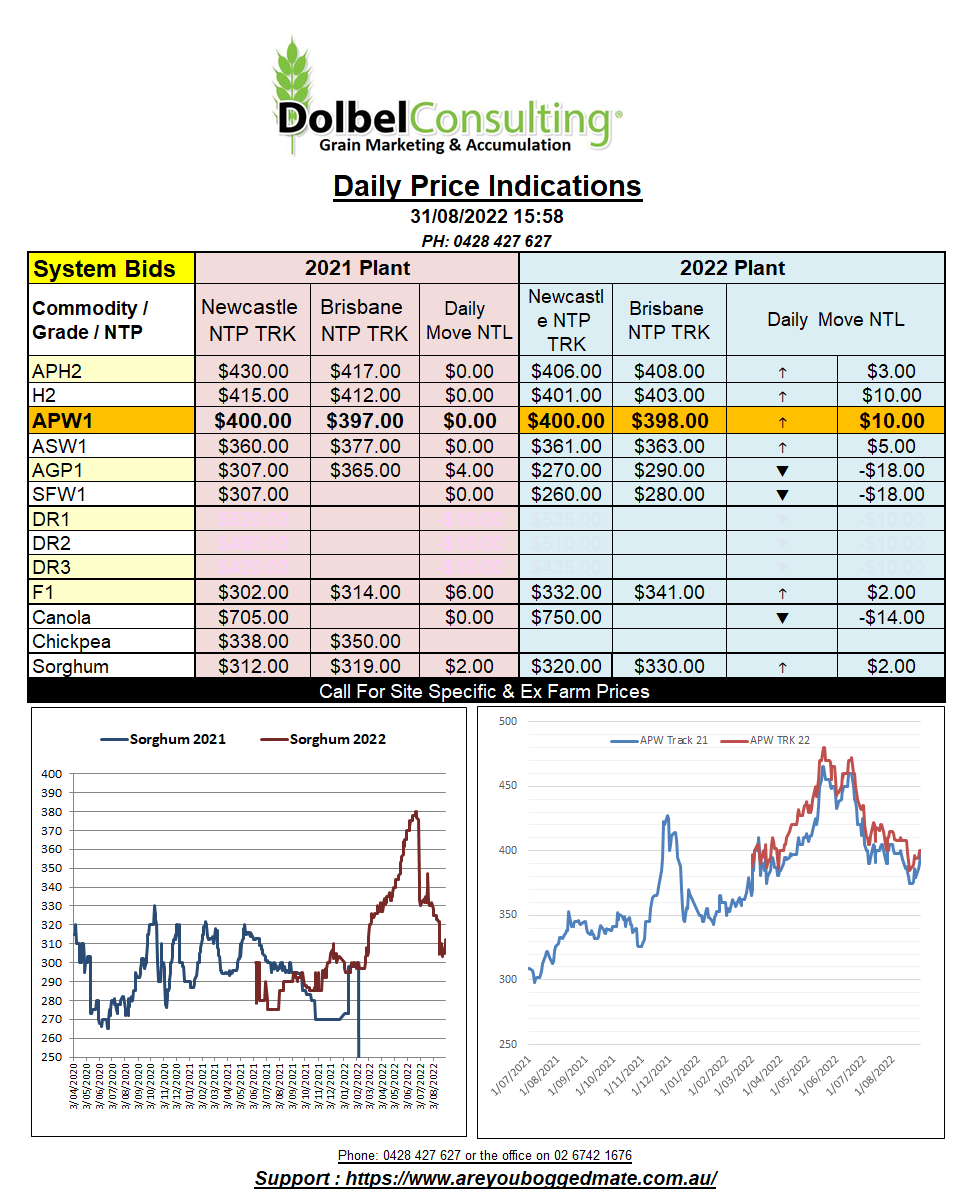

31/8/22 Prices

All three milling wheat futures contracts in the USA were lower in overnight trade, the SRWW contract at Chicago leading the way. Technically the wheat contract was due for a little profit taking and this coincided with thoughts that the world may be heading towards an economic slowdown……. Sherlock Holmes enters the party…… Outside markets pressured grains, losses in US crude, gasoline and diesel weighing on both corn and soybean futures at Chicago. Paris rapeseed followed the general sentiment lower but not so Winnipeg canola, one of the few grains which managed to close higher.

In the EU, Paris milling wheat futures were also sharply lower, dropping E7.00 in the December contract.

Spring milling wheat values across SE Saskatchewan followed the US futures market and cash bids out of the Pacific Northwest lower, slipping C$3.68 for a December lift. Durum was also a little lower, slipping C$2.13 for December lift, the average price ex farm SE Sask coming in at C$412.53 according the PDQ. Durum values out of the south of France rose by about the same value that Canadian product fell. FOB values at Port La Nouvelle indicated at US$464.75.

According to some media Turkey has increased passage fees through the Bosporus and Dardanelles fivefold, to US$4.00 per tonne. Not quite as much as what the Suez Canal charges but it’s getting up there. The increase will not only see income from the passage increase to around US$200m pa it may also help fund the new Kanal Istanbul mega canal, an alternative to the Bosporus.

Turkey stands to make come good coin this year with the Russian wheat crop looking to be a big one. Passing the 83mt mark this week, with yields some 35% above last year. Russian wheat exports have not been as fast paced as one would have expected given the size of their crop. With the recent decline in the export tax for Russian wheat their FOB price should start to become much more competitive into the N.African market.