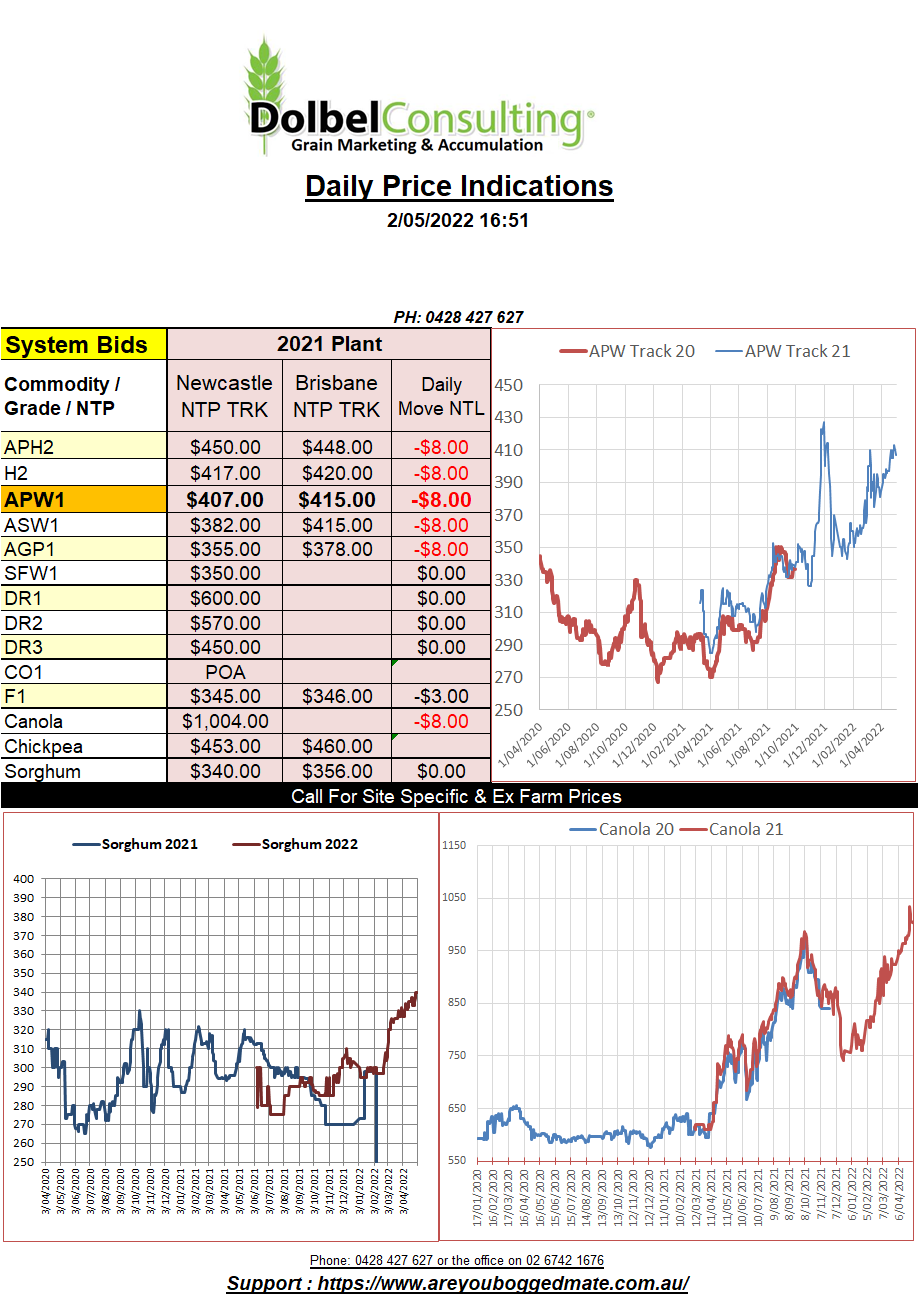

2/5/22 Prices

Wheat and canola futures saw some hefty downside on the nearby contracts overnight. Chicago SRWW and HRWW were sharply lower. In the December contract the SRWW product slipped AUD$13.00 and Dec 23 HRWW slipped AUD$16.50 per tonne. The prospect of some good rainfall across the driest parts of the US wheat belt was the catalyst. At these levels it didn’t take much for a round of profit taking and technical selling to be triggered, consolidating the downside momentum.

Looking at the 1-7 day rainfall model for the States and Canada it does show that Saskatchewan and Alberta will again miss out on the moisture. Heavy rain is predicted across Oklahoma, some models suggesting 100mm – 125mm is possible. That may be a case of too much too late if that eventuates.

Cash prices for spring wheat in SE Saskatchewan were softer, in line with the weaker US futures session for spring wheat. Durum prices for the new crop were not lower, persisting at C$473 ex farm, now C$10.00 under spring milling wheat at the same location.

News that the Indonesian export ban on palm oil could end in May was one of the bearish factors in the oilseed market. At these levels the markets are nervous and any negative news will often trigger some form of a sell off / profit taking. At the end of the week Paris futures basically finished where they started after Monday’s session, so some upside early in the week and some profit taking into the weekend. At Winnipeg the old crop contract paints a similar picture. New crop at Paris shed around E8.00 for the week while Winnipeg was actually higher, gaining C$20.80 in the Jan23 slot.

New crop canola basis here continues to take a hit, now out to -AUD$181 to Jan23 ICE, shedding around AUD$32 this week.