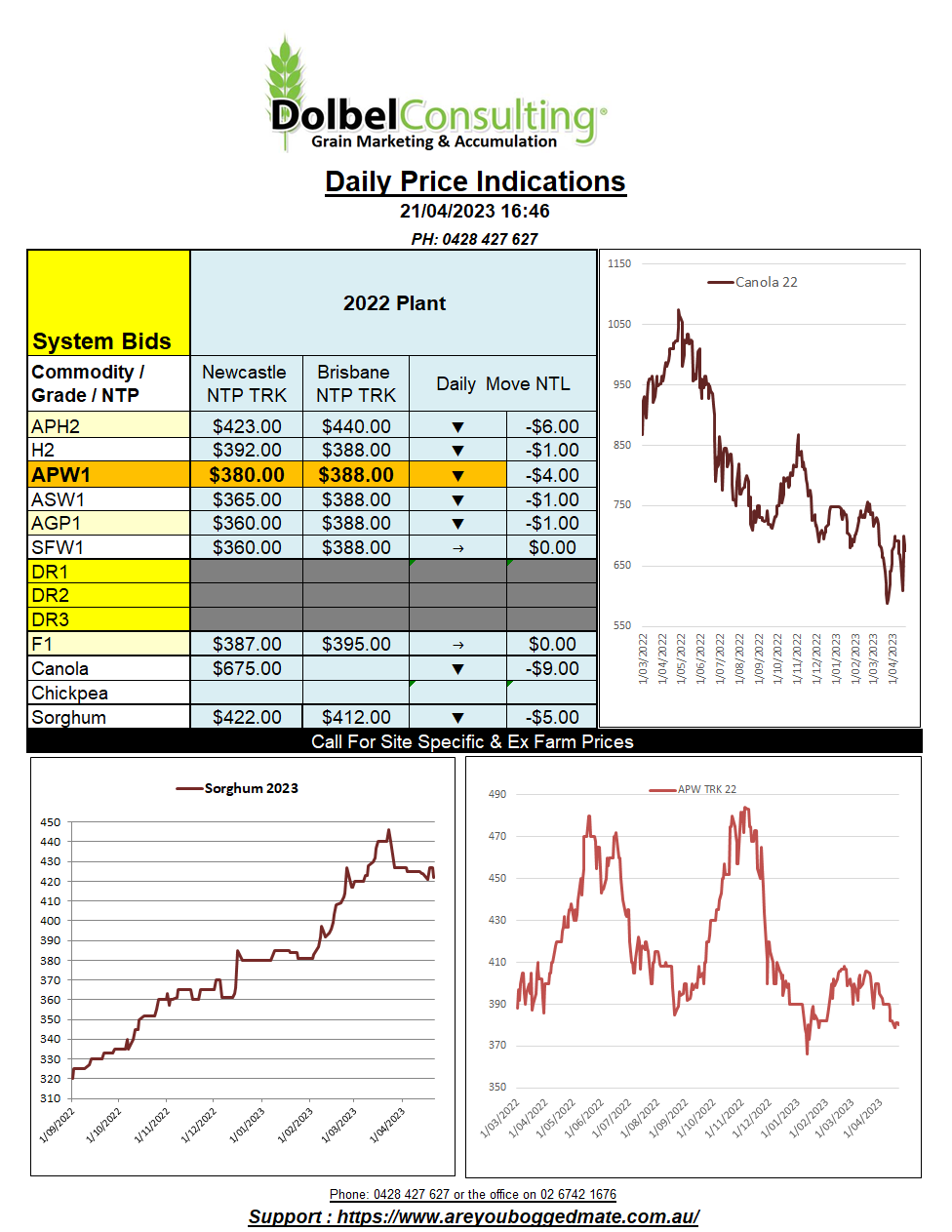

21/4/23 Prices

The sell off in ags continued into Thursday’s session. European and US futures market were again a sea of red. Wheat wore the brunt of the fall, Paris milling wheat shedding E4.25 (AUD$6.92) on the nearby contract and the Dec 23 slot. London feed wheat futures were AUD$7.66 lower on the nearby and Chicago hard red winter wheat fell 21.25c/bu (AUD$11.58) in the Dec 23 slot.

Corn, soybeans, and soy products were also lower. Canola and rapeseed closed lower. Winnipeg canola influenced by both an improved sowing outlook for the Prairies and by the weaker oilseed market, led by the decline in Chicago soybean futures. Paris rapeseed was back E12.50 nearby and E8.00 in the Feb24 slot, the former equating to a plausible downside in local prices here of AUD$22.34 when taking the move in the AUD/Euro into account and leaving basis unchanged at -AUD$81.62.

Corn, thus global feed grains, continue to be pressured by what could potentially be a record crop in Brazil. The prospect of cheaper corn into the world feed market from S.America has led to hand to mouth purchases, this trend continuing to hurt the already slow rate of exports out of the USA.

Corn futures in the US are inverted, indicating that as bad as prices are the nearby May > July market wants corn more than the outer months or new crop market does. Something to note for those thinking about holding sorghum here.

The wheat market is taking profit this week, boats are again moving through the Black Sea, although the continuation of the Grain Corridor deal remains in question, according to the Russians. Some showers across the US plains and more in the forecast will also help stop the HRW crop from deteriorating further. S.Korea picked up 50kt of ASW, AH2 and feed wheat from Australia. The ASW moving at FOB US$305 WA (AUD$360ish XF LPP).