimates next Tuesday, their time. The punters are expecting to see a 1 million acre increase in spring wheat area over last year. Anything under 24.7 million acres may be considered supportive.

Argentine produces are striking in protest of the crippling cost of fuel and fertilizer. Major industry bodies are calling for a 24 hour halt to all exports to begin on July 13th. Sovecon continue to increase the Russian wheat export forecast to a record high of 42.6mt. Starting to look a lot like Chinese data these days, always good. Egypt confirm the purchase of 815kt of wheat as noted yesterday.