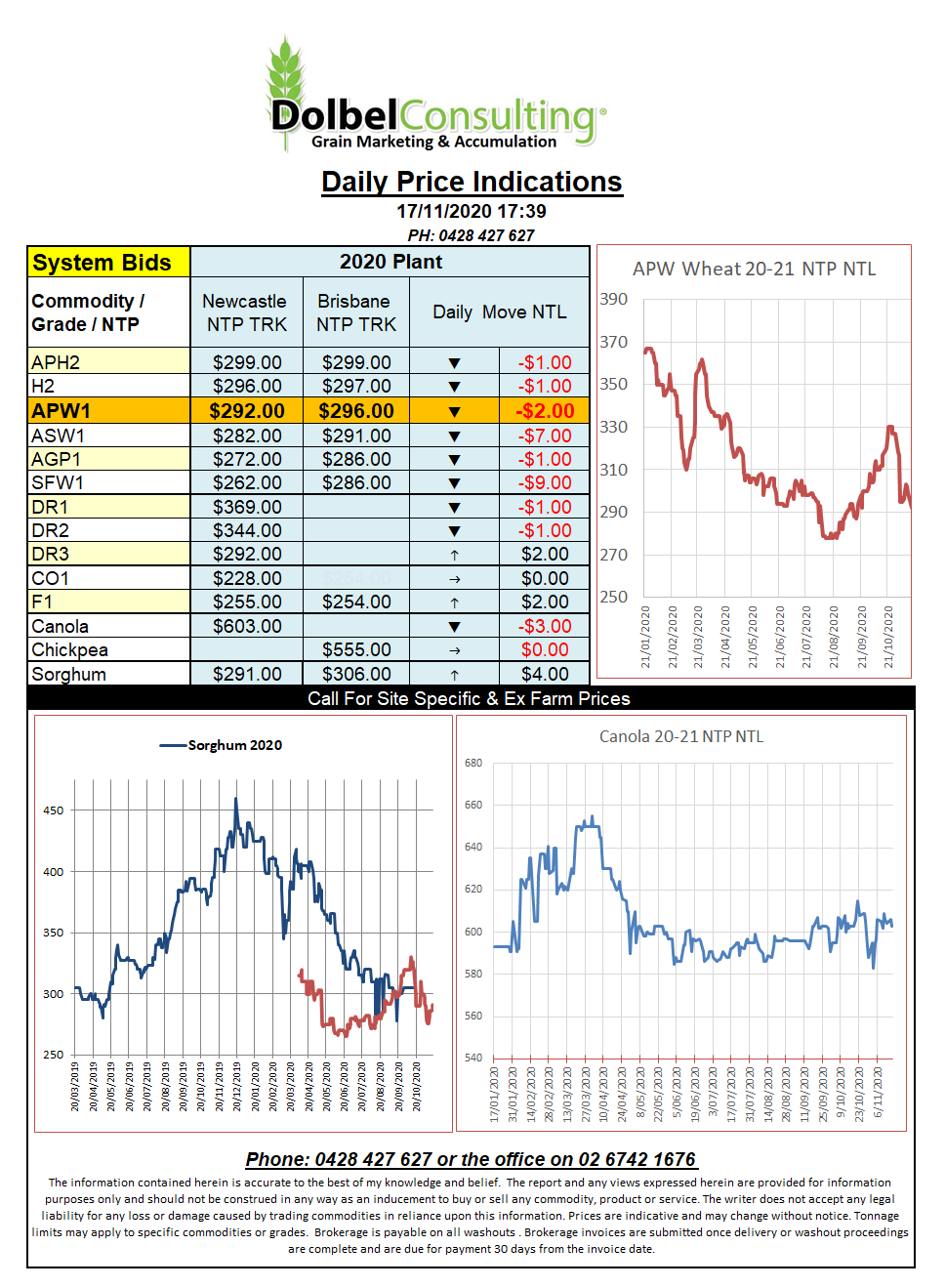

17/11/20 Prices

US weekly wheat export volume out of the Pacific North West was 217kt with the Philippines picking up 78.9kt, China 52kt, Japan 57kt and Korea 29kt. Hard red spring wheat and soft white wheat made up the lion’s share of loadings with 28.5kt of HRW making up the balance. Looking through the data shows sorghum loadings for China were at about 61kt with Eritrea and Japan making up the balance of the 116kt of export sorghum loadings. According to the wires sorghum values FOB Texas are still very good at US$283. On the back of an envelope this would equate to something close to AUD$397 Newcastle port equivalent (if going to China). US sorghum exports now sit at 904,638 tonnes for the market year to date compared to 446,286 at the same time last year.

Corn and soybeans are the big changes year on year. US corn exports total 8.4mt versus just under 5mt at the same time last year. Soybeans 22.18mt vs 12.44mt.

The numbers for wheat out of Argentina continue to fall, this time their total export projection. In last week’s USDA report they had Argentina pencilled in to ship out 12.5mt of wheat. Rosario Grain Exchange have predicted just 10mt will leave their shores. This may help firm up Argentine ending stocks a little as the USDA had them drifting as low as 1.16mt of carry over.

The US markets were fuelled with news of two possible coronavirus vaccines being fast tracked into the US market, good luck with that. Energy markets were firmer which lent support to corn. US corn futures were firmer on the back export potential to China as well.

In SW Saskatchewan durum values were flat while wheat and canola both closed higher in the cash market.