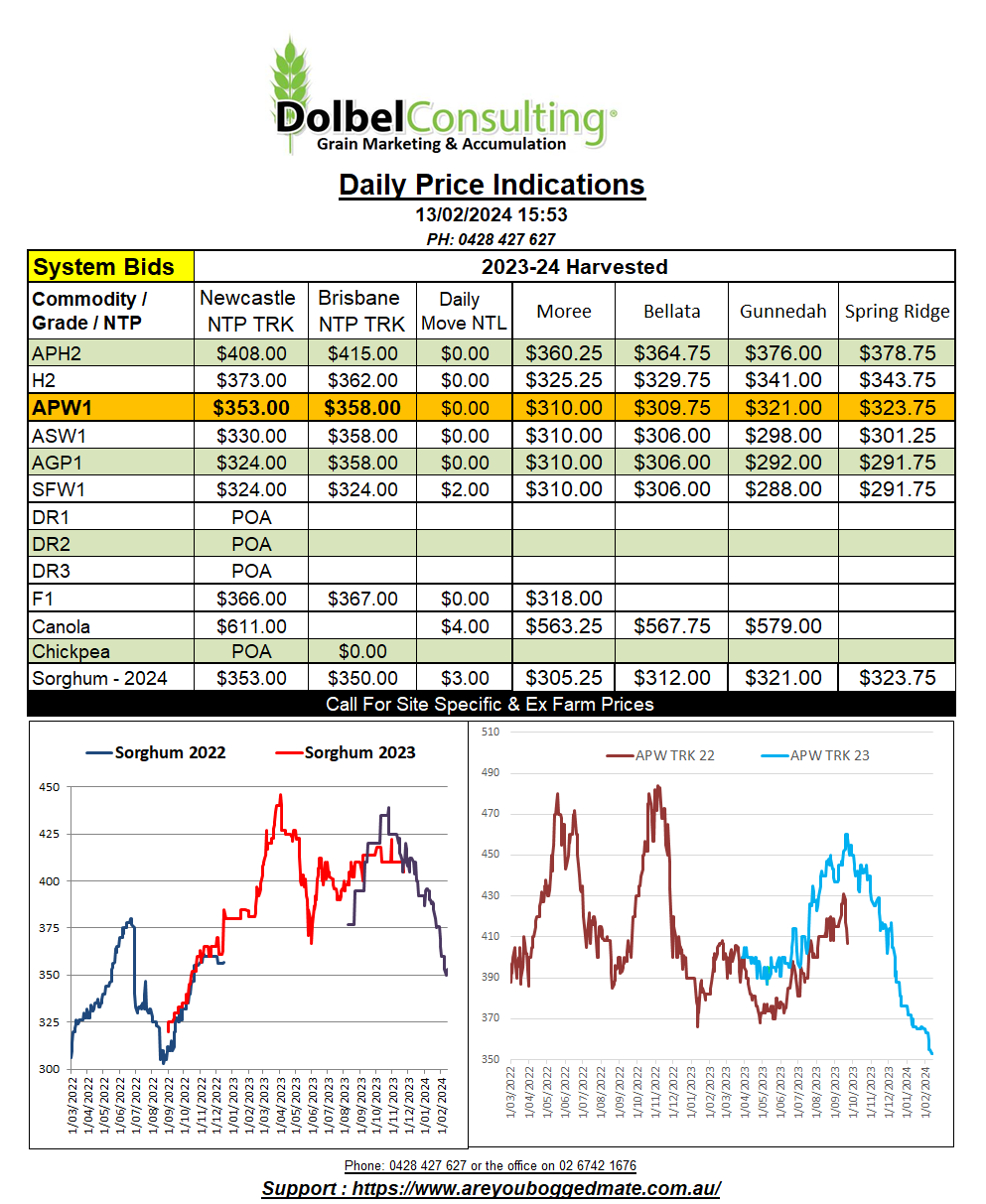

13/2/24 Prices

World futures markets were generally flat last night. US soybeans showed a slight pulse, rolling across to some additional support in both Winnipeg canola futures and Paris rapeseed futures. Delhi chickpeas were the clear winner though, chart attached.

Brazil is roughly 25% through their soybean harvest now, this is a little quicker than last year. A result of the tight start and mid season dryness in the early sown crops no doubt. The spec short grew week on week, the big money still betting on lower US soybean values in the mid to longer term. With US soybean futures already very close to setting a three year low the added pressure is expected to spill over to much of the oilseed complex in 2024.

For the week ending February 1st the US exported around 112kt of sorghum, 65% up on the previous week but down 34% on the 4 week average. China is again the major buyer with net sales coming in around 60.9kt, back 15% from the previous week. The US continue to sell sorghum to China at current values. Year to date the US has exported around 2.72mt of sorghum, the lions share going to China. This is almost 10X the volume of sorghum exported in the previous year.

French durum values were sharply lower of Port La Nouvelle, in AUD terms roughly AUD$12.00 lower, on last weeks closing values. In contrast Canadian values out of SE Saskatchewan which were relatively flat at C$406.59 XF on average. The decline in French values takes the EU product to within about AUD$8.00 of the Canadian product. So they are both in the same ball park for the Italian buyer, but are probably somewhere in the vicinity of AUD$20 above where the latest tender business was conducted.

Week on week funds increased their net short in US wheat futures.