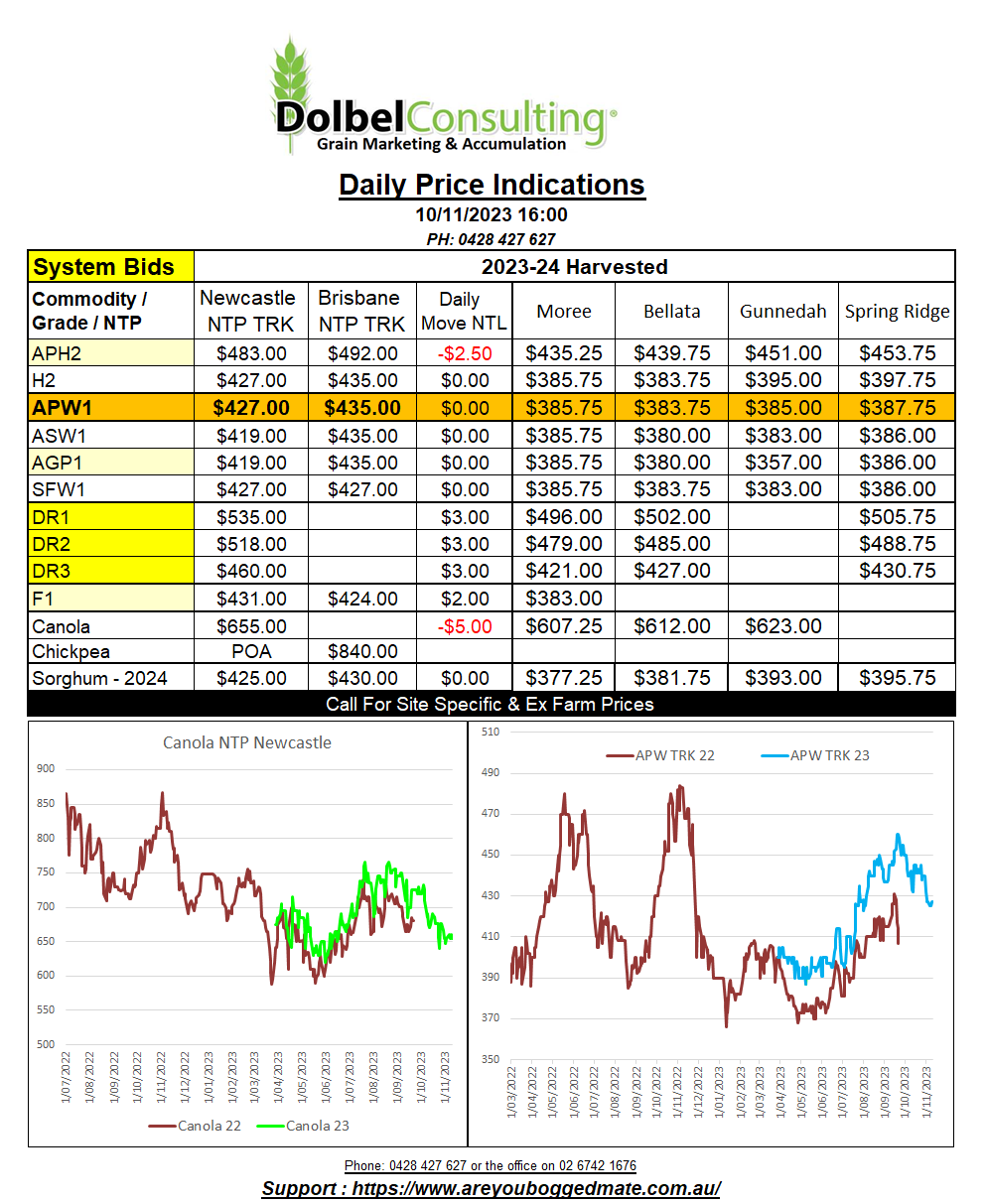

10/11/23 Prices

It was November USDA World Ag Supply & Demand Estimates night. Looking at wheat we see world ending stocks were increased by 560kt. The kicker was the increase in opening stocks though, up 2mt to 269.55mt. World production was reduced 1.45mt to 781.98mt, still a huge crop. Opening and ending stocks for wheat in the major exporters was increased, as was production, these increases were countered somewhat by increased consumption, but a 3.18mt increase in ending stocks was a surprise to some and treated as such in the futures markets.

Looking at the individual countries we see Argentine wheat production was reduced from 16.5mt in October to 15mt, that’s still 1.5mt higher than the last private estimate for that region. Brazilian production was reduced from 9.8mt to 9.4mt. Looking at the weather in the major wheat regions of Brazil there’s a good chance this will be amended even lower in the December edition. Australian production was left unchanged at 24.5mt. This is some 2.5mt higher than some of the local estimates for Australia.

Ukraine exports were increased by 1mt, taking 1mt straight off last months projected ending stocks leaving the Nov number at just 3.08mt. Russian production was finally increased to 90mt, now much closer to other industry estimates. Even with Russian domestic consumption increased from 41mt to 43mt, and exports left unchanged at 50mt, this results in an increase in ending stocks of 3mt. Unfortunately the slower pace of Russian exports is also has potential to build on Black Sea ending stocks going forward.

Chinese wheat imports were increased from 11mt to 12mt. Their consumption was left unchanged, which results in an increase in ending stocks from 132.92mt to 133.92mt, 51.7% of world wheat ending stocks. Global wheat stocks to use ratio remains high at 32.63%. If Chinese ending stocks were out by 20mt it would still give us a world stocks to use ratio above 30%. This suggests any rally could be short term and access driven, not supply driven.