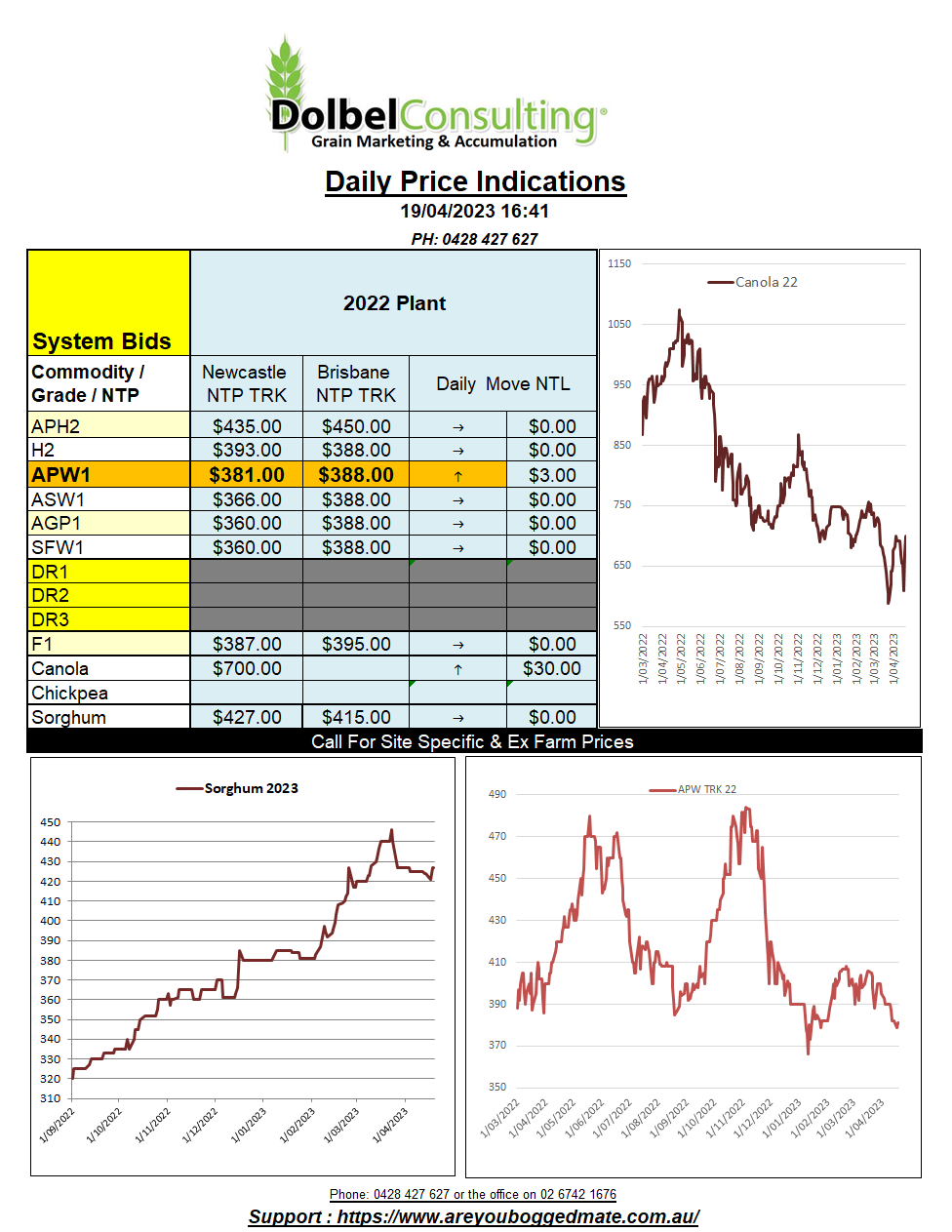

19/4/23 Prices

From an international perspective the slightly stronger AUD is worth a cut of $2.00 to $3.00 to prices today regardless of what the underlying futures or cash prices have done overnight. Fortunately, most international futures markets were flat to firmer.

Paris rapeseed futures again showed impressive strength, closing E16.50 higher on the nearby contract and E12.25 higher in the Feb 24 slot. The AUD was flat against the Euro. The nearby move in Paris would equate to a potential move of AUD$27.00 per tonne nearby if local canola basis remains unchanged today. Local basis was firmer yesterday, increasing by AUD$28 compared to the previous day.

Paris milling wheat and Chicago soft red winter wheat futures also closed higher. Paris milling wheat is still digesting the move by member states to the east banning the import of Ukraine wheat. Romania has joined the list of countries contemplating a ban on Ukraine wheat imports. Romania was very helpful in getting Ukraine wheat to port when the conflict started but are now seeing Ukraine wheat push into their domestic market instead of making its way to port. This is depressing local producer prices there as it has in Poland, Hungary and Slovakia, angering farmers.

The European Commission has rejected the bans put in place by Poland and Hungary. The EC said it was not up to member states to make trade policy. The EC said that the move by Hungary and Poland to ban imports of Ukraine wheat, dairy, sugar, fruit, and vegetables will not be tolerated.

The ban is imposed on Ukraine imports until June. The plan is to implement a process that would allow for Ukraine grain to pass through Poland to the sea ports, or to other EU importers, but the grain will be unable to sold in Poland. Meetings between Poland and Ukraine are scheduled for next week.

Wheat values into the latest 50kt Jordan tender varied a lot, from a high of US$333 from Viterra to a low of US$303 from FarmSense.