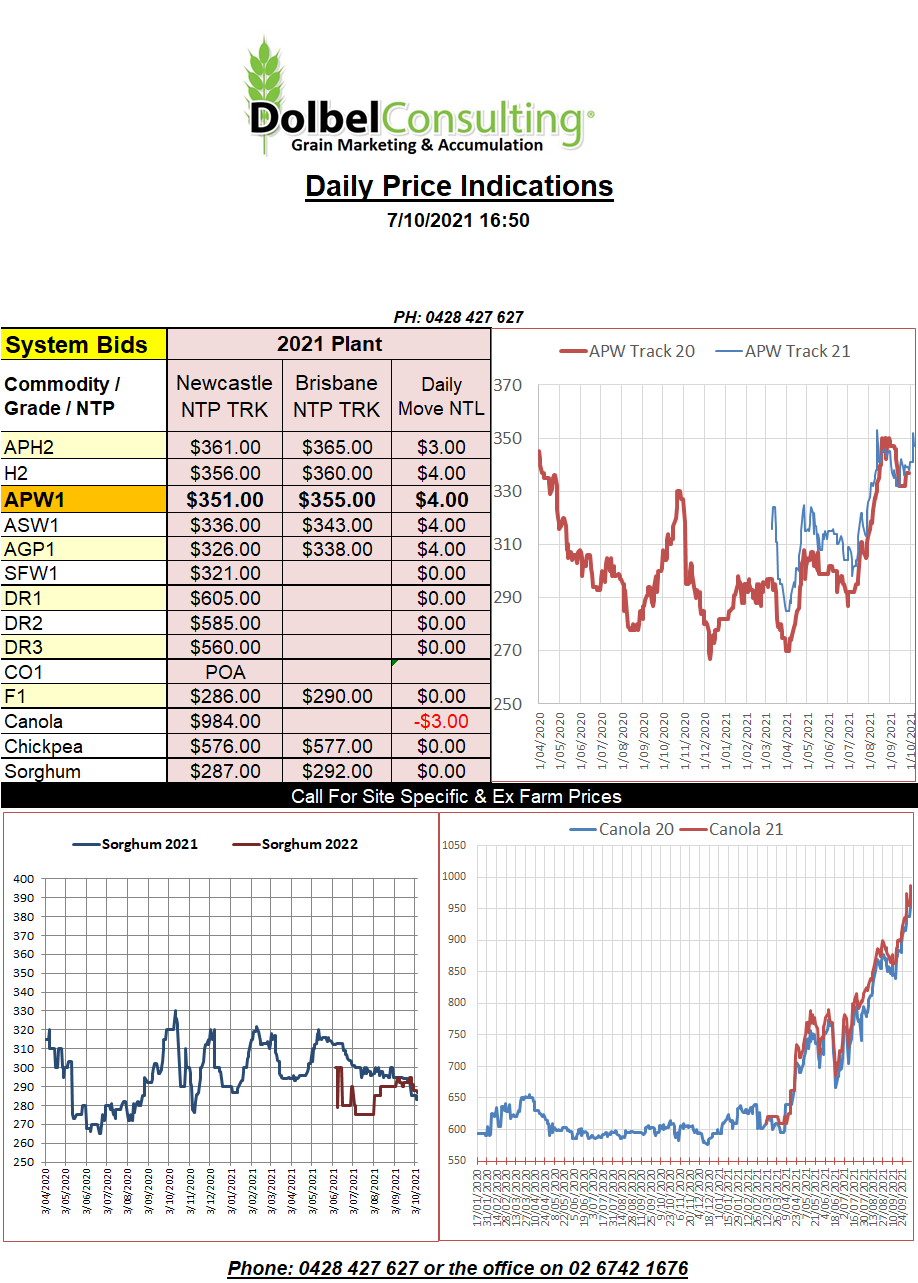

7/10/21 Prices

Egypt picked up 240kt of wheat from Black Sea suppliers overnight. Russian and Romanian wheat are expected to fill the slot for the last two weeks of November. Initial price estimates are coming in around US$320 FOB Romania and a little higher for the Russian wheat. This indicates about a US$10 jump from their previous tender.

On the back of an envelope this would equate to a H2 price somewhere around $327 XF LPP. Current pricing, AUD$337, would indicate that Australian wheat is better priced elsewhere.

In other tender news Tunisia are in for 100kt of optional origin durum for Nov / Dec, offers closing this evening.

Pakistan also announced a tender for 90kt, +/- 5%, of milling wheat, this is on top of recent purchases of 1.1mt. Tender closes Oct 13th. Tight stocks are still an issue in Pakistan even after a decent crop this year, 27.3mt, the previous crop was not as good at 24.9mt. According to USDA expectations Pakistan are still to buy up to another 600kt, probably later this year or early next year. Plans to increase government reserves to 4mt may see this import projection increased in coming USDA reports.

In the futures markets Chicago corn slipped, wheat rallied a little, soybeans slipped, ICE canola was a little firmer. Paris rapeseed continues to push higher, up E9.25 / tonne on the nearby overnight, supported by the prospect of 500kt ending stocks in 2021/22. The EU expect much of the mid-term canola supply to come from Australia. CnF offers China around US$830 Oct / Nov, just AUD$30 XF LPP under EU values.